Last Update 01 Nov 25

Analysts have marginally raised their price target for Tips Music to ₹658.67, reflecting subtle adjustments in financial projections and expectations for slightly stronger revenue growth and a lower discount rate.

What's in the News

- An upcoming Board Meeting is scheduled for October 15, 2025, to consider and approve unaudited financial results for the quarter and half year ended September 30, 2025 (Key Developments).

- The meeting will also include a discussion and possible declaration of a second interim dividend for the financial year 2025-2026, along with the fixation of the record date for dividend payment if declared (Key Developments).

Valuation Changes

- Consensus Analyst Price Target remains unchanged at ₹658.67, reflecting continued confidence in current valuation estimates.

- The discount rate has decreased slightly from 15.98 percent to 15.94 percent, suggesting a marginal reduction in perceived risk.

- The revenue growth projection has risen incrementally from 24.39 percent to 24.40 percent, indicating expectations of modestly higher sales expansion.

- Net profit margin is virtually unchanged at 50.11 percent, signaling stable profitability expectations.

- The future P/E ratio declined marginally from 40.89x to 40.84x, reflecting a very slight shift in valuation multiple.

Key Takeaways

- Expansion of the paid streaming model, wider smartphone use, and a strong music library are boosting recurring revenue and long-term financial stability.

- Strategic content investment, tech-driven efficiency, and improved anti-piracy efforts are expected to grow market share and strengthen profit margins.

- Heavy reliance on few digital platforms, rising content costs, and concentrated revenue streams heighten vulnerability to industry shifts, platform policy changes, and competitive pressures.

Catalysts

About Tips Music- Engages in the acquisition and exploitation of music rights in India and internationally.

- The shift of major music streaming platforms in India towards a paid subscription model (i.e., going behind the paywall) is expected to increase per-user monetization over time, even if initial volumes are lower. As the paid user base grows, this transition should drive higher recurring royalty revenues and improve long-term revenue visibility.

- Higher smartphone penetration and cheaper data across India continue to expand the reach and frequency of digital music consumption, widening Tips Music's addressable audience and sustaining long-term streaming revenue growth.

- Tips Music's robust and expanding back catalog of popular and evergreen Bollywood songs provides reliable, recurring earnings from both streaming and licensing, supporting stable net margins as digital music consumption increases both in India and among the diaspora globally.

- Strategic investments in new content (notably film music rights and non-film releases) and the development of in-house automation (Pulse content management system) are set to improve operational efficiency and expand market share, expected to drive topline and EBITDA growth.

- Recent enhancements in anti-piracy efforts including YouTube policy changes and more stringent copyright enforcement are expected to reduce revenue leakage, leading to stronger royalty collections and supporting both revenue and net margin improvement over time.

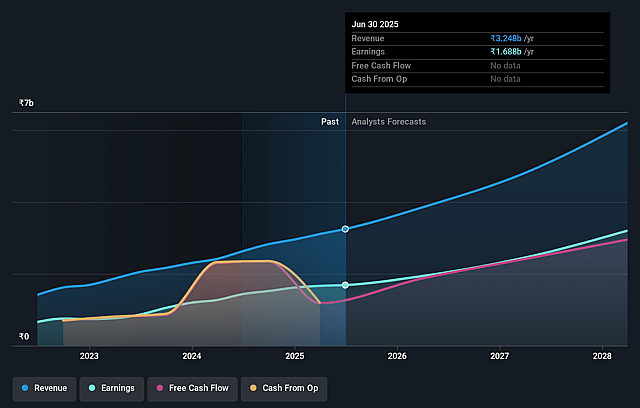

Tips Music Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tips Music's revenue will grow by 26.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 52.0% today to 51.5% in 3 years time.

- Analysts expect earnings to reach ₹3.4 billion (and earnings per share of ₹26.73) by about September 2028, up from ₹1.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.0x on those 2028 earnings, down from 43.3x today. This future PE is greater than the current PE for the IN Entertainment industry at 28.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.18%, as per the Simply Wall St company report.

Tips Music Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces increased dependence on a shrinking pool of key digital music partners, with platforms like Gaana, Resso, and Hungama shutting down or moving behind paywalls; this consolidation reduces distribution channels, could harm revenue diversity, and makes Tips vulnerable to future policy or payment changes by remaining OTT platforms-directly impacting top-line growth and revenue consistency.

- Policy changes and monetization models at global streaming giants (especially YouTube and Spotify) limit Tips Music's bargaining power; with YouTube Shorts currently operating on a lump-sum deal and not per-view monetization, explosive view count growth may not correspond to revenue growth, putting longer-term pressure on both revenue and net margins if platforms don't shift to more favorable payout models for content owners.

- High and rising content acquisition costs pose a structural risk, evidenced by content cost growing 85% YoY and management targeting 25–28% of revenue on content expenses; escalating competition for popular music IP may increase costs faster than revenue growth, compressing operating margins and reducing earnings visibility if new releases underperform.

- Slowdown in ad-based monetization, especially as digital platforms push users toward paid-subscription models with limited free-tier reach, could reduce the audience size and thus the addressable revenue from popular legacy content; if the pace of paid subscriber growth is not rapid enough, or if consumer wallet share for music shrinks in favor of other media, revenue growth could be adversely impacted.

- Tips Music's revenue remains concentrated: a large proportion comes from a partnership with Warner (25–30% of revenue), exposing the company to risks if the terms or duration of that deal change, or if global music labels increase competitive pressure. This reliance could lead to revenue and earnings volatility due to renegotiations or market share loss.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹703.667 for Tips Music based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹765.0, and the most bearish reporting a price target of just ₹599.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹6.6 billion, earnings will come to ₹3.4 billion, and it would be trading on a PE ratio of 41.0x, assuming you use a discount rate of 16.2%.

- Given the current share price of ₹571.65, the analyst price target of ₹703.67 is 18.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.