Key Takeaways

- Accelerated retail lending and ambitious acquisitions expose the bank to higher credit risk, operational complexity, and lasting pressure on asset quality and earnings stability.

- Persistent vulnerability to fintech competition and aggressive capital returns threaten fee income, financial flexibility, and the sustainability of traditional banking operations.

- Enhanced capital strength, diversified revenue, operational efficiency, potential Mediobanca synergies, and digital investment position the bank for resilient growth and long-term value creation.

Catalysts

About Banca Monte dei Paschi di Siena- Engages in the provision of retail and commercial banking services in Italy.

- The rapid acceleration in front-loaded mortgage origination and retail lending, while boosting short-term revenues, exposes the bank to heightened long-term credit risk in the context of an aging Italian population, which is likely to reduce sustainable loan demand and degrade asset quality over time, ultimately compressing future net interest income and increasing the cost of risk.

- Despite efforts to expand market share and diversify revenues, Banca Monte dei Paschi di Siena remains acutely vulnerable to digital disruption and escalating fintech competition that is steadily eroding the traditional banking model; this risks ongoing margin compression and declining fee income as new entrants capture high-value clients and alter consumer banking behavior.

- The bank's bullish pursuit of the Mediobanca acquisition and associated synergies is predicated on optimistic integration timelines and sustained commercial outperformance, yet the combined entity will almost certainly face greater regulatory burdens, operational complexity, and integration risks, which could lead to structurally higher costs, weaker earnings resilience, and ultimately impair the targeted double-digit earnings per share accretion.

- Anticipated 100% dividend payouts over the coming years signal management's aggressive capital returns policy, but this reduces retained earnings and limits financial flexibility in an environment of stricter capital requirements, growing shadow banking competition, and rising alternative lending platforms that threaten to erode the bank's traditional loan book and funding base.

- While headline asset quality has improved in recent quarters due to non-performing loan disposals and tactical risk management, legacy issues persist with the bank still holding a relatively high non-performing loan ratio compared to peers, creating ongoing pressure on credit provisions and capital adequacy, especially as sector consolidation in Italy could force Banca Monte dei Paschi di Siena into strategic disadvantages or further restructuring that damage long-term profitability.

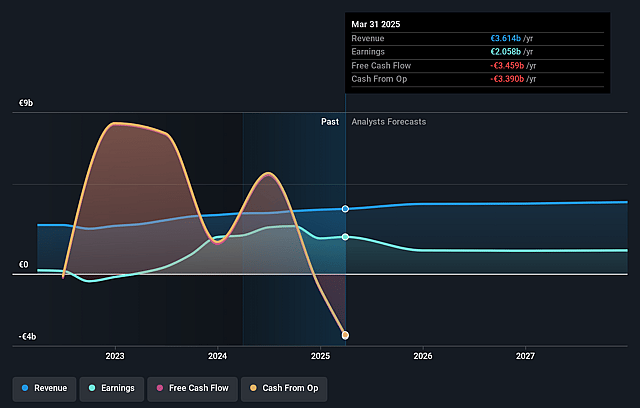

Banca Monte dei Paschi di Siena Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Banca Monte dei Paschi di Siena compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Banca Monte dei Paschi di Siena's revenue will grow by 3.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 45.9% today to 30.9% in 3 years time.

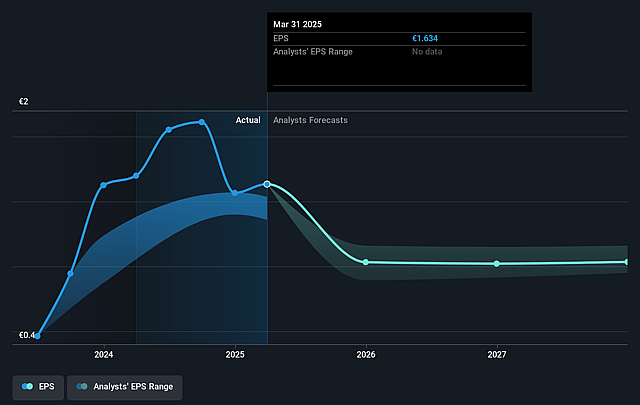

- The bearish analysts expect earnings to reach €1.3 billion (and earnings per share of €0.99) by about September 2028, down from €1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, up from 5.9x today. This future PE is greater than the current PE for the IT Banks industry at 8.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.22%, as per the Simply Wall St company report.

Banca Monte dei Paschi di Siena Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strengthening capital and asset quality metrics, including a core Tier 1 ratio of 19.6% and significant reductions in nonperforming loans, enhance the bank's risk profile and support long-term earnings stability.

- Accelerating growth in high-value areas such as wealth management and mortgage lending, as demonstrated by a 20% year-on-year increase in gross inflows and a doubling of new mortgage volumes, point to robust and diversified revenue streams.

- Effective cost control and operational efficiency, reflected in improvement of the cost/income ratio to 45% and stable non-HR cost dynamics, position the bank for stronger net margins over time.

- The Mediobanca combination, if successful, offers substantial cost and revenue synergies, immediate EPS accretion, and optionality for enhanced shareholder remuneration through a high dividend payout ratio, driving long-term shareholder value.

- Continued strategic investment in digital transformation and customer relationship management is underpinning fee growth and providing resilience against secular pressures, supporting fees and commissions income and supporting revenue durability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Banca Monte dei Paschi di Siena is €7.8, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Banca Monte dei Paschi di Siena's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €10.5, and the most bearish reporting a price target of just €7.8.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €4.0 billion, earnings will come to €1.3 billion, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 11.2%.

- Given the current share price of €7.92, the bearish analyst price target of €7.8 is 1.5% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.