Catalysts

About Nova

Nova provides process control and metrology tools used in semiconductor manufacturing, with exposure to advanced logic, memory and advanced packaging applications.

What are the underlying business or industry changes driving this perspective?

- AI focused chip manufacturing requires more complex device architectures and tighter tolerances. However, if customers slow node migrations or extend existing nodes, Nova’s advanced node metrology tools could see softer demand, which would weigh on product revenue growth and limit operating leverage.

- High bandwidth memory and DRAM are currently strong pockets of demand. Any pause in capacity additions or delays in HBM ramps would leave Nova’s recent wins in Veraflex, PRISM and WMC underutilized, which could pressure top line momentum and keep gross margins closer to the low end of the 57% to 60% target range.

- Gate all around adoption is spreading across four major players. If process flows stabilize faster than expected or customers consolidate tool suppliers, Nova’s anticipated order pipeline could fall short, which would cap earnings growth relative to recent quarters where non GAAP EPS reached US$2.16.

- Advanced packaging is gaining importance for AI and power devices. If customers emphasize cost control over metrology intensity or delay investments in 2.5D, 3D and hybrid bonding, utilization of platforms like WMC, PRISM and Ancolyzer may lag, limiting the contribution of this segment to overall revenue mix and net margins.

- The new Mannheim facility allows Nova to triple capacity for advanced packaging optical metrology. If wafer fab equipment growth moderates or shifts toward regions or nodes where Nova has less share, this added fixed cost base could dilute gross margin and constrain free cash flow generation, despite the current US$1.6b cash and marketable securities position.

Assumptions

This narrative explores a more pessimistic perspective on Nova compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

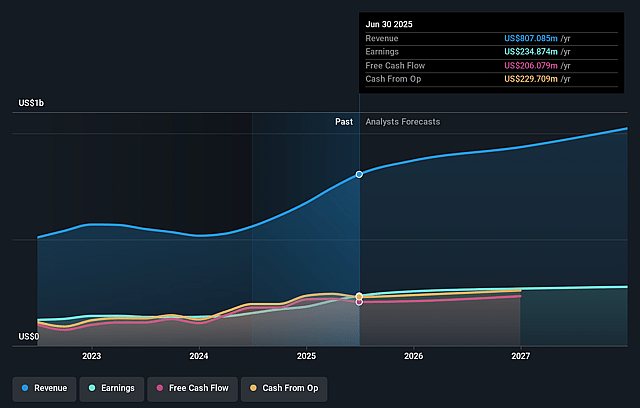

- The bearish analysts are assuming Nova's revenue will grow by 14.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 28.7% today to 32.2% in 3 years time.

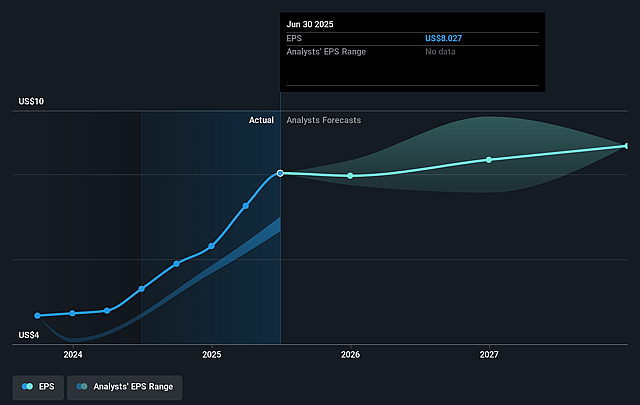

- The bearish analysts expect earnings to reach $413.4 million (and earnings per share of $12.15) by about January 2029, up from $245.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 38.4x on those 2029 earnings, down from 54.7x today. This future PE is lower than the current PE for the US Semiconductor industry at 43.4x.

- The bearish analysts expect the number of shares outstanding to grow by 2.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.95%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Record quarterly revenue of US$224.6 million in Q3 2025, six consecutive quarters of record results and guidance for 2025 to be a record revenue year with about 30% year-over-year growth suggest Nova is currently gaining traction across advanced logic, memory and packaging, which could support revenue and earnings more than a bearish share price view implies.

- Exposure to several long-term semiconductor growth areas, including advanced DRAM, high bandwidth memory, gate all around logic nodes and advanced packaging for AI related devices, points to structural demand drivers that may support sustained product and service revenue and help maintain net margins.

- The advanced packaging portfolio, including PRISM, WMC, SemDex, integrated metrology and Ancolyzer, is already contributing an estimated 20% of 2025 revenue compared with about 15% last year. A rising mix of packaging applications could broaden the revenue base and help support overall gross margins near the 57% to 60% target range.

- Nova’s selection as a tool of record by leading foundries and wins that replace competing tools, combined with the ability to triple production capacity for advanced packaging optical metrology at the new Mannheim facility, could help the company capture incremental share in key nodes, supporting long term revenue and operating margins.

- A strong balance sheet with about US$1.6b in cash, cash equivalents, bank deposits and marketable securities and access to additional capital through the US$750 million 0% convertible notes provide financial flexibility to keep investing in R&D and potential M&A, which could support future earnings growth even if parts of the industry slow.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Nova is $335.0, which represents up to two standard deviations below the consensus price target of $393.75. This valuation is based on what can be assumed as the expectations of Nova's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $500.0, and the most bearish reporting a price target of just $335.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2029, revenues will be $1.3 billion, earnings will come to $413.4 million, and it would be trading on a PE ratio of 38.4x, assuming you use a discount rate of 13.9%.

- Given the current share price of $452.09, the analyst price target of $335.0 is 35.0% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Nova?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.