Last Update 22 Feb 26

Fair value Increased 12%AMG: Saudi Energy Storage Progress And Higher Fair Value Will Support Interest

Analysts have raised their price target on AMG Critical Materials by €10 to €39.51, reflecting updated views on fair value, slightly adjusted discount rate assumptions, and revised expectations for revenue growth, profit margin, and future P/E multiples.

Analyst Commentary

Analysts revising their fair value views on AMG Critical Materials are focusing on how the updated discount rate assumptions and refreshed expectations for revenue growth, margin profile, and future P/E multiples line up with the new €39.51 price target.

Bullish Takeaways

- Bullish analysts see the higher price target as more closely aligned with their fair value work, suggesting the previous target left limited room for AMG's execution on its current plan.

- The revised expectations around revenue growth and profit margin are viewed as supportive of a higher earnings base, which in turn underpins the higher P/E multiples used in their models.

- Some are comfortable with the slightly adjusted discount rate, reading it as greater confidence in AMG's risk profile and cash flow visibility.

- Overall, the €10 uplift is framed as a recalibration that rewards AMG for progress already reflected in updated forecasts, rather than a stretch case that relies on aggressive assumptions.

Bearish Takeaways

- Bearish analysts caution that the move to a higher target partly rests on revised revenue and margin expectations, which may prove optimistic if execution or pricing conditions turn out weaker than modeled.

- There is some concern that using higher future P/E multiples could leave less room for error, especially if earnings growth or returns on new projects do not track current forecasts.

- The tweak to the discount rate is seen by some as leaving AMG with a tighter risk buffer, which could make the valuation more sensitive to any change in funding costs or project timing.

- These analysts view the new €39.51 target as reducing the margin of safety for new entrants, since a larger portion of expected improvement is now embedded in the valuation assumptions.

What's in the News

- AMG Critical Materials reported that subsidiary AMG LIVA will install its Hybrid Energy Storage System, combining Lithium Ion and Vanadium Redox Flow batteries, at Aramco's Bulk Plant in Tabuk, Saudi Arabia to work alongside an existing solar plant and support lower carbon emissions from the site's energy supply (Key Developments).

- The Hybrid ESS uses artificial intelligence routines and self learning algorithms that are aimed at improving efficiency, safety, reliability, and battery lifetime while supporting potential grid independence for the Aramco facility at different times of day (Key Developments).

- The project is intended to contribute to Saudi Arabia's Vision 2030 targets around carbon emissions reduction, renewable energy deployment, and energy storage capacity, positioning AMG LIVA's technology within that policy framework (Key Developments).

- This initiative aligns with the IK Metals Reclamation and Catalyst Manufacturing Project, or "IK Supercenter", which is being developed by Advanced Circular Materials Company, a joint venture involving Shell & AMG Recycling B.V. and United Company for Industry, to recycle metals such as vanadium concentrate and gasification ashes from Aramco's Jazan plant (Key Developments).

- The IK Supercenter is planned to include a vanadium electrolyte production plant aimed at supplying vanadium flow battery demand within Saudi Arabia, supporting a more integrated domestic value chain for energy storage materials (Key Developments).

Valuation Changes

- Fair value has been updated from €35.29 to €39.51, representing a modest uplift of around 12% in the modelled estimate.

- The discount rate has been adjusted slightly from 7.80% to 7.79%, indicating a minimal change in the risk input used in the valuation work.

- The revenue growth assumption has been revised from 4.50% to 5.11%, reflecting a higher revenue growth input in the updated model.

- The profit margin assumption has been fine tuned from 8.62% to 8.57%, a small reduction in the net profit margin used in the analysis.

- The future P/E multiple has moved from 10.81x to 12.99x, indicating a higher earnings multiple being applied in the refreshed valuation framework.

Key Takeaways

- Expanded lithium capacity and new agreements strengthen AMG's regional leadership, supporting revenue stability, margin gains, and greater supply chain resilience.

- Strategic recycling initiatives and geographic diversification increase access to raw materials, positioning AMG for improved profitability and lower cost volatility.

- Continued exposure to commodity price swings, high capital spending, and operational challenges threaten cash flow, limit financial flexibility, and could prolong earnings volatility.

Catalysts

About AMG Critical Materials- Develops, produces, and sells energy storage materials.

- The ramp-up of AMG's expanded lithium production capacities in Brazil and Germany, combined with progress on resolving temporary equipment issues, positions the company to capture rising demand from the EV and energy storage sectors; this is likely to support accelerated revenue and EBITDA growth once full capacity is restored and as pricing recovers.

- The commissioning and demand coverage (contracted utilization) of the Bitterfeld lithium refining facility, as well as new feedstock agreements in Europe, are set to solidify AMG's position as a key regional supplier-likely leading to greater revenue stability and the potential for premium pricing, supporting both top-line growth and margin enhancement.

- Strategic investments in recycling and circular economy initiatives, particularly in vanadium catalyst and battery materials, are increasing AMG's access to critical secondary raw materials and improving supply chain resilience, which should drive higher net margins and reduce input cost volatility relative to competitors.

- AMG's expanding presence in North America and the Middle East (notably through the chrome metal plant in Pennsylvania and joint ventures in Saudi Arabia), aligned with Western government support for domestic critical materials supply chains, could yield long-term volume and pricing upside as national security policies drive contract stability and elevated demand-positively impacting future revenue and EBITDA.

- The recent high profitability in the Antimony segment, underpinned by favorable market conditions, persistent order backlog in AMG Technologies, and anticipated normalization of working capital, suggest that earnings and cash flow are poised for improvement in the medium term as market conditions recover and operational bottlenecks are addressed.

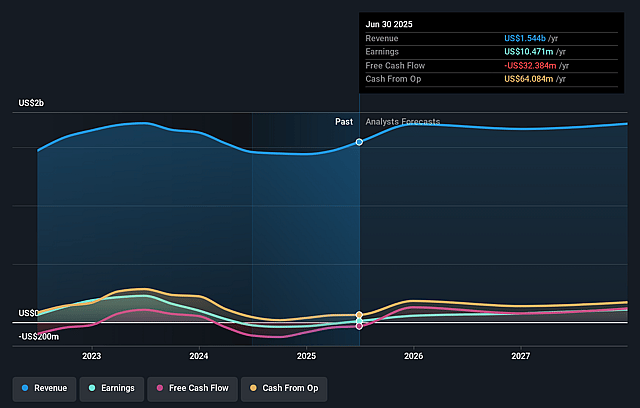

AMG Critical Materials Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AMG Critical Materials's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.7% today to 8.5% in 3 years time.

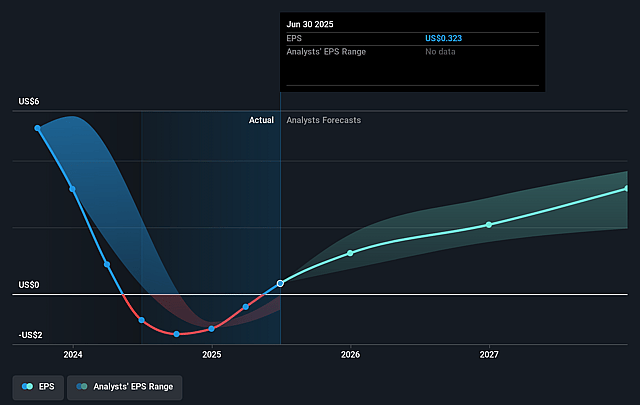

- Analysts expect earnings to reach $146.4 million (and earnings per share of $3.15) by about September 2028, up from $10.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.5x on those 2028 earnings, down from 99.0x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 9.9x.

- Analysts expect the number of shares outstanding to decline by 1.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.88%, as per the Simply Wall St company report.

AMG Critical Materials Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent volatility and price declines in key products such as lithium and vanadium, as evidenced by recent revenue and EBITDA declines in those segments, highlight exposure to commodity cycles and may continue to depress revenue and net income if market prices do not recover sustainably.

- Ongoing high levels of capital expenditure for facility expansions, technological upgrades, and environmental compliance (as noted, $75–100 million expected in 2025) may constrain free cash flow and limit dividend growth or debt reduction, impacting net earnings and financial flexibility.

- Elevated inventories and working capital tied up in raw material bidding (notably vanadium and antimony) have already negatively affected operating cash flow; if market demand or pricing fails to absorb inventories at expected rates, future earnings and cash flow generation may suffer.

- The company's profitability in the AMG Antimony segment this quarter was boosted by a one-off tailwind from low-cost inventory sales at higher market prices-an effect management explicitly described as temporary-raising the risk of lower future segment margins and more volatile earnings once this effect dissipates.

- Operational risks related to ramping new capacity, equipment failures (e.g., the lithium expansion issue in Brazil), and customer qualification processes could prolong underutilization of assets, delay production volume increases, and dampen revenue growth or EBITDA contribution in key new investments over the long-term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €25.72 for AMG Critical Materials based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €32.06, and the most bearish reporting a price target of just €20.22.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $146.4 million, and it would be trading on a PE ratio of 7.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of €27.54, the analyst price target of €25.72 is 7.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AMG Critical Materials?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.