Last Update 09 Jan 26

Fair value Increased 1.63%BMPS: Fair Value And 2026 Shareholder Meeting Will Shape Future Outlook

Analysts have nudged their fair value estimate for Banca Monte dei Paschi di Siena to €9.96 from €9.80, reflecting slightly adjusted assumptions for discount rate, revenue growth, profit margin and future P/E, which together point to a modestly higher long term valuation profile.

What's in the News

- Banca Monte dei Paschi di Siena has scheduled a Special and Extraordinary Shareholders Meeting for February 4, 2026, at 14:30 W. Europe Standard Time. This meeting could involve decisions on capital structure or governance topics that matter for long term shareholders (Key Developments).

Valuation Changes

- Fair value estimate, adjusted slightly to €9.96 from €9.80, reflecting small tweaks to the valuation model inputs.

- Discount rate, set at 10.90%, compared with the previous 10.97%, which is a very small change in the assumed risk profile.

- Revenue growth, now modelled at 33.16%, essentially in line with the prior 33.16% assumption.

- Net profit margin, now at 34.25%, effectively unchanged from the earlier 34.25% input.

- Future P/E, adjusted modestly to 7.39x from 7.29x, indicating a slightly higher assumed earnings multiple in the outer years of the model.

Key Takeaways

- Declining interest rates, demographic challenges, and digital disruption threaten future profitability, loan growth, and revenue sustainability.

- Reliance on merger synergies and digital transformation is crucial, but scale disadvantages and rising costs may constrain long-term earnings improvement.

- Improved asset quality, capital strength, and expansion initiatives position the bank for enhanced profitability, strategic growth, and stronger shareholder returns amid ongoing sector consolidation.

Catalysts

About Banca Monte dei Paschi di Siena- Engages in the provision of retail and commercial banking services in Italy.

- The bank's recent strong profit growth and improved asset quality appear to reflect favorable Italian economic conditions, but with interest rates expected to decline and structural macro headwinds like Italy's aging population persisting, credit demand and loan growth could slow longer-term, compressing revenues and ultimately earnings.

- Current robust net interest income benefits from strong lending volumes and retail deposit growth, but the anticipated environment of declining rates in the EU threatens net interest margins and makes it difficult to maintain the current level of profitability, likely leading to margin pressure ahead.

- While the high current profitability and strong capital position underpin a raised guidance and the prospect of a 100% payout dividend policy, intensifying competition from fintechs and rapid digitalization may erode traditional fee and lending revenues, weakening future revenue growth.

- The bank's optimistic forward guidance hinges heavily on merger synergies with Mediobanca, but if industry consolidation trends accelerate, BMPS risks competitive disadvantage or value-dilutive terms if unable to achieve scale, which could hamper cost synergies and constrain earnings growth.

- Long-term structural pressures-including regulatory tightening, higher capital requirements, and persistent scale disadvantages versus larger EU peers-threaten to drive up operating costs and maintain elevated cost-to-income ratios, limiting sustainable improvement in net margins and overall earnings.

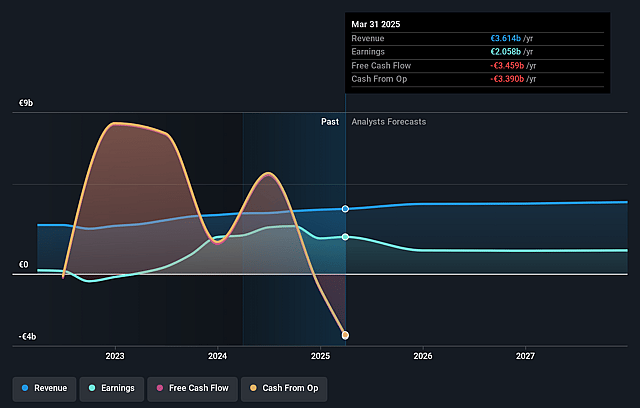

Banca Monte dei Paschi di Siena Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Banca Monte dei Paschi di Siena's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 45.9% today to 34.2% in 3 years time.

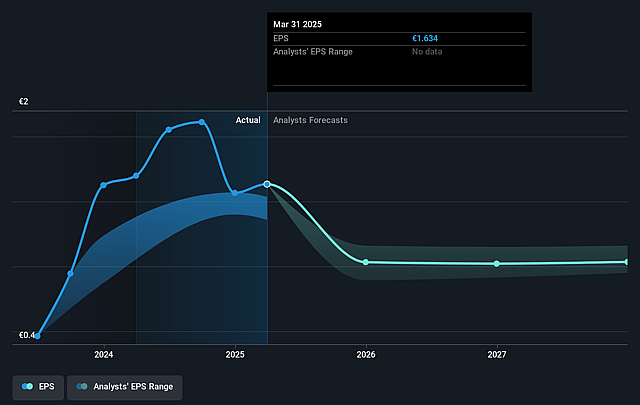

- Analysts expect earnings to reach €1.4 billion (and earnings per share of €1.12) by about August 2028, down from €1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.5x on those 2028 earnings, up from 6.0x today. This future PE is greater than the current PE for the IT Banks industry at 8.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.04%, as per the Simply Wall St company report.

Banca Monte dei Paschi di Siena Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained improvements in asset quality, evidenced by consistent reductions in non-performing loan (NPL) stock and a declining cost of risk, could enhance net margins and reduce future credit losses, positively impacting profitability and earnings.

- The robust capital position (CET1 ratio of 19.6%) and strong results in stress tests provide a significant buffer above regulatory requirements, enabling strategic flexibility for further growth, M&A, and increased shareholder payouts, which could support or boost the share price.

- The proposed combination with Mediobanca is projected to deliver substantial pre-tax synergies (~€700 million per year) and double-digit accretion in adjusted earnings per share, as well as a 100% payout ratio and high dividend yield, directly benefiting shareholder returns and future earnings growth.

- Ongoing expansion in wealth management, commercial banking, and consumer lending-demonstrated by strong inflows, increased lending volumes, and rising fee income-reflects effective digital transformation and commercial execution, which may drive revenue growth and operational efficiency long-term.

- Progressive financial sector consolidation in Europe could unlock cross-border synergies, improved scale, and competitive positioning for the combined entity, positioning Banca Monte dei Paschi di Siena to capture new revenue streams, enhance net margins, and improve cost-to-income ratios over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €8.589 for Banca Monte dei Paschi di Siena based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €10.5, and the most bearish reporting a price target of just €6.35.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €4.1 billion, earnings will come to €1.4 billion, and it would be trading on a PE ratio of 10.5x, assuming you use a discount rate of 11.0%.

- Given the current share price of €7.96, the analyst price target of €8.59 is 7.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Banca Monte dei Paschi di Siena?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.