Last Update 27 Oct 25

Argan's analyst price target has risen significantly, with projections now at $315 from the prior $220. Analysts cite surging demand for AI-driven power infrastructure and robust project backlogs as key factors supporting a more optimistic outlook.

Analyst Commentary

Recent research coverage has highlighted both optimism and caution regarding Argan's valuation and growth prospects amid rising demand for power infrastructure linked to artificial intelligence trends.

Bullish Takeaways

- Bullish analysts have cited Argan's position as an underappreciated beneficiary of the rapidly accelerating AI-driven power demand cycle. This supports the case for multiple valuation upgrades.

- The company's record project backlog, especially in large-scale U.S. gas initiatives, indicates strong visibility into future revenues and helps support multi-year growth forecasts.

- Favorable and unprecedented pricing tailwinds in the gas turbine market are expected to drive continued margin expansion.

- Recent quarterly results showing better-than-expected margins bolster confidence that execution strength will persist. This may merit a premium multiple as industry investment cycles accelerate.

Bearish Takeaways

- Bearish analysts remain cautious about the durability of current pricing tailwinds and warn that any cooling of demand for large-scale gas projects could impact backlog visibility.

- There is scrutiny around Argan's ability to consistently convert its robust project backlog into realized revenue and margin expansion in the face of potential macroeconomic or regulatory setbacks.

- Uncertainty remains regarding the long-term sustainability of margin improvements if project environments or input costs change unfavorably.

What's in the News

- Argan's Board of Directors approved a 33% increase in the quarterly cash dividend. The dividend will rise from $0.375 to $0.50 per common share and will be payable on October 31, 2025, to shareholders of record as of October 23, 2025 (Key Developments).

- Between May 1, 2025, and July 31, 2025, Argan completed the repurchase of 1,000 shares for $0.23 million. This finalizes a multi-year buyback program totaling 2,760,294 shares, or 18.83% of outstanding stock, for $110.21 million (Key Developments).

Valuation Changes

- The Fair Value estimate remains unchanged at $262.00.

- The Discount Rate has increased slightly, moving from 8.10% to 8.15%.

- The Revenue Growth projection remains virtually unchanged at 17.88%.

- The Net Profit Margin forecast is steady at approximately 11.13%.

- The future P/E ratio has risen marginally from 27.59x to 27.63x.

Key Takeaways

- Diversified project backlog and strong industry trends position Argan for multi-year revenue and margin growth, with expanded capabilities in energy, water, and recycling sectors.

- Robust financial health enables strategic investments and project execution advantages, supporting continued earnings growth and improved long-term profitability.

- Heavy dependence on large gas power projects and centralized infrastructure exposes Argan to significant risks from sector decarbonization, project volatility, and shifts in regulatory or market trends.

Catalysts

About Argan- Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

- The aging North American power infrastructure and rising electricity demand-driven by widespread electrification and the proliferation of AI data centers-are resulting in record project backlog and robust pipeline visibility for Argan. This is likely to drive sustained top-line revenue growth for several years.

- Strong secular investment momentum in grid modernization and the ongoing energy transition is accelerating the need for new construction of both natural gas-fired and renewable energy facilities. Argan's diversified capabilities position it to capitalize on this trend, potentially expanding its addressable market and supporting revenue growth.

- Record backlog and continued project wins across gas, renewables, water treatment, and recycling plants provide multi-year revenue visibility, indicating potential for increased operating leverage and higher gross margins as larger projects are executed successfully.

- Argan's reputation for on-time, on-budget project delivery and its expanded workforce enable it to handle more and larger projects than competitors, which is likely to support earnings growth and improve net margin stability over time.

- The company's strong balance sheet and consistently high net cash position allow it to pursue strategic M&A and invest in team expansion, enabling further scale and resilience, which can enhance earnings consistency and long-term profitability.

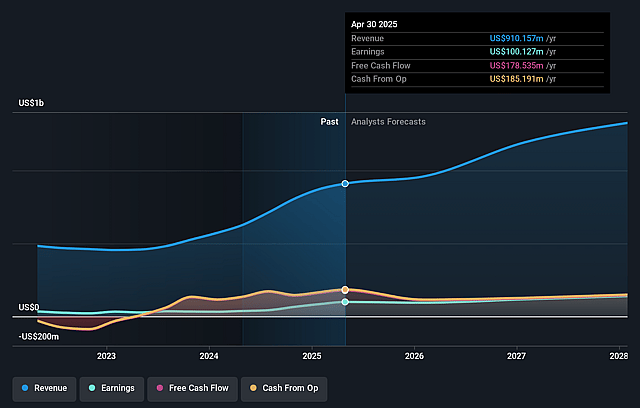

Argan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Argan's revenue will grow by 18.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.7% today to 9.4% in 3 years time.

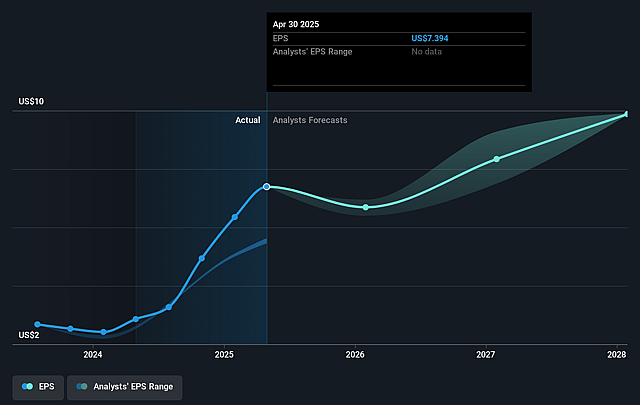

- Analysts expect earnings to reach $142.0 million (and earnings per share of $9.95) by about September 2028, up from $117.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.6x on those 2028 earnings, up from 25.6x today. This future PE is lower than the current PE for the US Construction industry at 34.7x.

- Analysts expect the number of shares outstanding to grow by 2.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.05%, as per the Simply Wall St company report.

Argan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Argan's backlog is heavily weighted toward natural gas-fired projects (61%), and management expects this trend to continue, exposing the company to long-term risk if the energy sector accelerates its transition to renewables and shifts away from gas plants; this could reduce project opportunities and future revenue over time.

- The company relies on a relatively small universe of large, complex EPC (Engineering, Procurement, Construction) projects, meaning any major project delays, cost overruns, or cancellations could lead to significant variability or declines in quarterly and annual earnings and net margins.

- While gross margins have recently improved due to strong project execution, management notes the margins are "lumpy" and cautions that sustainability at current levels is uncertain, particularly if competitive pressures intensify or project execution challenges arise; this may introduce volatility or downward pressure on long-term profitability.

- Despite record backlog and current industry demand, Argan's growth is tied to the cyclical nature of infrastructure and power-plant spending, which depends on favorable macroeconomic and regulatory conditions; shifts in government budgets, permitting, or utility investment cycles could cause unpredictable swings in revenue and net income.

- Although Argan is expanding its workforce and capacity, its business model remains concentrated in large-scale centralized power projects; a secular trend toward distributed generation, modular energy solutions, or more rapid decarbonization efforts could erode its core markets and lead to long-run revenue declines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $230.333 for Argan based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $142.0 million, and it would be trading on a PE ratio of 28.6x, assuming you use a discount rate of 8.1%.

- Given the current share price of $217.41, the analyst price target of $230.33 is 5.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.