Last Update 01 Nov 25

Analysts have increased the price target for Advanced Drainage Systems from $146 to $167, citing solid first quarter results and the company's steadfast fiscal 2026 outlook as key factors behind the upward revision.

Analyst Commentary

Bullish Takeaways- Bullish analysts highlight the company's solid first quarter performance, viewing this as evidence of strong operational execution.

- The reaffirmed fiscal 2026 outlook is seen as a signal of management’s confidence in long-term growth prospects and strategy.

- The upward price target revision reflects positive sentiment regarding the company’s ability to deliver on its growth plan and sustain profitability improvements.

- Analysts note that maintaining a Buy rating, alongside the increased target, underscores expectations for continued valuation expansion if current trends persist.

- Bearish analysts caution that the positive outlook and recent performance are largely reflected in the current share price. This could potentially limit further upside.

- Some express concern that maintaining expectations for fiscal 2026 without upward revisions could point to limited incremental growth catalysts in the near term.

- There are ongoing risks related to execution against long-term targets, particularly if market or economic conditions shift unexpectedly.

What's in the News

- The company confirmed fiscal 2026 financial targets with expected net sales ranging from $2.825 billion to $2.975 billion, citing a solid backlog and positive business trends (Key Developments).

- The company completed the repurchase of 8,244,000 shares, representing 11.41% of shares outstanding, for a total of $852.26 million under the buyback program announced in 2022 (Key Developments).

- No shares were repurchased during the period from April 1, 2025 to June 30, 2025, with buyback activity paused after prior repurchases (Key Developments).

Valuation Changes

- Fair Value estimate remains unchanged at $161.22 per share.

- Discount Rate has risen slightly, moving from 8.39% to approximately 8.40%.

- Revenue Growth projection holds steady at 4.40%.

- Net Profit Margin remains virtually unchanged at 16.97%.

- Future P/E ratio shows a minimal increase from 28.40x to 28.41x.

Key Takeaways

- Heightened demand for innovative stormwater solutions and regulatory pressures are driving growth in high-margin products, supporting revenue acceleration and expanding profit margins.

- Strategic investments in automation, segment expansion, and geographic reach are improving operational efficiency and positioning the company for sustained earnings and margin gains.

- Revenue and margin growth face risks from weak demand, rising input costs, dependence on acquisitions, pricing pressures, and uncertain infrastructure investment trends.

Catalysts

About Advanced Drainage Systems- Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

- Ongoing climate change and increasing frequency/severity of extreme weather events are driving up the necessity for advanced stormwater management and resilient drainage infrastructure, underpinning structural, long-term volume growth – supporting sustained revenue acceleration.

- Rising regulatory emphasis on water quality and sustainable construction (with more stringent stormwater and pollution controls) is increasing adoption of high-margin, innovative solutions such as the recently launched Arcadia hydrodynamic separator and EcoStream Biofiltration products, which is likely to expand net margins and boost revenue mix over time.

- Continuous expansion of the Allied Products and Infiltrator segments, both of which command higher margins and are growing faster than the core Pipe business, is shifting product mix toward higher profitability, resulting in improved EBITDA margins and long-term earnings power.

- Strategic investments in manufacturing automation, logistics, and operational efficiency (including new technology centers and line upgrades) have significantly increased production per line and lowered fixed costs, positioning the company to achieve sustained margin expansion even in tepid end market demand environments.

- ADS's flexibility for geographic and product expansion-supported by a robust balance sheet, strong free cash flow, and liquidity-enables opportunistic acquisitions and organic penetration in high-growth regions (e.g., Southeast, South, and West), further underpinning top-line growth and scale-driven margin improvement.

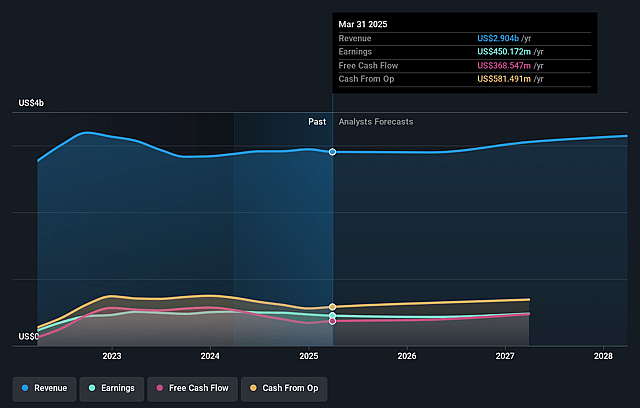

Advanced Drainage Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Advanced Drainage Systems's revenue will grow by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.8% today to 16.8% in 3 years time.

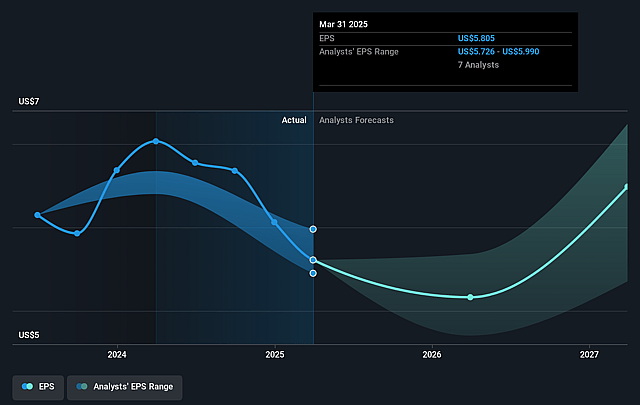

- Analysts expect earnings to reach $558.3 million (and earnings per share of $7.4) by about September 2028, up from $432.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.5x on those 2028 earnings, up from 24.8x today. This future PE is greater than the current PE for the US Building industry at 23.0x.

- Analysts expect the number of shares outstanding to grow by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.38%, as per the Simply Wall St company report.

Advanced Drainage Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Management repeatedly emphasizes a tepid, flattish, and choppy demand environment across core end markets (residential, nonresidential, infrastructure), with particular concern around the sustainability of future demand growth; protracted softness or stagnation in construction and infrastructure spending would directly constrain revenue growth.

- There is significant ongoing reliance on favorable input costs, particularly resin and other raw materials. Persistent or unexpected increases in these commodity input prices could quickly compress net margins and earnings, as margin expansion in recent quarters was partially attributed to lower material costs.

- The company's organic growth is lagging while recent revenue growth is heavily driven by acquisitions like Orenco, suggesting that if acquisition-driven expansion cannot be sustained or fails to deliver expected synergies, overall top-line growth may underperform, impacting both revenue and long-term earnings.

- Long-term uncertainty remains regarding the ability to increase or even maintain price levels in a highly competitive environment, especially if end-market demand weakens further or new competitors (or alternative products) pressure pricing; this poses ongoing risk to both revenue and operating margins.

- Despite positive long-term secular water infrastructure trends, end-market dynamics such as delayed project starts, uneven government infrastructure outlays, and shifting public/private investment priorities could result in structurally lower or slower-than-expected volume growth, ultimately limiting realized revenue and margin expansion over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $154.5 for Advanced Drainage Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $167.0, and the most bearish reporting a price target of just $130.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.3 billion, earnings will come to $558.3 million, and it would be trading on a PE ratio of 27.5x, assuming you use a discount rate of 8.4%.

- Given the current share price of $138.2, the analyst price target of $154.5 is 10.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.