Key Takeaways

- Enhanced scale, digitalization, and wealth management uniquely position BMPS for structurally higher profitability, share gains, and secular uplift in fee-based income and margins.

- Strong capital resilience and proactive risk management enable aggressive shareholder returns, value-creating M&A, and high-quality loan growth despite sector-wide normalization.

- Demographic headwinds, legacy loan risks, digital disruption, state ownership, and complex merger plans create significant uncertainty for future growth, profitability, and shareholder value.

Catalysts

About Banca Monte dei Paschi di Siena- Engages in the provision of retail and commercial banking services in Italy.

- While analyst consensus anticipates value creation from the Mediobanca merger, the scale and resilience of the combined group are likely being understated; the expanded reach, deepened product suite, and technological capacity could accelerate multi-year double-digit revenue growth and propel earnings, with synergies potentially far outpacing the initially guided 700 million euro per year as group efficiency and pricing power improve.

- Analysts broadly agree on the positive impact of wealth management growth, yet the rapid 20% annual increase in inflows and cross-sell potential suggest BMPS is uniquely positioned to capture outsized share of Italy's massive retirement and intergenerational wealth transfer trend, supporting a secular repositioning of fee-based income and structurally lifting net margins over the next decade.

- Persistent digitalization, already apparent in BMPS's remote advisory uptake and high net fee growth, signals a structural lowering of cost-to-income as process automation and customer acquisition costs decline, while digital engagement improves fee scalability and lowers cycle volatility, together driving higher sustainable profitability.

- The ongoing revitalization of Italian and Eurozone economic activity, combined with BMPS's fortified balance sheet and above-peer capital ratios, sets the stage for an extended phase of high-quality loan growth at attractive spreads, boosting net interest income even as the broader sector faces normalization in rates.

- BMPS's proactive reduction of non-performing loans and best-in-sector cost of risk equips it with industry-leading resilience and capital flexibility, increasing scope for aggressive dividend policy and potential for value-accretive bolt-on M&A, both of which can accelerate EPS growth beyond current market expectations.

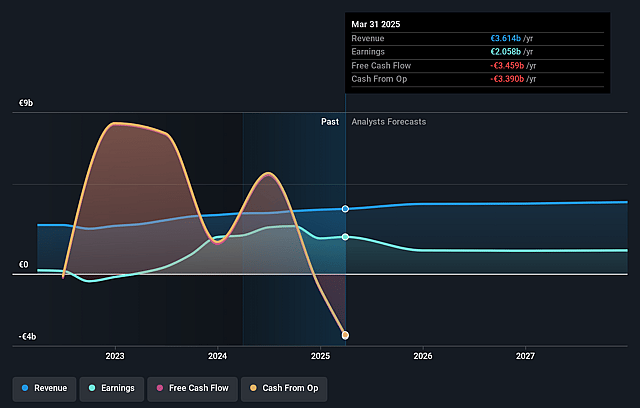

Banca Monte dei Paschi di Siena Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Banca Monte dei Paschi di Siena compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Banca Monte dei Paschi di Siena's revenue will grow by 6.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 45.9% today to 34.4% in 3 years time.

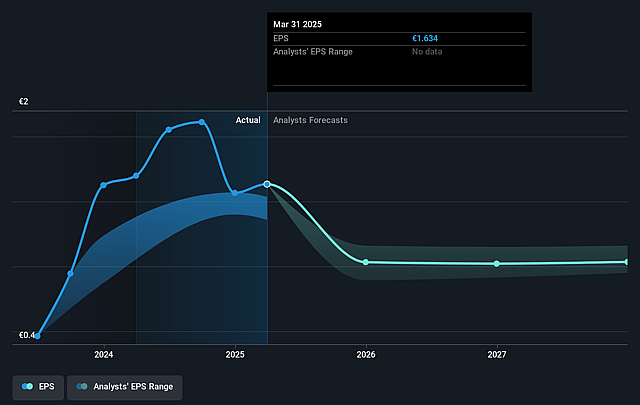

- The bullish analysts expect earnings to reach €1.5 billion (and earnings per share of €1.2) by about September 2028, down from €1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, up from 5.9x today. This future PE is greater than the current PE for the IT Banks industry at 8.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.22%, as per the Simply Wall St company report.

Banca Monte dei Paschi di Siena Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The long-term demographic decline and aging population in Italy may lead to sluggish economic growth and weaker demand for loans and banking products, potentially reducing Banca Monte dei Paschi di Siena's ability to sustain revenue and fee growth over time.

- Persistent legacy issues such as a still-elevated ratio of non-performing loans, despite recent reductions, pose continuing balance sheet risk and could result in higher provisions for loan losses in future downturns, thereby depressing net profit and return on equity.

- The rise of fintech players and ongoing digital disruption threaten to erode traditional banks' customer bases and fee income unless MPS accelerates its investments in digital transformation, risking future declines in revenues and margin compression if not addressed decisively.

- MPS remains majority owned by the state and relies on repeated capital increases; this pattern risks future dilution of shareholders, limits management's strategic options, and can weigh on earnings per share as well as long-term valuation multiples.

- The planned Mediobanca merger, while positioned as transformational, introduces complex execution risks, potential for shareholder dilution, and uncertainty about realizing forecasted synergies, with any shortfalls or integration missteps likely to negatively impact cost efficiency, profitability, and ultimately the share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Banca Monte dei Paschi di Siena is €10.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Banca Monte dei Paschi di Siena's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €10.5, and the most bearish reporting a price target of just €7.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €4.4 billion, earnings will come to €1.5 billion, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 11.2%.

- Given the current share price of €7.92, the bullish analyst price target of €10.5 is 24.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.