Narratives are currently in beta

- Strategic focus on reducing non-profitable promotions and investing in digitalization aims to improve efficiency, profitability, and positively impact net margins.

- Anticipated revenue growth from higher price mix and strategic pivot towards smaller pack sizes in international markets to meet consumer needs and enhance engagement.

- Shifts in product sizes and pricing strategies aimed at managing inflation and maintaining market affordability may risk volume and revenue, amid cautious consumer spending.

What are the underlying business or industry changes driving this perspective?

- The strategic focus on optimizing volume and margins, with decisions such as reducing non-profitable promotions, is expected to drive improved efficiency and profitability, positively impacting net margins.

- The anticipated higher price mix in 2024 due to sustained inflation and strategic pricing actions is likely to contribute to revenue growth and margin expansion.

- Investments in digitalization and global business services aimed at driving out unnecessary costs and enhancing operational efficiency are expected to positively influence the company-s cost structure and margins.

- The pivot towards smaller pack sizes and affordability, especially in international markets, reflects adaptability to consumer needs and is expected to sustain volume growth and enhance consumer engagement, potentially impacting revenue positively.

- The early guidance for 2024, reflecting a balance between cautious consumer expectations and proactive cost management strategies, indicates a forward-looking confidence in achieving growth targets, positively impacting investor sentiment and the stock value.

How have these above catalysts been quantified?

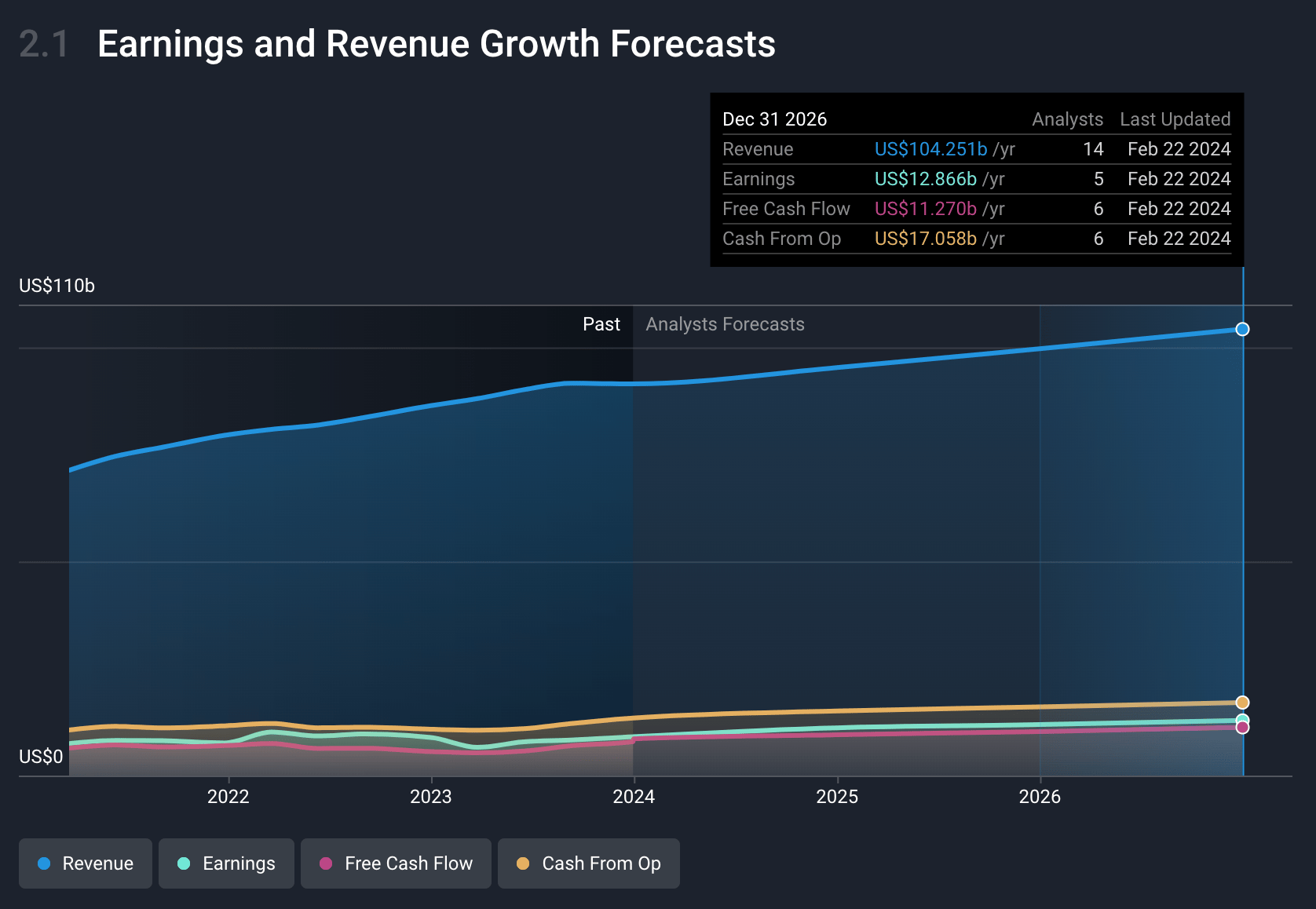

- Analysts are assuming PepsiCo's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.9% today to 12.3% in 3 years time.

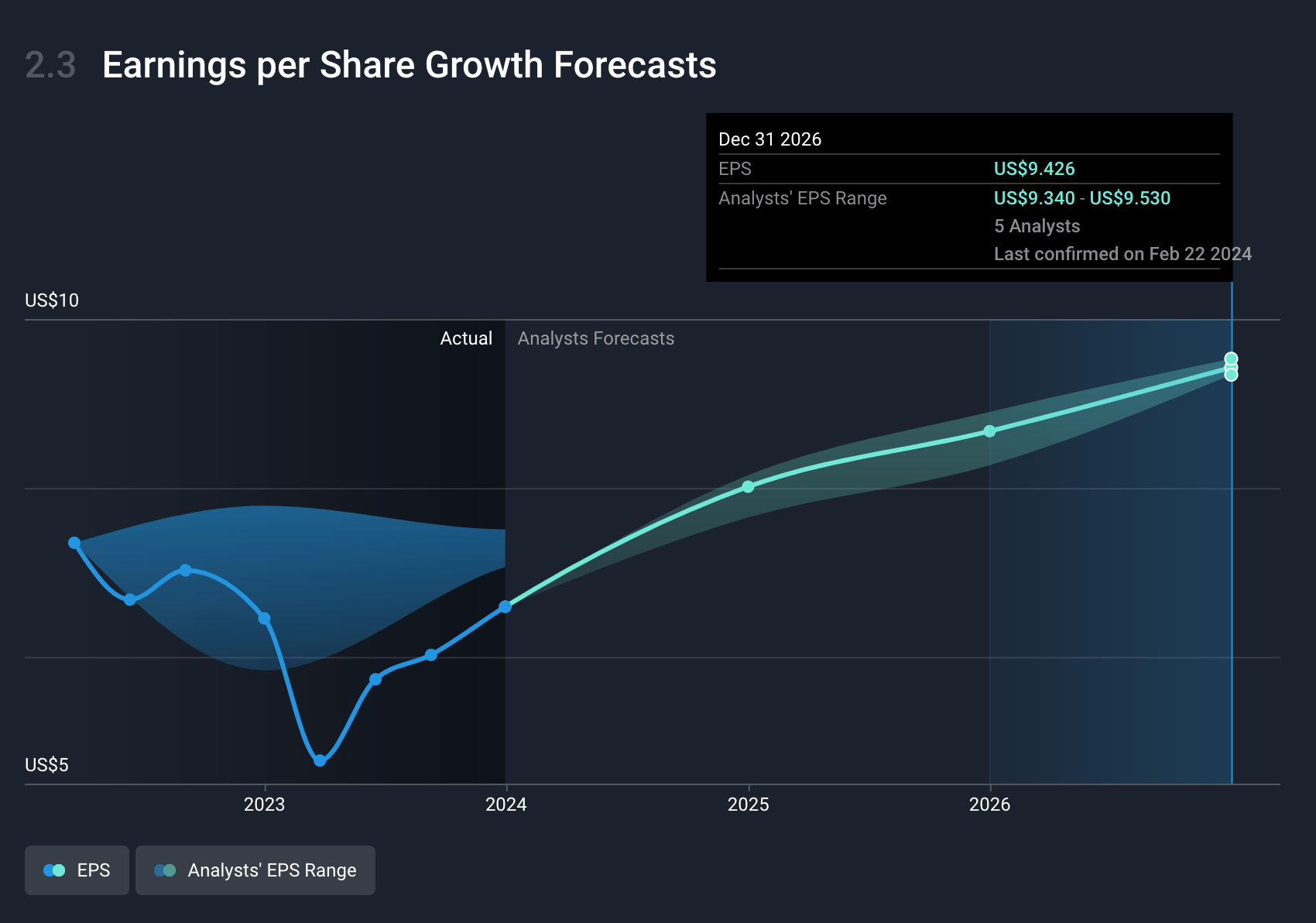

- Analysts expect EPS to reach $9.42 ($12.9 billion in earnings) by about February 2027, up from $6.6 today.

What could happen that would invalidate this narrative?

- The shift to smaller pack sizes and optimization of PBNA portfolio for margin expansion might lead to a reduction in volume, impacting revenue growth.

- Guidance for 2024 suggests a higher price mix to combat inflation, which could risk lowering demand if consumers are more price-sensitive, potentially affecting volumes and revenue.

- The strategy to maintain affordability in Latin American markets by reducing product sizes could impact overall volume, although it aims to keep the products within consumer reach, potentially affecting revenue from this region.

- The indication of continuing cautious consumer behavior into 2024, and reliance on driving productivity to mitigate challenges, may suggest potential risks if consumer spending tightens further, impacting revenue and net margins.

- The focus on digitalization and efficiency improvements, while beneficial for long-term growth, carries execution risk. If these strategic shifts do not meet expectations or result in unforeseen costs, they could impact earnings.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

US$181.94

FV

12.7% undervalued intrinsic discount3.53%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

16users have followed this narrative

Updated narrative