Last Update08 Oct 25Fair value Increased 8.37%

Analysts have raised Sanmina's fair value estimate by $10 to $129.50, citing recent momentum from strategic data center partnerships and an increased focus on AI-related opportunities in the sector.

Analyst Commentary

Analysts remain divided on the trajectory and drivers of Sanmina's valuation, reflecting both optimism about recent developments and recognition of persistent risks and uncertainties.

Bullish Takeaways- Bullish analysts highlight the increased price targets, citing new data center partnerships and strong positioning in artificial intelligence, which could support sustainable revenue growth.

- The recent agreement involving Sanmina as AMD's preferred NPI partner in AI datacenter collaborations with OpenAI highlights the company's importance in emerging, high-growth technology segments.

- Sanmina's strategic acquisition of a data center infrastructure manufacturing business is expected to accelerate scaling in the cloud and AI markets and drive further top-line expansion.

- Improvements in end markets, such as communications as inventory corrections ease, are providing incremental support to Sanmina's long-term growth outlook.

- Bearish analysts emphasize that the ultimate impact of AI-related partnerships is difficult to quantify, as outcomes depend on customer integration choices and the number of racks Sanmina eventually manufactures.

- Execution risks remain due to the need for program ramps to materialize and achieve scale in the coming quarters.

- There is caution around the ongoing weak macroeconomic environment, which could challenge Sanmina’s growth targets despite its strategic moves.

- Competition remains a factor, with customers retaining options to select alternative manufacturing partners for new product introduction and production work.

What's in the News

- Sanmina issued new earnings guidance for the fourth fiscal quarter ending September 27, 2025. The company projects revenue in the range of $2.0 billion to $2.1 billion and GAAP diluted earnings per share between $1.21 and $1.31 (Company Guidance).

- The company repurchased 197,018 shares for $13.38 million between March 30 and June 28, 2025, completing its share buyback program for a total of 801,093 shares and $60.8 million (Buyback Update).

Valuation Changes

- The Fair Value Estimate has increased by $10, moving from $119.50 to $129.50. This reflects greater optimism about Sanmina’s future prospects.

- The Discount Rate has edged up modestly from 8.31% to 8.34%, indicating a slightly higher perceived risk or required return on capital.

- The Revenue Growth Projection remains virtually unchanged at 6.38%, suggesting no material adjustment in expected top-line expansion rates.

- The Net Profit Margin is stable, with negligible change, holding at 3.88% for both the prior and current analysis.

- The Future Price-to-Earnings (P/E) Ratio has risen from 20.6x to 22.4x, signaling a greater willingness by the market to pay for anticipated future earnings.

Key Takeaways

- Recent strategic acquisitions and investments in automation position Sanmina to capitalize on robust demand for advanced electronics manufacturing in high-growth sectors.

- Expansion of capabilities and a strong financial position enable sustained margin improvement, operational efficiency, and long-term earnings growth across diverse markets.

- Customer concentration, supply chain risks, and execution challenges from acquisitions and expansion threaten future growth, margins, and revenue stability amid shifting industry and geopolitical pressures.

Catalysts

About Sanmina- Provides integrated manufacturing solutions, components, products and repair, logistics, and after-market services in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

- The imminent acquisition of ZT Systems is expected to add $5–6 billion of annual run-rate revenue, positioning Sanmina to double its net revenue within three years and capitalize on explosive growth in data center and AI infrastructure investment; this should provide a multi-year boost to overall revenue and EPS accretion from synergies and integration.

- Broad-based demand for complex electronics manufacturing remains strong across end-markets, especially in communications networks, cloud infrastructure, medical, defense, aerospace, and industrial segments; these markets favor sophisticated EMS providers like Sanmina and are expected to support long-term revenue growth and earnings stability.

- Sanmina's expanding footprint in North America and investment in automation/advanced capabilities directly align with the rising demand for regionalized, resilient supply chains and higher-value engineering-driven services, underpinning both future volume growth and potential margin improvement.

- Strategic investments in automation, digital transformation, and the shift toward full system integration (highlighted by the buildout of end-to-end solutions for data center AI, liquid cooling, advanced circuit boards, etc.) are already showing benefits in operational efficiencies and gross margin expansion, which should compound over time and lift net margins.

- The company is redeploying free cash flow and maintains a robust balance sheet, enabling ongoing investment in growth markets such as India and sustained share repurchases; this financial flexibility supports long-term earnings per share growth and allows the company to capture opportunities presented by the proliferation of IoT, increased electronics content in diverse industries, and ongoing sector consolidation.

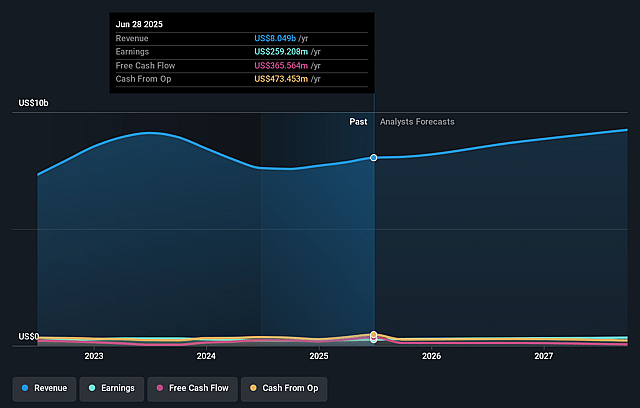

Sanmina Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sanmina's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.2% today to 3.9% in 3 years time.

- Analysts expect earnings to reach $375.6 million (and earnings per share of $7.33) by about September 2028, up from $259.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.6x on those 2028 earnings, down from 24.2x today. This future PE is lower than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to decline by 1.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.31%, as per the Simply Wall St company report.

Sanmina Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The planned acquisition of ZT Systems brings significant working capital and inventory risk, including the potential for write-downs on lagging-generation products and possible overvaluation of $2 billion in inventory, which could impact future net margins and earnings if market demand or product mix shifts unfavorably.

- Customer concentration remains high, with the top 10 customers accounting for 52.8% of revenue; any loss or reduction in orders from these major clients could cause outsized declines in revenue and net income.

- Geopolitical uncertainties, tariffs, and regionalization pressures may complicate global operations and force costly relocation or reorganization of manufacturing, potentially squeezing margins and reducing operational efficiency over the long term.

- The integration of ZT Systems and expansion into new markets (U.S., India, Mexico) require ongoing, substantial investment in both technology and talent; if these investments do not yield sufficient returns or if execution falters, long-term revenue and margin expansion targets may be missed.

- There are industry risks of accelerating OEM vertical integration and insourcing, especially as customers seek more control over supply chains and intellectual property, which could reduce Sanmina's addressable market and future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $119.5 for Sanmina based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.7 billion, earnings will come to $375.6 million, and it would be trading on a PE ratio of 20.6x, assuming you use a discount rate of 8.3%.

- Given the current share price of $117.76, the analyst price target of $119.5 is 1.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.