Key Takeaways

- Regulatory changes in the EU and US are expected to significantly increase demand and drive sustainable revenue and margin growth for AudioEye.

- Continued AI platform enhancements, customer retention, and margin-focused strategy support higher-quality earnings and greater cash returns to shareholders.

- Heavy dependence on regulatory developments, customer transitions, and successful technology innovation creates near-term growth risks and could limit revenue retention and margin expansion.

Catalysts

About AudioEye- Provides Internet content publication and distribution software and related services to Internet and other media to people regardless of their device, location, or disabilities in the United States and Europe.

- The implementation of the European Accessibility Act is expected to drive a multi-year surge in demand for digital accessibility solutions across the EU, with AudioEye reporting its EU pipeline tripled quarter-over-quarter and forecasting further acceleration-this is likely to substantially boost top-line revenue and ARR growth as EU enforcement intensifies and more enterprises seek compliance.

- Anticipated enforcement of new U.S. Department of Justice rules (DOJ Title II) in 2026 represents a significant catalyst, especially via large enterprise and government-adjacent partners currently ramping go-to-market efforts, supporting further sustained revenue expansion and larger contract values.

- Ongoing AI-driven enhancements to AudioEye's platform are increasing automation and scalability, evidenced by stable R&D investment and management comments on improved accuracy and efficiency-these technology gains are projected to drive higher gross margins and EBITDA margins as operational scale improves.

- The strategic phaseout of lower-margin consulting and audit customers, and consolidation of acquired businesses onto AudioEye's higher-margin automated platform, is expected to improve overall margin mix and increase adjusted EPS and free cash flow, especially as integration efforts are completed heading into 2026.

- Recurring revenue mix remains strong, with customer retention metrics in the upper 80s to low 90s and continued expansion in the enterprise and partner channels; this supports growing predictability and quality of earnings, positioning the company for durable EPS growth and improving valuation as more cash is returned to shareholders through buybacks.

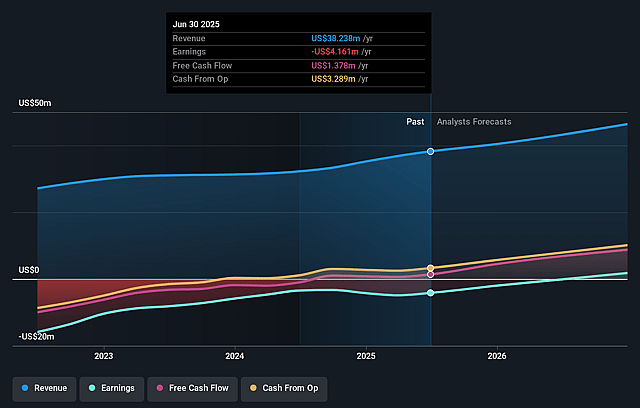

AudioEye Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AudioEye's revenue will grow by 13.3% annually over the next 3 years.

- Analysts are not forecasting that AudioEye will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate AudioEye's profit margin will increase from -10.9% to the average US Software industry of 13.1% in 3 years.

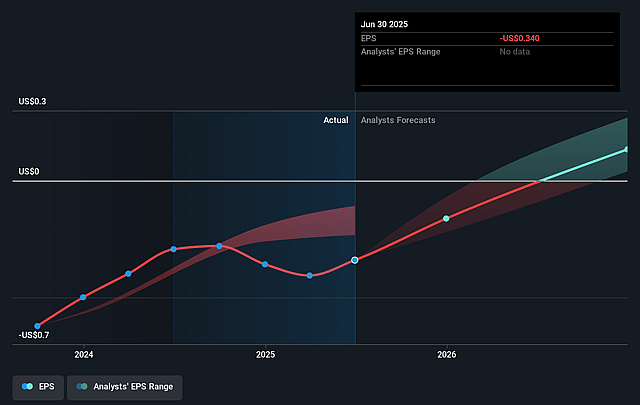

- If AudioEye's profit margin were to converge on the industry average, you could expect earnings to reach $7.3 million (and earnings per share of $0.56) by about September 2028, up from $-4.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 50.9x on those 2028 earnings, up from -35.9x today. This future PE is greater than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 1.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.66%, as per the Simply Wall St company report.

AudioEye Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The phaseout of lower-margin, legacy services acquired through recent acquisitions has resulted in acquisition-related customer churn and a reduction in 2025 revenue guidance, which may impact AudioEye's ability to sustain topline revenue growth and could pressure short-term revenues and earnings as customer transitions complete.

- AudioEye's growth is heavily reliant on increasing regulatory enforcement (e.g., EU Accessibility Act, DOJ Title II in the US); should governments delay, weaken, or inconsistently enforce these regulations, customer urgency and adoption rates could slow, creating longer sales cycles and reducing the company's addressable market, directly impacting revenue growth.

- The migration of acquired customers to new, higher-value AudioEye platforms has led to elevated churn, which combined with the commentary about some customers not willing to pay for enhanced offerings, highlights the risk of potential pricing power limitations or value perception issues, potentially lowering revenue retention and net margin expansion.

- The growing complexity and rapid evolution of accessibility technology, particularly AI and automated remediation, may require sustained or increased R&D investment beyond current levels; if AudioEye fails to keep up with leading-edge innovations, it risks losing clients to competitors, increasing R&D costs and pressuring net margins.

- Strong expansion in Europe is projected but currently based on pipeline growth from a small base and without clear enforcement history, meaning actual conversion to revenue could be delayed if enterprises wait for clearer penalty precedents or regulatory enforcement-potentially resulting in near

- to mid-term revenue and ARR below expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.2 for AudioEye based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $55.6 million, earnings will come to $7.3 million, and it would be trading on a PE ratio of 50.9x, assuming you use a discount rate of 8.7%.

- Given the current share price of $12.03, the analyst price target of $22.2 is 45.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AudioEye?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.