Last Update23 Oct 25Fair value Decreased 19%

Analysts have lowered their price target for Dyadic International from $7.00 to $5.67 per share, citing updated forecasts for lower revenue growth along with stronger profit margins. They also note continued confidence in the company's commercialization efforts and an attractive valuation relative to peers.

Analyst Commentary

Recent street research has highlighted both promising opportunities and notable risks for Dyadic International as it progresses with commercial initiatives and partnerships.

Bullish Takeaways- Bullish analysts see multiple near-term catalysts for revenue growth from the company's ongoing commercialization efforts.

- There is optimism about substantial gains as partners advance Dyadic's proprietary platforms through clinical development, supporting potential future milestones.

- Current valuation, with shares trading at a significant discount to peers based on enterprise value to forward sales, is viewed as an attractive entry point for investors.

- Improving profit margins are strengthening the company’s fundamental outlook and increasing the potential for sustainable profitability.

- Some analysts caution that updated revenue forecasts point to slower top-line growth than previously expected.

- While partnership milestones offer promise, successful clinical advancement is not guaranteed and could impact growth projections if delayed.

- The company remains highly sensitive to execution risk as commercialization efforts are still in relatively early stages.

- Valuation, though discounted compared to peers, may reflect market skepticism about the pace or certainty of future growth.

What's in the News

- Dyadic International has completed a follow-on equity offering. The company raised approximately $5.75 million through the sale of over 6 million shares of common stock at $0.95 per share (Key Developments).

- The company has filed an additional follow-on equity offering involving common stock (Key Developments).

- Multiple securities, including 30,135,798 shares of common stock, certain restricted stock units, and certain options, are subject to lock-up agreements ending on October 29, 2025. These agreements prevent designated insiders from selling or otherwise disposing of shares for 91 days beginning July 30, 2025 (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has decreased from $7.00 to $5.67 per share, reflecting a lower fair value assessment.

- Discount Rate has risen slightly from 6.94% to 7.04%, suggesting a modest uptick in perceived risk or required return.

- Revenue Growth projections have fallen significantly, dropping from 91.23% to 75.66%.

- Net Profit Margin estimates have improved from 14.17% to 22.24%, indicating expectations for stronger profitability.

- Future P/E ratio forecasts have dropped notably from 91.94x to 61.33x, signifying a lower anticipated premium on forward earnings.

Key Takeaways

- Transitioning to commercial sales and broad product launches positions the company to improve operating margins and gain more predictable, recurring revenue streams.

- Strategic partnerships, scalable technology, and sustainability focus give competitive advantages and support accelerating market adoption and long-term profit growth.

- Prolonged lack of profitability, reliance on uncertain partner payments, and competitive, regulatory, and geographic challenges threaten Dyadic's growth, cash flow, and shareholder value.

Catalysts

About Dyadic International- A biotechnology platform company, develops, produces, and sells industrial enzymes and other proteins in the United States and internationally.

- The company's platforms are positioned to capitalize on the rapidly growing demand for sustainable, animal-free, precision-engineered proteins across large, high-growth markets (e.g., cell culture media, food nutrition, molecular biology, bioindustrial enzymes), which, if realized, could drive significant revenue growth and recurring income streams as global industries shift toward sustainable biotechnology solutions.

- Dyadic's successful transition from an R&D-focused entity to a commercial enterprise-evidenced by an expanded management team, operational realignment, and a robust product pipeline nearing launch-positions the company for improved revenue visibility, operating leverage, and potential gross/operating margin expansion as product sales increasingly replace milestone-driven or grant revenues.

- Deepening strategic partnerships (e.g., Proliant Health & Biologics, Inzymes, Fermbox Bio) and late-stage commercialization programs with major industry validation provide a realistic pathway for accelerating market adoption of Dyadic's proprietary platforms, directly enhancing near

- and mid-term revenue while supporting long-term earnings growth and margin improvement.

- The platforms' ability to rapidly scale, deliver high yields, and operate at lower cost with full animal-free processes aligns with rising industry demands for sustainability and efficiency, offering Dyadic a competitive edge as regulatory and consumer pressures drive further adoption-potentially increasing market share, recurring revenue, and long-term profit potential.

- With operating expenses expected to remain flat or decrease, new product launches and a growing sales pipeline, management is targeting a return to positive cash flow by late 2026 and profitability thereafter-suggesting significant operating leverage and earnings inflection if revenue projections materialize.

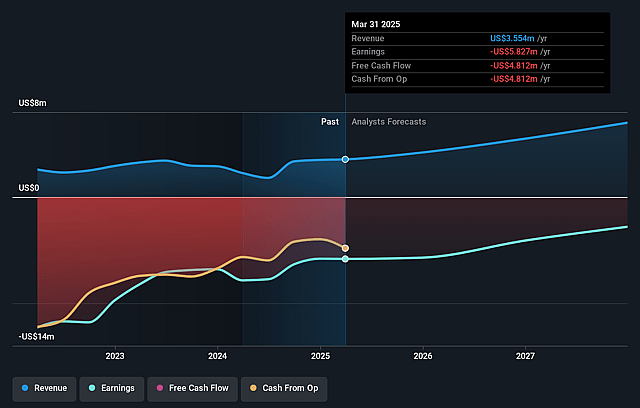

Dyadic International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dyadic International's revenue will grow by 22.3% annually over the next 3 years.

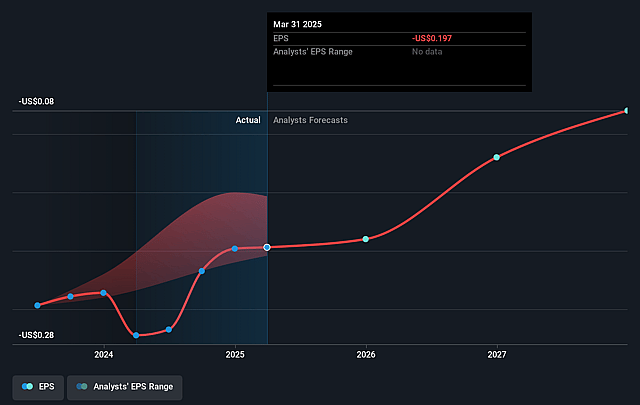

- Analysts are not forecasting that Dyadic International will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Dyadic International's profit margin will increase from -134.8% to the average US Biotechs industry of 16.1% in 3 years.

- If Dyadic International's profit margin were to converge on the industry average, you could expect earnings to reach $1.2 million (and earnings per share of $0.03) by about September 2028, up from $-5.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 397.5x on those 2028 earnings, up from -6.4x today. This future PE is greater than the current PE for the US Biotechs industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.87%, as per the Simply Wall St company report.

Dyadic International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Dyadic continues to report significant operating losses and negative cash flows, having just completed a $5.3 million equity raise to fund current operations-prolonged lack of profitability may force further dilutive equity offerings, suppressing earnings per share and limiting value creation for shareholders.

- The company's commercial revenues remain highly dependent on milestone and grant payments from a concentrated group of partners (e.g., Proliant, Inzymes, Gates Foundation), making for lumpy and uncertain revenue streams that could destabilize cash flow, net margins, and long-term revenue forecasts if deals are delayed or fail to materialize.

- The success of Dyadic's platforms hinges on industry adoption in competitive markets (e.g., recombinant proteins, enzymes) with well-capitalized incumbents-if larger biotechs or disruptive technologies (such as CRISPR, synthetic biology, or alternative protein expression platforms) outpace Dyadic's offerings, the company may struggle to gain market share, impacting long-term revenue growth and relevance.

- Regulatory and validation hurdles, particularly in high-value life sciences and food/nutrition markets, pose a risk of delayed product launches and slower-than-expected commercial adoption; longer timelines and evolving compliance standards could defer or diminish revenue realization and increase R&D expenses.

- Global supply chain uncertainties and the relative lack of traction in key geographies (notably the U.S. for bioindustrial opportunities) may constrain the company's ability to scale, enter lucrative markets, or secure manufacturing and distribution partnerships, limiting future revenue streams and margin expansion prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.0 for Dyadic International based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.6 million, earnings will come to $1.2 million, and it would be trading on a PE ratio of 397.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of $0.98, the analyst price target of $9.0 is 89.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.