Last Update26 Sep 25Fair value Increased 5.48%

Analysts raised their price target for American Public Education from $36.50 to $38.50, citing robust post-COVID enrollment growth, outperformance in quarterly results, and a strong position in military and nursing education as key drivers of optimism and perceived undervaluation.

Analyst Commentary

- Bullish analysts highlight the company's strong recovery post-COVID, evidenced by sustained enrollment growth and stabilization, which has driven significant share price appreciation.

- Continued outperformance in quarterly results, with recent earnings and raised FY25 guidance exceeding expectations, supports upward price target revisions.

- Analysts note American Public Education holds a leading position in military education and has seen a strategic inflection at Rasmussen University, benefiting from an ongoing nursing shortage.

- Expectations for a more favorable regulatory environment and persistent demand for affordable online and nursing education provide a positive outlook for profitable growth.

- Despite recent gains, the stock is viewed as undervalued, trading at a significant discount to peers, with further margin expansion and multiple catalysts still ahead.

What's in the News

- The Supreme Court has permitted the Trump administration to proceed with mass layoffs at the Education Department, a decision that could affect publicly traded education companies including American Public Education (APEI) (Wall Street Journal).

- American Public Education completed the redemption of all outstanding Series A Senior Preferred Stock for $44.5 million, including accrued dividends, funded from cash on hand (Key Developments).

- The company executed no share repurchases during Q2 2025 but has now completed the previously announced buyback program, totaling 431,555 shares (2.44%) at $4.42 million (Key Developments).

- Full-year 2025 consolidated revenue guidance is reaffirmed at $650–$660 million; net income guidance is reset to $18–$24 million to reflect losses from the sale of Graduate School USA and the preferred equity redemption (Key Developments).

- Q3 2025 guidance anticipates consolidated revenue of $159–$161 million with an expected net loss to common stockholders between $2.9 million and $0.8 million (Key Developments).

Valuation Changes

Summary of Valuation Changes for American Public Education

- The Consensus Analyst Price Target has risen from $36.50 to $38.50.

- The Future P/E for American Public Education has risen from 13.68x to 14.42x.

- The Discount Rate for American Public Education remained effectively unchanged, moving only marginally from 7.49% to 7.47%.

Key Takeaways

- Consolidating educational brands and expanding career-oriented healthcare offerings drive operational efficiencies and align with rising demand for upskilling among adult learners.

- Enhanced online capabilities and strong military partnerships boost student retention, recurring revenue, and sustain revenue stability through affordable, outcome-focused programs.

- Integration challenges, reliance on federal funding, regulatory uncertainty, and competition from alternative education models threaten profitability and margin growth despite enrollment gains.

Catalysts

About American Public Education- Provides online and campus-based postsecondary education and career learning in the United States.

- Ongoing double-digit enrollment growth at Rasmussen University and Hondros College of Nursing, combined with operating leverage as these units scale, positions APEI to benefit from increased demand for career-oriented healthcare education-likely supporting future revenue growth and margin expansion.

- Strategic consolidation of APUS, Rasmussen, and Hondros into a single accredited institution will unlock cost and revenue synergies, including shared curriculum access and more efficient marketing across a unified brand platform, potentially accelerating top-line growth and improving net margins.

- Expansion in online learning and remote education, reinforced by investments in intelligent infrastructure, predictive analytics, and personalized digital tools, strengthens student engagement and retention-expected to drive higher recurring revenues and improved profitability over time.

- Elevated government support for military education (e.g., $100M extension in tuition assistance through the Department of Defense) and APEI's strong relationships with military institutions enhance visibility of future enrollment and reduce student acquisition costs, contributing to sustained revenue stability and higher gross margins.

- APEI's focus on affordable, outcome-based educational offerings in high-demand fields (especially nursing) aligns with rising demand for upskilling and reskilling among adult learners, supporting a stable, growing customer base and underpinning long-term revenue and earnings growth.

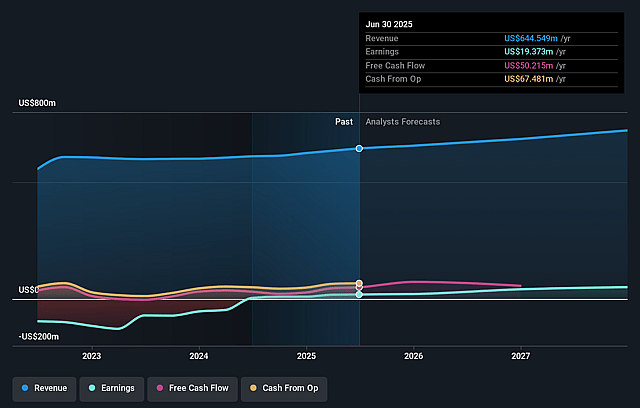

American Public Education Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming American Public Education's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 8.6% in 3 years time.

- Analysts expect earnings to reach $63.0 million (and earnings per share of $2.46) by about September 2028, up from $19.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, down from 31.8x today. This future PE is lower than the current PE for the US Consumer Services industry at 18.6x.

- Analysts expect the number of shares outstanding to grow by 2.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.49%, as per the Simply Wall St company report.

American Public Education Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing integration of APUS, Rasmussen, and Hondros into a single accredited institution presents execution and consolidation risks-delays, unexpected costs, or difficulty realizing anticipated synergies could negatively affect expenses and profitability.

- Despite enrollment growth, Rasmussen and Hondros are operating at or near breakeven levels, and profitability relies heavily on continued enrollment momentum-any slowdown could compress margins and restrain earnings growth.

- The company's strong reliance on federal military tuition assistance and related policies exposes revenue and profitability to future legislative, regulatory, or budgetary changes, despite recent funding increases.

- The sector remains vulnerable to increased regulatory scrutiny, accountability standards, and potential changes in gainful employment or loan caps that, even if currently manageable, could increase compliance costs or reduce available funding, pressuring margins and enrollments.

- American Public Education's strategy of focusing on affordable, high-demand programs requires ongoing marketing efficiency and technological investment; escalating competition from alternative credential providers or new education models could erode market share and force tuition reductions, negatively impacting revenues and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.5 for American Public Education based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $735.1 million, earnings will come to $63.0 million, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 7.5%.

- Given the current share price of $34.15, the analyst price target of $36.5 is 6.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.