Last Update 01 Nov 25

Narrative Update on Honda Motor: Analyst Price Target Adjustment

Analysts have maintained their fair value estimate for Honda Motor at ¥1,744.38, citing stable profit margins and consistent revenue growth expectations as justification for leaving the price target unchanged.

What's in the News

- Completed repurchase of 746,480,900 shares, representing 17.03% of outstanding shares, under a buyback plan totaling ¥1,099,999.88 million as of September 10, 2025. (Buyback Tranche Update)

- Entered a multi-year joint development agreement with Helm.ai to accelerate Honda's next-generation self-driving capabilities and Advanced Driver Assistance Systems. Mass production is targeted after 2027. (Strategic Alliances)

- Raised consolidated earnings guidance for the fiscal year ending March 31, 2026, with expected sales revenue of JPY 21,100,000 million and profit attributable to owners of the parent now forecast at JPY 420,000 million. The update cites tariff impact analysis and updated foreign exchange assumptions. (Corporate Guidance - Raised)

Valuation Changes

- Fair Value Estimate: Remained unchanged at ¥1,744.38.

- Discount Rate: Held steady at 11.02%.

- Revenue Growth: Maintained at approximately 1.35%.

- Net Profit Margin: Essentially unchanged at 3.80%.

- Future P/E Ratio: Stable at roughly 9.17x.

Key Takeaways

- Expanding motorcycle sales in emerging markets and localizing hybrid production are strengthening Honda's revenue base and supply chain resilience.

- Strategic focus on electrification, cost optimization, and technology partnerships is positioning Honda for long-term margin growth and new revenue opportunities.

- Intensifying global competition, EV challenges, and regulatory pressures are eroding Honda's market share, margins, and earnings potential, raising significant concerns about sustained profitability.

Catalysts

About Honda Motor- Develops, manufactures, and distributes motorcycles, automobiles, power, and other products in Japan, North America, Europe, Asia, and internationally.

- Honda's robust growth in its motorcycle business-especially with record profitability and expanding sales in Brazil, Vietnam, and other emerging markets-reflects increasing urbanization and rising middle-class demand for affordable mobility, positioning Honda to benefit from long-term demographic shifts in Asia and South America, supporting sustained revenue and earnings growth.

- Strategic localization of production, with an emphasis on increasing North American production (e.g., potential shift to 3-shift operations in US plants) and plans to localize hybrid system manufacturing in the US, enhances supply chain resilience and could mitigate tariff and trade risk long-term, leading to stabilized costs and improved net margins.

- Aggressive R&D and model adjustment in electrification and hybrid technology-including write-offs on non-competitive EVs and focus on next-generation hybrid components-signal a pivot to align product offerings with accelerating demand for lower-emission vehicles, which is expected to drive stronger revenue and margin expansion as Honda better matches consumer preference and regulatory requirements.

- Ongoing cost optimization through price revisions, operational efficiencies, and expanding use of common platforms across models is improving cost structure and profitability, which will likely support higher long-term net margins and earnings stability even amidst short-term pressures from tariffs and currency fluctuations.

- Persistent investment in mobility services and partnerships in advanced technologies (including collaborations with GM, Sony, and exploration of ADAS/OTA solutions) is setting the stage for Honda to access new high-margin revenue streams beyond traditional car sales, fostering long-run earnings growth and margin enhancement as the mobility industry evolves.

Honda Motor Future Earnings and Revenue Growth

Assumptions

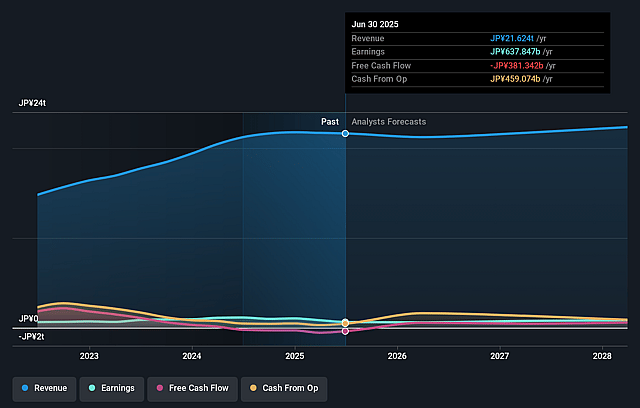

How have these above catalysts been quantified?- Analysts are assuming Honda Motor's revenue will grow by 1.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 3.8% in 3 years time.

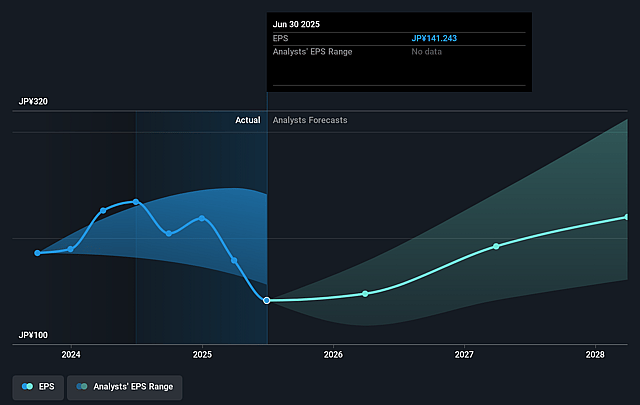

- Analysts expect earnings to reach ¥855.5 billion (and earnings per share of ¥226.48) by about September 2028, up from ¥637.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥1123.8 billion in earnings, and the most bearish expecting ¥649.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.6x on those 2028 earnings, down from 10.4x today. This future PE is lower than the current PE for the US Auto industry at 11.1x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.02%, as per the Simply Wall St company report.

Honda Motor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Honda is experiencing sustained declines in automobile sales across key Asian, Chinese, and European markets, driven by intensifying competition (especially from Chinese OEMs), struggles to launch and compete with hybrid models, and challenges meeting regional consumer preferences and policies, which threatens long-term revenue growth and market share.

- The company continues to report significant nonrecurring and recurring losses associated with its EV business (¥650 billion forecast for FY ending March 2026, including write-offs and provision for losses on EVs currently sold in the U.S.), underscoring Honda's lag behind global competitors in EV and battery technology and pressuring future net margins and earnings growth.

- Honda's automobile operations posted an operating loss for the first fiscal quarter, the first since 2020, indicating vulnerability to external shocks (such as COVID in the past and tariffs/EV losses now) and highlighting Honda's historical weakness in maintaining robust operating margins in its core auto segment compared to peers.

- Global trade uncertainties and frequent changes in tariff regimes, particularly between the U.S., Japan, Mexico, and Canada, are causing substantial earnings volatility and unplanned expenses, while the need to localize key hybrid/EV components (currently sourced from Japan) adds cost and operational complexity, directly threatening both net margins and future profitability.

- There is persistent risk of margin compression from global price competition, especially with aggressive discounting in China and growing competition from lower-cost automakers, along with rising R&D and compliance costs (stringent regulatory, technology, and localization requirements), all of which could erode Honda's profitability and limit long-term earnings expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥1671.518 for Honda Motor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥1900.0, and the most bearish reporting a price target of just ¥1400.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥22320.2 billion, earnings will come to ¥855.5 billion, and it would be trading on a PE ratio of 8.6x, assuming you use a discount rate of 11.0%.

- Given the current share price of ¥1656.0, the analyst price target of ¥1671.52 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.