Last Update 18 Nov 25

Fair value Increased 1.31%NG.: Revenue Expectations And Margin Pressures Will Shape Performance Ahead

Narrative Update: National Grid Analyst Price Target Increased

Analysts have raised their price target for National Grid to $11.93, up from $11.78. They cite improved expectations for revenue growth despite a slightly higher discount rate and modestly lower profit margins.

Analyst Commentary

Analyst opinions on National Grid remain mixed, with both optimistic and cautious perspectives emerging from recent research coverage. Below is a summary of the main takeaways from these reports.

Bullish Takeaways- Bullish analysts are increasing price targets based on firm expectations for revenue growth, which is seen as a catalyst for future valuation upside.

- Some view National Grid’s operations in stable, highly regulated markets as a key strength that should support consistent earnings and lower business risk.

- Expectations for continued infrastructure investment and network expansion may fuel long-term growth and justify higher price projections.

- Analysts highlight potential re-rating opportunities as financial and operational execution continues to improve.

- Bearish analysts caution that higher discount rates and modestly lower margins could weigh on profit growth and limit upside to the new price target.

- There are concerns about regulatory and inflationary pressures that may dampen National Grid’s ability to fully capture returns on future investments.

- Some express reservations about the pace of margin recovery, noting that incremental improvements may be slower than what is currently priced in to valuation.

What's in the News

- National Grid announced a proposed interim dividend of 16.35 pence per ordinary share ($1.0657 per American Depositary Share) for the year ending 31 March 2026. Payment is expected on 13 January 2026 and ex-dividend dates are set for November 2025. (Key Developments)

- The company provided earnings guidance for the six months ended 30 September 2025, stating performance is in line with expectations. Underlying earnings per share are expected to be weighted to the second half of the year. (Key Developments)

- National Grid and Emerald AI formed a strategic partnership to demonstrate how AI data centres can flexibly manage energy consumption in real time. The initiative aims to support the UK's digital growth while enhancing electricity grid stability, with a live demonstration planned for late 2025. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has increased modestly from $11.78 to $11.93.

- Discount Rate has risen slightly, moving from 6.82 percent to 7.07 percent.

- Revenue Growth expectations have strengthened significantly, rising from 6.50 percent to 11.10 percent.

- Net Profit Margin has declined modestly, from 20.97 percent to 19.92 percent.

- Future P/E ratio has decreased markedly from 18.75x to 15.34x, which reflects an improved valuation based on projected earnings.

Key Takeaways

- National Grid plans massive network investments to drive asset growth, boost future revenues, and stabilize earnings.

- Strategic initiatives like asset sales and streamlined processes support margins while enhancing earnings and operational efficiency.

- Regulatory risks, tax policy changes, rising equipment costs, supply chain constraints, and legislative delays could impact National Grid's profitability, earnings growth, and project timelines.

Catalysts

About National Grid- National Grid plc transmits and distributes electricity and gas.

- National Grid plans to invest around £60 billion in its networks over the next 5 years, which is expected to drive significant asset growth and provide strong visibility on future revenues. This is likely to positively impact future revenue streams and earnings growth.

- The company has secured new rates for its Downstate New York gas business and Massachusetts Electric business, which provides better visibility on investment plans and supports earnings stability. This regulatory clarity is likely to improve net margins and earnings.

- The ongoing £4 billion Upstate Upgrade in the U.S. and accelerated investment in the National Grid Ventures segment reflect an increase in capacity and infrastructure reliability, which should enhance future revenues.

- National Grid's strategic initiatives to secure supply chain capacities and streamline project delivery processes aim to mitigate potential delays and cost overruns, thus supporting net margins and operational efficiency.

- The planned sale of non-core assets, such as National Grid Renewables and the Grain LNG facility, is expected to unlock shareholder value, potentially leading to buybacks or debt reduction, and enhance earnings per share (EPS).

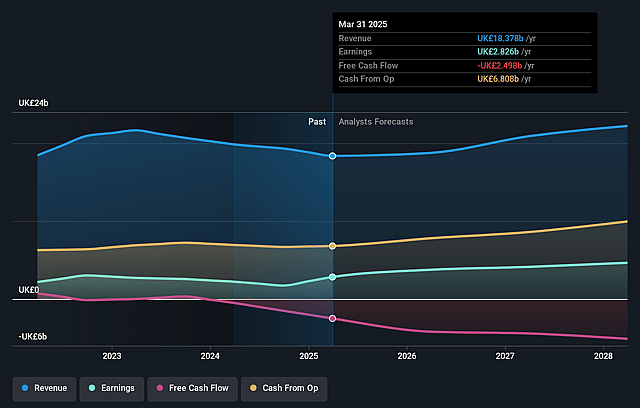

National Grid Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming National Grid's revenue will grow by 6.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.4% today to 21.0% in 3 years time.

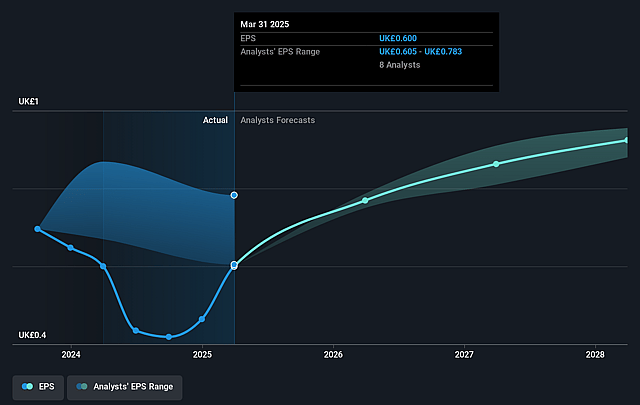

- Analysts expect earnings to reach £4.7 billion (and earnings per share of £0.92) by about September 2028, up from £2.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, up from 17.9x today. This future PE is greater than the current PE for the GB Integrated Utilities industry at 18.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

National Grid Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory risks associated with the RIIO-T3 process could impact National Grid's allowed returns. If returns are set at the lower end of the expected range, it could affect earnings growth. Additionally, changes in the associated incentive mechanisms could further impact profitability.

- Potential changes in U.S. tax policy could affect National Grid's financial performance. Although changes in tax rates are often passed through to customers, adjustments could create cash-flow and earnings volatility.

- Rising equipment costs, such as for transformers and HVDC systems, due to increased demand could affect National Grid's capital expenditure efficiency and lead to higher costs than anticipated, which might impact net margins if such costs cannot be fully recovered.

- There is a risk of supply chain constraints and delays, especially with securing critical materials and equipment for capital projects. This could delay project timelines, impact CapEx deployment, and subsequently affect revenue growth and earnings.

- Several projects depend on favorable planning and legislative reforms. Any delays in reforms, such as fast-track consenting in the U.K., could impact infrastructure project timelines, hindering the ability to meet investment targets, affecting future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £11.781 for National Grid based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £22.2 billion, earnings will come to £4.7 billion, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of £10.18, the analyst price target of £11.78 is 13.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.