Key Takeaways

- Weakness in electric vehicle strategy and mounting competition threaten long-term growth, with Honda at risk of losing market share and facing sustained earnings pressure.

- Tariffs, volatile trade policies, and costly innovation strain margins and cash flow, while high capital requirements and macroeconomic headwinds limit profitability and shareholder returns.

- Leadership in motorcycles, strong hybrid margins, generous shareholder returns, ample cash for innovation, and effective tariff strategies position Honda for resilient long-term growth.

Catalysts

About Honda Motor- Develops, manufactures, and distributes motorcycles, automobiles, power, and other products in Japan, North America, Europe, Asia, and internationally.

- Escalating global tariffs and shifting trade policies, particularly in North America, are introducing significant long-term uncertainty and costs into Honda's supply chain and production planning. This ongoing volatility is likely to suppress revenue growth and place persistent pressure on net margins, as future mitigation measures may not offset lost competitiveness or elevated input expenses.

- Honda's delayed and cautious investment in battery electric vehicles, highlighted by the indefinite postponement of its large-scale EV and battery plant in Canada, risks leaving the company structurally behind as global electrification accelerates. This ongoing underperformance in the BEV segment threatens future topline growth and could lead to prolonged earnings erosion as internal combustion sales decline faster than Honda can transition.

- Growing competitive pressures from new EV entrants, especially cost-aggressive Chinese manufacturers, threaten to erode market share and force Honda into more price competition in both developed and emerging markets. This intensifying rivalry will likely result in shrinking average selling prices and further margin compression over the long term.

- Rising global interest rates and ongoing geopolitical instability are expected to dampen consumer demand for vehicles, reduce access to automotive financing, and contribute to an overall slowdown in auto sales across key Honda markets. This macroeconomic environment is likely to drive weaker sales volumes, higher inventories, and downward pressure on earnings for an extended period.

- Heavy ongoing capital expenditure and R&D requirements to address electrification, autonomous technologies, and supply chain resilience may continue to strain Honda's free cash flow and limit shareholder returns. Meanwhile, overreliance on low-margin volume segments such as motorcycles exposes the business to further margin risk as affordability pressures and digital disruption reduce long-term pricing power.

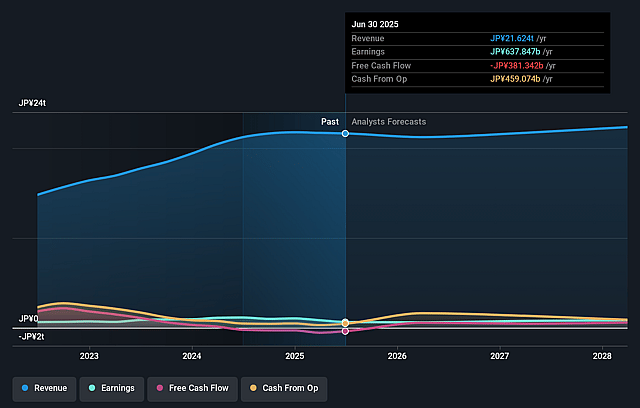

Honda Motor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Honda Motor compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Honda Motor's revenue will decrease by 1.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 3.9% today to 3.1% in 3 years time.

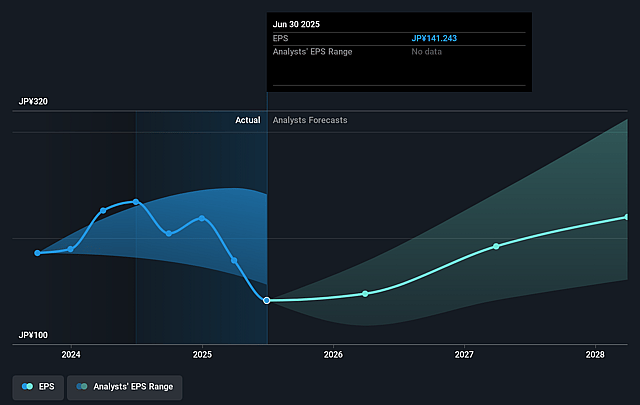

- The bearish analysts expect earnings to reach ¥655.4 billion (and earnings per share of ¥158.86) by about July 2028, down from ¥835.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, up from 8.1x today. This future PE is greater than the current PE for the US Auto industry at 7.6x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.99%, as per the Simply Wall St company report.

Honda Motor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Honda's motorcycle business remains the world's leader by unit sales, achieving record high profits and operating margins, and is expected to continue driving stable and resilient revenue and profit growth, especially as demand for affordable personal mobility increases across emerging markets.

- The company has demonstrated strong hybrid vehicle profitability, with the latest model generating profit margins 1.5 times higher than the prior generation, and is expanding its hybrid EV sales in both North America and globally, supporting higher net margins and revenue despite headwinds in other regions.

- Honda's shift to a dividend-on-equity (DOE) policy and a higher dividend per share, along with a sizeable share buyback program, reflects increased capital returns to shareholders, which could attract long-term investors and provide upward support for the share price through improved earnings per share.

- The company maintains a robust free cash flow and significant cash balances, enabling continued investment in next-generation technologies, R&D, and flexible responses to industry shifts, all of which support long-term earnings growth and financial stability.

- Strategic initiatives to mitigate tariff impacts, such as optimizing global production allocation, increasing US production capacity, and leveraging cost reductions in hybrids, point to Honda's ability to offset short-term shocks and maintain or grow profitability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Honda Motor is ¥1234.22, which represents two standard deviations below the consensus price target of ¥1619.74. This valuation is based on what can be assumed as the expectations of Honda Motor's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥1900.0, and the most bearish reporting a price target of just ¥1200.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ¥20942.2 billion, earnings will come to ¥655.4 billion, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 11.0%.

- Given the current share price of ¥1650.0, the bearish analyst price target of ¥1234.22 is 33.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Honda Motor?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.