Last Update 27 Jan 26

RDI: Modest Assumption Tweaks Will Support Stronger Future Share Price

Analysts have modestly raised their price target for Reading International, citing small adjustments to fair value and updated assumptions for revenue growth, profit margin, and future P/E that slightly refine their outlook on the stock.

Valuation Changes

- Fair Value: Fair value is reported at 2.0, which is unchanged from the prior 2 figure in narrative terms.

- Discount Rate: The discount rate remains steady at 12.5%, indicating no adjustment to the risk or return assumptions used in the model.

- Revenue Growth: Forecast revenue growth has edged down slightly, from 7.01% to 6.95%.

- Net Profit Margin: Assumed net profit margin has been trimmed modestly, from 10.39% to 10.22%.

- Future P/E: The future P/E assumption has risen slightly, from 2.54x to 2.59x.

Key Takeaways

- Rebounding cinema attendance, premium offerings, and digital enhancements are fueling revenue growth, margin expansion, and improved per-visitor economics across all markets.

- Strategic real estate monetization and debt reduction strengthen the balance sheet and enable reinvestment, improving financial flexibility and long-term earnings stability.

- Declining cinema attendance, reliance on blockbuster films, asset sales to pay debt, high leverage, and rising costs threaten long-term revenue stability and profitability.

Catalysts

About Reading International- Focuses on the ownership, development, and operation of entertainment and real property assets in the United States, Australia, and New Zealand.

- The strong rebound in cinema attendance and box office performance, combined with improving average ticket pricing and record food & beverage spend per patron across all markets, signals that consumer demand for out-of-home entertainment experiences-especially among younger demographics-is accelerating, driving revenue growth and margin expansion.

- Reading's strategic real estate asset monetization and subsequent debt pay-down have meaningfully improved the company's balance sheet and reduced interest expense, increasing financial flexibility to reinvest in operations and new development, which should enhance earnings stability and future net margins.

- Ongoing enhancements to digital engagement-such as revamped loyalty and paid membership programs, online F&B ordering, and expanded merchandise sales-are unlocking higher ancillary revenue streams and improving per-visitor economics, directly supporting top-line revenue and EBITDA margin growth.

- The development and leasing progress at high-value urban properties (e.g., 44 Union Square), combined with rising occupancy rates and retail foot traffic in key city-center locations, positions Reading to unlock significant additional rental income and asset value over time, which can boost long-term net income and book value.

- Investments in premium cinema offerings (recliner seating, specialty event programming, themed F&B, and immersive experiences) align with consumer willingness to pay for enhanced experiences, supporting higher pricing power and improved revenue per patron, further driving revenue and EBITDA margin expansion.

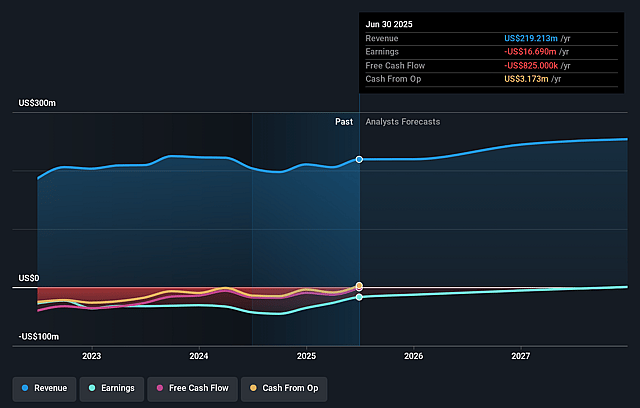

Reading International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Reading International's revenue will grow by 6.6% annually over the next 3 years.

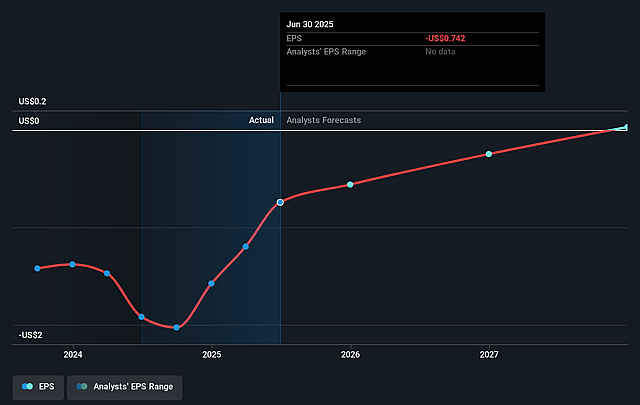

- Analysts are not forecasting that Reading International will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Reading International's profit margin will increase from -7.6% to the average US Entertainment industry of 9.4% in 3 years.

- If Reading International's profit margin were to converge on the industry average, you could expect earnings to reach $25.1 million (and earnings per share of $1.09) by about September 2028, up from $-16.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.3x on those 2028 earnings, up from -2.1x today. This future PE is lower than the current PE for the US Entertainment industry at 38.2x.

- Analysts expect the number of shares outstanding to grow by 1.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Reading International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained decline in overall movie theater attendance industry-wide, with Reading's cinema revenues still below pre-pandemic levels despite a strong film slate; this exposes the company to long-term revenue risk if consumer behavior continues shifting toward streaming and home entertainment.

- Reliance on high-profile Hollywood releases for financial performance adds significant earnings volatility, as box office upticks in recent quarters were largely attributed to major franchise films, but the company noted expectations for significant slowdowns in less robust quarters that could dampen future revenue and margin growth.

- Ongoing asset sales to pay down debt have reduced real estate revenue streams and diminished the asset base, as evidenced by declining global real estate revenues and lower numbers of third-party tenants, creating long-term risk to future rental income, book value, and earnings stability.

- High leverage and persistent net losses, with the company still posting a net loss ($2.7 million for Q2 2025 and $7.4 million for the half-year) even after substantial asset sales, suggest continued financial strain; future interest rates, debt servicing, and refinancing challenges could compress net margins and earnings.

- Increased occupancy and operating costs, particularly for cinema leases in premium urban centers, coupled with rising film rent percentages and pressure from landlords, threaten profitability, especially if attendance and admissions revenue do not fully recover-negatively impacting future margins and cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.5 for Reading International based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $265.4 million, earnings will come to $25.1 million, and it would be trading on a PE ratio of 3.3x, assuming you use a discount rate of 12.3%.

- Given the current share price of $1.55, the analyst price target of $2.5 is 38.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Reading International?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.