Last Update 09 Feb 26

Fair value Decreased 3.57%ETD: Refined Fair Value And Margins Will Shape Future Shareholder Upside

The analyst price target for Ethan Allen Interiors has been reduced by $1 to $27 as analysts incorporate updated assumptions for fair value, revenue growth, profit margins and future P/E following recent research commentary.

Analyst Commentary

Bullish Takeaways

- Bullish analysts view the modest US$1 reduction in the price target to US$27 as a fine tuning of their fair value work rather than a shift in the overall thesis, keeping the stock within a similar valuation range on updated P/E assumptions.

- They see room for execution upside if Ethan Allen Interiors can stabilize or improve revenue growth versus the assumptions now embedded in the target, which could support a higher multiple over time.

- Some are encouraged that margin expectations have been recalibrated to what they see as more achievable levels, reducing the risk of future estimate cuts tied to profitability.

- Bullish analysts highlight that a refreshed framework around growth, margins and P/E creates a clearer yardstick for tracking whether management is hitting key milestones on revenue and earnings.

Bearish Takeaways

- Bearish analysts focus on the need to trim the target, reading it as a sign that previous assumptions for revenue growth and profit margins may have been too optimistic.

- They point to updated P/E inputs as a reminder that investors could be paying a full price if execution on sales and margins does not track the new model, which may limit upside from current levels.

- There is caution that, with lower fair value estimates now in place, any slip in demand or cost discipline versus the revised assumptions could put further pressure on earnings forecasts.

- Some bearish analysts flag that even small downward moves in targets can influence sentiment, especially if they are followed by additional revisions to revenue or margin expectations.

Valuation Changes

- Fair Value: Trimmed from US$28 to US$27, a reduction of US$1 on the analyst model.

- Discount Rate: Adjusted slightly from 8.99% to 8.97%, indicating only a very small change in the assumed risk profile.

- Revenue Growth: Reset from 1.61% to 0.51%, reflecting a much lower growth assumption now built into the valuation work.

- Net Profit Margin: Lifted from 6.22% to 6.90%, signaling a higher modeled level of profitability for Ethan Allen Interiors.

- Future P/E: Reduced from 22.88x to 21.62x, implying a slightly lower valuation multiple applied to expected earnings.

Key Takeaways

- Heavy reliance on traditional showrooms and North American markets increases vulnerability to digital disruption and regional economic changes.

- Margin growth is limited by high fixed costs and rising competition from online and budget retailers, straining pricing power and long-term sales.

- Strong operational efficiency, financial stability, and product customization have increased profitability and resilience, enabling Ethan Allen to adapt to shifting consumer trends and maintain long-term growth.

Catalysts

About Ethan Allen Interiors- Operates as an interior design company, and manufacturer and retailer of home furnishings in the United States and internationally.

- Investors appear to be pricing in ongoing pressure from the continued shift of furniture sales to e-commerce and direct-to-consumer channels, which threatens Ethan Allen's more traditional, showroom-dependent operating model and could lead to slower revenue growth relative to industry peers with stronger digital-first capabilities.

- The market expects that the company's concentrated focus on North American manufacturing and sales exposes it to regional macroeconomic volatility and limits diversification, potentially resulting in more pronounced swings in revenue and earnings, particularly during U.S. economic slowdowns.

- Ethan Allen's strong gross and operating margins-helped by significant cost control and technology-led efficiency gains-may have limited further upside as fixed costs remain high due to its capital-intensive retail footprint, suggesting margin expansion from current levels is unlikely and could reverse if sales weaken.

- There are concerns that an aging demographic in developed markets, particularly among Ethan Allen's core higher-income segments, may result in less demand for large-ticket premium furniture as downsizing and reduced home spending accelerate, ultimately capping medium

- to long-term revenue growth.

- Increased competitive pressure from online and value-oriented furniture retailers is likely to constrain the company's pricing power and may force greater promotional activity to maintain market share, which could compress net margins and limit future earnings growth.

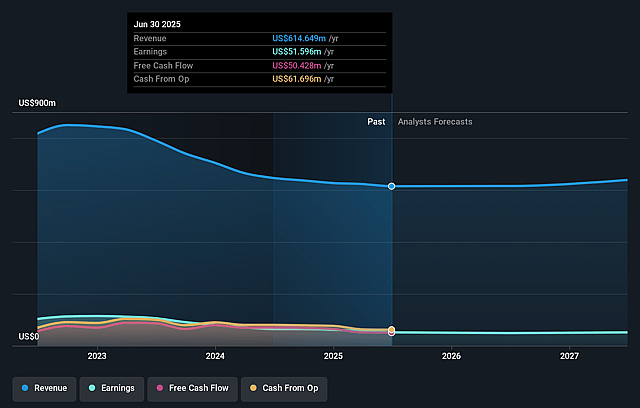

Ethan Allen Interiors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ethan Allen Interiors's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.4% today to 7.8% in 3 years time.

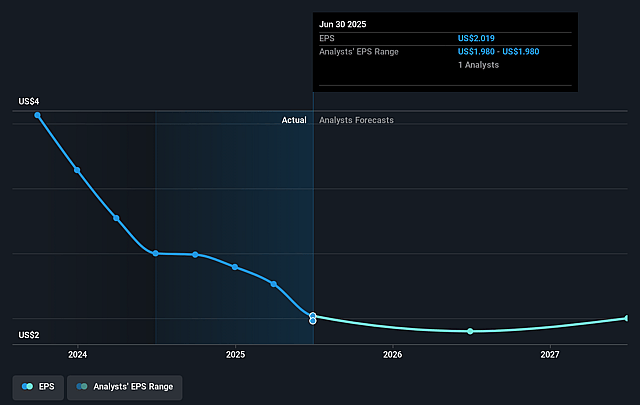

- Analysts expect earnings to reach $51.0 million (and earnings per share of $1.99) by about September 2028, down from $51.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, up from 14.5x today. This future PE is greater than the current PE for the US Consumer Durables industry at 11.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.63%, as per the Simply Wall St company report.

Ethan Allen Interiors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ethan Allen's vertically integrated business model, with 80% of manufacturing in North America, has limited the impact of tariffs and global supply chain disruptions, supporting strong gross margins and operating margins that are likely to sustain earnings stability in the long term.

- The company's significant reduction in headcount and operating costs, along with its ongoing investment in technology and digital marketing, has improved operational efficiency and allowed for maintained or increased net margins even in a challenging demand environment, potentially supporting continued profitability.

- Customization now constitutes 80% of the product mix (up from 20% fifteen years ago), reducing excess inventory and clearance needs; this shift cushions gross margins and boosts cash flow resilience, counteracting pressures from fluctuating demand.

- Ethan Allen's robust balance sheet-with $196 million in cash, zero debt, and sustained cash generation-provides financial flexibility for reinvestment or increased shareholder returns, limiting downside risks to net income and supporting dividend sustainability.

- Recent improvements in retail order growth (+1.6% year-over-year in a tough quarter), combined with proactive store relocations and renovations, point to an adaptive business model that is capitalizing on changing consumer trends and positioning for long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $30.0 for Ethan Allen Interiors based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $651.0 million, earnings will come to $51.0 million, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 8.6%.

- Given the current share price of $29.35, the analyst price target of $30.0 is 2.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ethan Allen Interiors?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.