Last Update 01 May 25

Fair value Decreased 8.62%Key Takeaways

- Expansion into new subsea and renewable energy markets supports long-term revenue growth while reducing reliance on oil and gas.

- Investments in R&D and global distribution are expected to improve margins and drive sustained earnings through premium, less commoditized offerings.

- Overreliance on the subsea oil and gas sector and slow diversification expose Matrix to high volatility, margin pressure, and significant long-term growth challenges.

Catalysts

About Matrix Composites & Engineering- Engages in the design, engineering, and manufacturing of engineered polymer products for the energy, mining and resource, and defence industries.

- Strong pipeline of new product launches and broader applications in the SURF subsea segment, with expansion of the addressable market beyond traditional buoyancy products, is poised to drive significant top-line revenue growth over the next several years as global offshore development increases.

- Increasing participation and successful track record in high-growth deepwater markets (e.g. Brazil, West Africa, Southeast Asia), coupled with rising global offshore exploration and production activity, supports elevated utilization rates and multi-year revenue expansion.

- Diversification into renewable energy (notably floating offshore wind, with commercial projects nearing final investment decisions in Asia) positions Matrix to capitalize on global decarbonization investment and reduce cyclicality and reliance on oil and gas, broadening future revenue streams.

- Ongoing investment in R&D, new distributors, and innovative manufacturing (such as the build-out in Advanced Materials and specialty energy/defense components) is expected to drive higher-margin, recurring revenues as Matrix enters markets with premium pricing and less commoditization, thereby structurally improving net margins.

- Strategic market expansion into North America, Europe, and Asia-enabled by geographic advantages, strong distributor networks, and qualification with major global customers-creates a platform for sustained earnings growth as Matrix leverages global infrastructure and energy modernization initiatives.

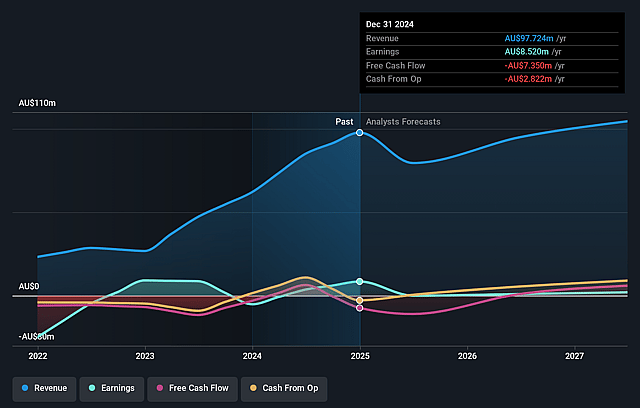

Matrix Composites & Engineering Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Matrix Composites & Engineering's revenue will grow by 3.8% annually over the next 3 years.

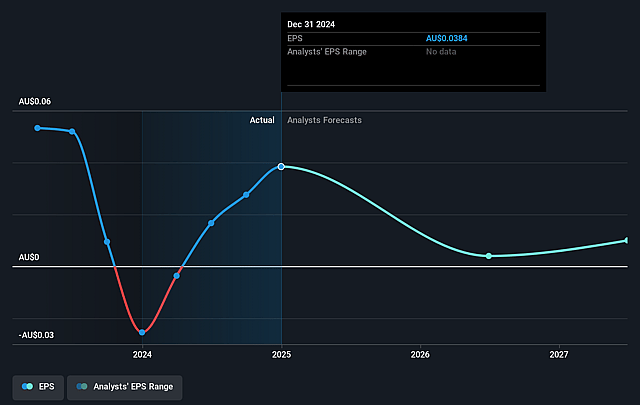

- Analysts assume that profit margins will shrink from 8.7% today to 3.9% in 3 years time.

- Analysts expect earnings to reach A$4.2 million (and earnings per share of A$0.02) by about August 2028, down from A$8.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, up from 6.3x today. This future PE is greater than the current PE for the AU Energy Services industry at 7.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.24%, as per the Simply Wall St company report.

Matrix Composites & Engineering Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy dependence on the subsea oil & gas market, which represented nearly 90% of FY '25 revenue, exposes Matrix to long-term risks from the accelerating global energy transition and decarbonization policies, potentially shrinking its core addressable market and impacting revenue and earnings growth.

- Customer concentration in a limited set of major oil & gas and energy clients, as well as the lumpy, project-based nature of large contracts, creates revenue volatility and outsized sensitivity to oil/gas industry capital cycles, threatening revenue predictability and stability.

- Slower-than-expected diversification into new sectors (e.g., renewables, mining, defense, advanced materials), evident in recent underperformance in annuity-style recurring revenue segments, could limit growth opportunities if the core business stagnates, affecting long-term top-line growth.

- Delays, distributor disruptions, and customer execution risk-such as postponed contract deliveries or defense project slippages-have already led to missed revenue targets in FY '25, and ongoing timing and utilization gaps could further compress margins and net earnings if not addressed.

- Intensifying competition and product commoditization in the offshore supply chain, as well as new entrants in advanced materials and corrosion prevention, may pressure pricing, reduce market share, and increase margin compression, especially if Matrix cannot sustain technological differentiation, ultimately weighing on future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.265 for Matrix Composites & Engineering based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$109.3 million, earnings will come to A$4.2 million, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of A$0.24, the analyst price target of A$0.26 is 9.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Matrix Composites & Engineering?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.