Last Update 21 Jan 26

Fair value Increased 6.83%NVMI: Rising Multi Year Demand Expectations Will Likely Outrun Fundamentals

Narrative Update on Nova

Analysts have raised their price target on Nova to $450 from $380, citing expectations of stronger multi-year demand, improving visibility, broader customer exposure and the potential for higher free cash flow in an upturn.

Analyst Commentary

Bullish analysts see the higher price target as a reflection of what they view as improving fundamentals around demand visibility, customer mix and potential cash generation, all of which they factor into their updated valuation work.

Bullish Takeaways

- Stronger multi year demand expectations for semicap equipment are seen as supporting Nova's growth profile, which bullish analysts use to justify a higher target price.

- Analysts highlight increasing visibility on orders and customer activity, which they view as reducing uncertainty around execution and revenue planning.

- Greater customer diversification is viewed as a positive for Nova's risk profile, as it can spread exposure across more buyers and product cycles.

- Potential for higher free cash flow generation in an upturn is factored into valuation models, with bullish analysts assigning more value to future cash generation capacity.

Bearish Takeaways

- Even with a higher target, bearish analysts may question whether expectations for multi year demand are too optimistic, especially if end markets turn out softer than currently assumed.

- Improving visibility still depends on continued follow through from customers, so any slowdown in order activity could challenge execution against current expectations.

- Customer diversification, while helpful, does not fully remove concentration risk in semicap cycles, which can affect both growth and free cash flow in weaker periods.

- A higher target price can imply less room for upside if execution or demand trends do not track the stronger outlook that bullish analysts are currently baking in.

What's in the News

- Nova issued earnings guidance for the fourth quarter ending December 31, 2025, with management expecting revenue of $215 million to $225 million. (Company guidance)

- The company also guided to diluted GAAP EPS of $1.77 to $1.95 for the same quarter, giving investors a reference range for projected profitability. (Company guidance)

Valuation Changes

- Fair Value: updated from $368.57 to $393.75, representing a modest upward shift in the modeled estimate.

- Discount Rate: adjusted from 14.05% to 13.95%, reflecting a slight reduction in the required return used in the analysis.

- Revenue Growth: updated from 13.93% to 14.26%, indicating a small increase in assumed top line expansion.

- Net Profit Margin: revised from 31.51% to 31.63%, reflecting a minor change in expected profitability levels.

- Future P/E: moved from 42.65x to 44.88x, suggesting a modestly higher multiple applied to projected earnings.

Key Takeaways

- Demand for Nova's advanced metrology and analytics solutions is rising due to semiconductor complexity and global industry investments, supporting broad, diversified growth.

- Product innovation and recurring, high-margin services are strengthening customer relationships and margins, positioning Nova for increased market share and operational leverage.

- Heavy reliance on key customers, technology adoption risks, higher R&D spending, geopolitical exposure, and rising competition all cloud Nova's revenue and margin outlook.

Catalysts

About Nova- Engages in the design, development, production, and sells of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

- The accelerating complexity of semiconductor devices-driven by AI, larger die sizes, advanced nodes, and heterogeneous packaging-continues to fuel demand for Nova's advanced metrology solutions across both logic/foundry and memory segments, which is poised to lift long-term revenue growth as global digitization trends expand.

- Ongoing global investments in semiconductor manufacturing capacity (including reshoring, new fabs in multiple regions, and government incentives) are broadening Nova's customer base and diversifying revenue streams, supporting sustained top-line growth and reducing reliance on any single geography or customer.

- Expansion of Nova's software-driven analytics, AI/ML integration, and value-added services is deepening customer relationships and driving a recurring revenue mix with higher margins, which is likely to support stable or improving net margins over time.

- Introduction and ramp of new product platforms (e.g., Sentronics integration, VeraFlex, METRION, and ELIPSON tools) for advanced logic, memory, and 3D NAND applications positions Nova to capture additional market share and opens new cross-selling opportunities, further boosting future revenue trajectories.

- Operational excellence achieved through diversified revenue streams, a resilient business model, and continued efficiency investments positions Nova to leverage scale and expand operating margins as their solutions proliferate through industry inflection points.

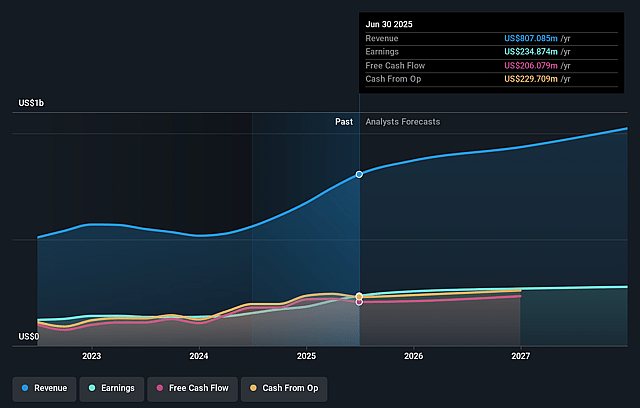

Nova Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nova's revenue will grow by 9.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 29.1% today to 27.5% in 3 years time.

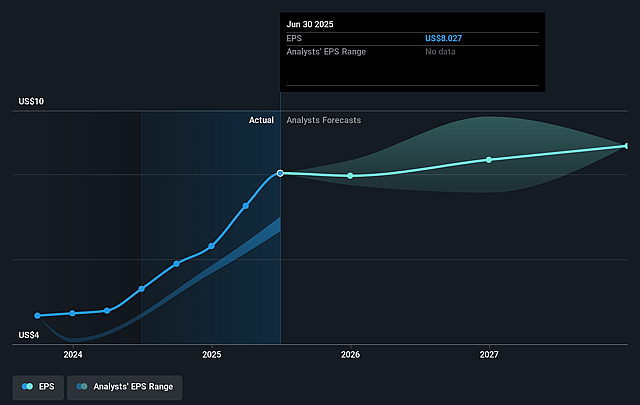

- Analysts expect earnings to reach $293.1 million (and earnings per share of $8.67) by about September 2028, up from $234.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.5x on those 2028 earnings, up from 34.7x today. This future PE is greater than the current PE for the US Semiconductor industry at 33.5x.

- Analysts expect the number of shares outstanding to grow by 1.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.01%, as per the Simply Wall St company report.

Nova Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Nova's significant exposure to a few major "gate-all-around" and advanced node customers increases concentration risk-if any large customer reduces or delays CapEx, as hinted at for one IDM customer, it could result in uneven revenue growth and threaten earnings stability over time.

- The company's ongoing growth depends on successful adoption and commercialization of new technologies like ELIPSON, METRION, and advanced material metrology platforms; failure to reach "process tool of record" status or slower-than-expected lab-to-fab conversion could stall product diversification and limit future top-line expansion.

- Heightened investments in R&D and integration of new acquisitions (e.g., Sentronics), while necessary for innovation, may pressure net margins if commercialization cycles are longer than planned or if revenue synergy assumptions are not fully realized.

- Nova cites increasing strength in advanced packaging and China, but given potential future shifts in trade restrictions, tariffs, or geopolitical tensions, its global revenue diversification remains vulnerable to external shocks that could negatively impact both revenue and margin profiles.

- The market's current optimism about Nova's competitive leadership in several segments could be undermined by intensified competition in integrated and stand-alone metrology, especially if larger or emerging players launch new products or price aggressively, potentially eroding Nova's gross margins and long-term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $298.333 for Nova based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $293.1 million, and it would be trading on a PE ratio of 45.5x, assuming you use a discount rate of 13.0%.

- Given the current share price of $277.22, the analyst price target of $298.33 is 7.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Nova?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.