Last Update 14 Dec 25

Fair value Increased 5.26%7267: Stronger Revenue Outlook And Rising Dividend Will Support Shares

Analysts have raised their price target on Honda Motor from JPY 1,900 to JPY 2,000, citing stronger expected revenue growth despite only modest changes in the discount rate, profit margin assumptions, and future valuation multiples.

What's in the News

- Honda Motor revised its consolidated earnings guidance for the fiscal year ending March 31, 2026, projecting sales revenue of JPY 20,700,000 million and operating profit of JPY 550,000 million, with profit attributable to owners of the parent expected at JPY 300,000 million and earnings per share of JPY 75.05 (company guidance).

- The company announced a second quarter dividend of JPY 35.00 per share for the period ended September 30, 2025, up from JPY 34.00 per share a year earlier, with payments scheduled to commence on December 5, 2025 (company announcement).

- A board meeting is scheduled for November 7, 2025, with the agenda focused on considering the dividend, indicating continued attention to shareholder returns (board meeting notice).

Valuation Changes

- Fair Value: Raised from ¥1,900 to ¥2,000, indicating a modest upward revision in the target valuation.

- Discount Rate: Increased slightly from 10.99% to 11.10%, reflecting a marginally higher required return.

- Revenue Growth: Upgraded from approximately 3.23% to about 4.69%, signaling a meaningful improvement in expected top line expansion.

- Net Profit Margin: Trimmed slightly from around 4.81% to roughly 4.77%, implying a minor downward adjustment in profitability assumptions.

- Future P/E: Reduced modestly from 7.44x to about 7.28x, suggesting a slightly more conservative earnings multiple for future valuation.

Key Takeaways

- Strong motorcycle market leadership and efficient cost structure position Honda for sustained revenue and margin gains, outpacing global peers in key growth regions.

- Accelerated hybrid and EV deployment, combined with advanced cost-saving strategies and tech partnerships, set the stage for robust long-term profitability and volume growth.

- Delayed EV transition, persistent cost inflation, tariff threats, and reliance on motorcycles amid shifting mobility trends are straining Honda's margins and revenue outlook.

Catalysts

About Honda Motor- Develops, manufactures, and distributes motorcycles, automobiles, power, and other products in Japan, North America, Europe, Asia, and internationally.

- Analysts broadly agree Honda's motorcycle business will see ongoing strong sales, but given record margin expansion from platform and powertrain sharing plus market leadership in high-growth ASEAN markets, motorcycle segment operating profit has potential to far exceed consensus, driving above-expected revenue and sustained net margin improvement.

- Analyst consensus anticipates hybrid EVs will secure stable revenue, but Honda's rapid cost reductions, robust North American demand for next-generation hybrids, and expanded hybrid production suggest hybrid sales could scale much faster and wider than expected, substantially boosting operating profit and net margins as hybrids deliver over 50% higher profitability than prior models.

- Honda's accelerating expansion into emerging markets, where rising incomes and urbanization are driving a structural surge in two-wheeler and compact car demand, positions the company for multi-year volume growth and revenue upside, leveraging its entrenched brand and low-cost production to outpace global peers.

- The company's continued investment in advanced electrified and connected vehicles, including 30 global EV models and strategic tech partnerships, gives Honda first-mover advantages as regulatory pressure and consumer preferences shift, setting the stage for significant future revenue growth and long-term margin improvement.

- Honda's supply chain digitalization and global manufacturing optimization will unlock further cost efficiencies, providing structural uplift to net margins and operational resilience, particularly important as the industry transitions toward electrification and value-added mobility services.

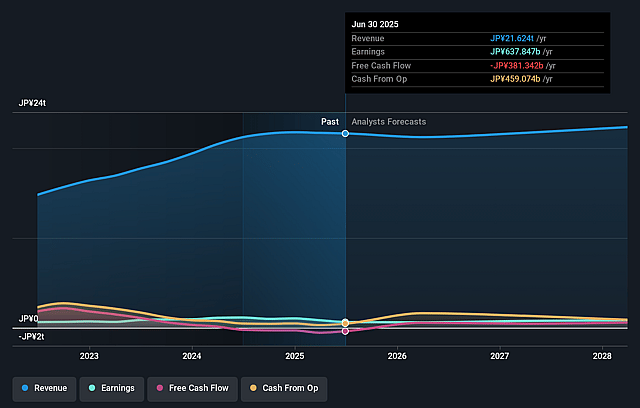

Honda Motor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Honda Motor compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Honda Motor's revenue will grow by 3.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.9% today to 4.8% in 3 years time.

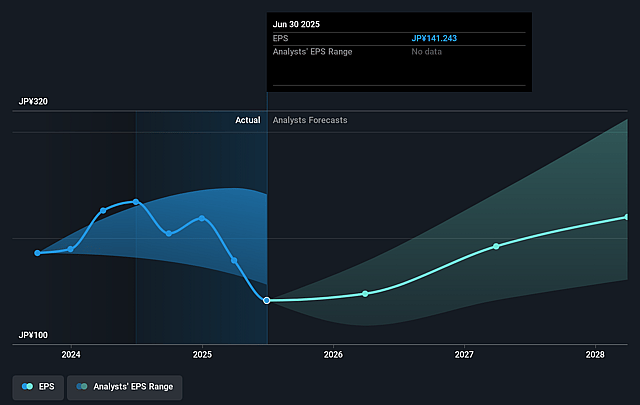

- The bullish analysts expect earnings to reach ¥1147.9 billion (and earnings per share of ¥336.89) by about July 2028, up from ¥835.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.4x on those 2028 earnings, down from 8.1x today. This future PE is lower than the current PE for the US Auto industry at 7.6x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.99%, as per the Simply Wall St company report.

Honda Motor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Honda's slow pace in shifting resources to battery electric vehicles, highlighted by the postponement of a major Canadian EV investment and continued reliance on hybrids, exposes the company to long-term risk of losing market share and future revenues as global auto demand accelerates toward full electrification.

- The company faces significant headwinds from rising input and labor costs, with executives stressing the need for cost optimization and noting pressures from inflation and currency depreciation, both of which are likely to compress margins and erode earnings if not fully offset by price increases.

- Heightened global tariffs, especially in North America, are having a pronounced and uncertain impact on Honda's profitability, as seen by detailed forecasts showing hundreds of billions of yen in potential operating profit reductions, with management warning operating profit could bottom at low levels if tariffs persist or become more onerous in future years.

- A substantial portion of Honda's profits depends on the performance of its motorcycle business, which is predominantly exposed to emerging markets; continuing economic or regulatory shifts in those regions-combined with global secular trends toward urban mobility models over personal vehicle ownership-could shrink Honda's addressable market and put future revenue growth at risk.

- Persistently high research and development costs, driven by the need to catch up in electrification and next-generation technologies, are already cutting into the company's net margins, with management emphasizing that BEV gross profit is presently deeply negative and R&D on electrification is causing substantial profit drag for the foreseeable future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Honda Motor is ¥1900.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Honda Motor's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥1900.0, and the most bearish reporting a price target of just ¥1200.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ¥23858.6 billion, earnings will come to ¥1147.9 billion, and it would be trading on a PE ratio of 7.4x, assuming you use a discount rate of 11.0%.

- Given the current share price of ¥1650.0, the bullish analyst price target of ¥1900.0 is 13.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Honda Motor?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.