Last Update 05 Feb 26

Fair value Decreased 0.43%GRAB: Indonesia Merger Talks And Q3 Execution Will Drive Future Leadership

Narrative Update

The updated analyst price target for Grab Holdings edges lower to approximately $6.80 from about $6.83, as analysts factor in a slightly higher discount rate and a marginally lower future P/E multiple, while keeping their core growth and margin assumptions broadly unchanged.

Analyst Commentary

Recent research on Grab Holdings highlights a mix of optimism around execution and growth, alongside some caution around valuation and the path forward. Here is how analysts are framing it.

Bullish Takeaways

- Bullish analysts point to the recent upgrades as a sign that they see the risk or reward profile improving, with the current share price viewed as more attractive relative to their assessment of Grab's long term prospects.

- The move by one large global bank to raise its price target to $7 from $6.50 follows Q3 results that were described as better than expected. These analysts take that as a positive signal for execution on both revenue and cost control.

- Supportive research notes generally frame the higher price targets and ratings as reflecting confidence that Grab can keep building on recent operating trends while maintaining discipline on profitability and capital allocation.

- Some bullish analysts highlight that the updated targets, including levels around $6.80 to $7, still assume a reasonable P/E multiple. They see this as leaving room if the company continues to meet or slightly beat internal goals.

Bearish Takeaways

- Even with recent upgrades, cautious analysts point to the slightly higher discount rate used in updated models. This signals an awareness of risk around execution, competitive intensity or macro sensitivity.

- The marginally lower future P/E multiple baked into the new targets suggests some restraint about how much investors may be willing to pay for Grab's earnings, particularly if growth or margins slow versus internal plans.

- Some bearish analysts may question the sustainability of Q3 results that were better than expected, viewing them as needing to be repeated over several quarters before they assign higher valuation multiples.

- The clustering of targets around a relatively tight price range, such as $6.50 to $7, can also be read as a signal that analysts see limited room for error, with less cushion if execution slips or sector sentiment weakens.

What's in the News

- Indonesia is discussing a potential merger or acquisition between Grab and rival GoTo Gojek, with a combined entity cited as having over 91% market share in Indonesia's market for certain services, and officials indicating a decision could come soon (Reuters).

- Grab and GoTo are reported to be in talks to offer Indonesia's sovereign wealth fund, Danantara, a "golden share" with special rights over Indonesian operations, including areas such as driver pay, as part of efforts to secure approval for a potential US$29b merger (Financial Times).

- Hesai Technology and Grab entered into a cooperation agreement under which Grab will act as Hesai's exclusive distributor of lidar products in Southeast Asia, handling sales, customer support, and marketing across a range of industries and autonomous applications.

- Singapore's Land Transport Authority approved WeRide and Grab to conduct autonomous vehicle testing with the full Ai.R fleet in Punggol, with plans to increase test runs on shuttle service routes by up to four times by the end of the year as part of preparations for a public autonomous shuttle service.

Valuation Changes

- Fair Value: The model fair value estimate edges slightly lower, from about US$6.83 to around US$6.80 per share.

- Discount Rate: The discount rate used in the valuation is marginally higher, moving from roughly 7.73% to about 7.76%.

- Revenue Growth: The long term revenue growth assumption is effectively unchanged at around 22.57%.

- Net Profit Margin: The projected net profit margin remains stable at roughly 15.53%.

- Future P/E: The assumed future P/E multiple eases slightly, from about 38.27x to roughly 38.14x.

Key Takeaways

- Superapp ecosystem growth and fintech expansion are driving higher user engagement, new revenue streams, and long-term earnings potential.

- Tech investments and operational efficiencies are boosting margins, while advancements in urban mobility may further enhance future profitability.

- Increasing competition, regulatory risks, heavy incentive spending, and large tech investments threaten Grab's margins, revenue growth, and long-term profitability in core Southeast Asian markets.

Catalysts

About Grab Holdings- Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

- Accelerated digital payments and fintech adoption in Southeast Asia is expanding Grab's addressable market and boosting transaction volumes, as evidenced by the rapid growth in GrabFin and digital bank loan disbursals; this supports strong long-term revenue and earnings potential.

- Rising smartphone and internet penetration, alongside urbanization and expanding middle-class affluence across the region, is driving higher user engagement and increased frequency of usage within Grab's superapp ecosystem, underpinning robust GMV and top-line growth.

- Expansion and monetization of cross-vertical products (e.g., Mart, food delivery, premium rides, loyalty programs, and bundled services) are increasing revenue per user and creating new avenues for higher-margin advertising and financial services; this is expected to enhance margin and earnings over time.

- Operational efficiencies from continued tech investments (AI, automation, product-led growth, cost discipline) are producing operating leverage and improving net margins, as shown by margin improvement despite increased investment in affordability and new user acquisition.

- The ongoing development of autonomous vehicle fleets and partnerships positions Grab to benefit from future advancements in urban mobility, which could lower long-term costs, boost utilization, and drive new revenue streams, positively impacting profitability and long-term earnings growth.

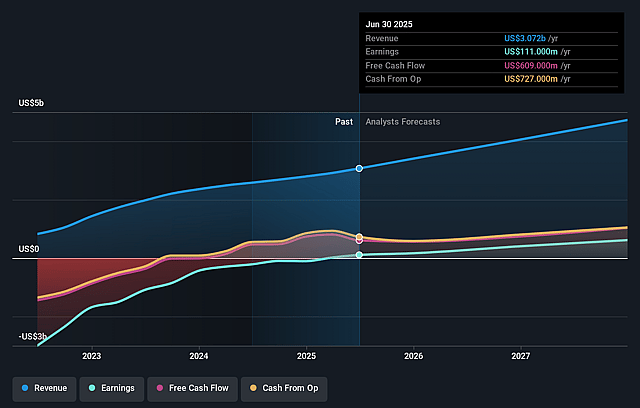

Grab Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Grab Holdings's revenue will grow by 20.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.6% today to 15.0% in 3 years time.

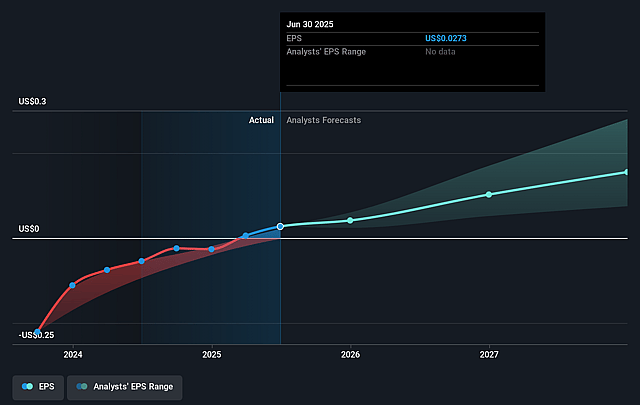

- Analysts expect earnings to reach $802.4 million (and earnings per share of $0.2) by about September 2028, up from $111.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.1 billion in earnings, and the most bearish expecting $319.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.1x on those 2028 earnings, down from 180.7x today. This future PE is greater than the current PE for the US Transportation industry at 25.4x.

- Analysts expect the number of shares outstanding to grow by 1.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.66%, as per the Simply Wall St company report.

Grab Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in key markets, particularly Vietnam (with new food delivery entrants) and across Southeast Asia from both local and regional players, risks compressing take rates and increasing promotional spending, which may erode net margins and limit Grab's ability to sustainably grow earnings.

- Ongoing heavy investments in affordability (Saver rides/delivery) and persistent reliance on incentives (consumer incentive spending at 7%+ of GMV) could delay operating leverage, suppress underlying margins in Delivery and Mobility segments, and weigh on both revenue per user and overall earnings growth.

- Looming macroeconomic uncertainties in major markets (Thailand, Indonesia) and globally-such as consumption slowdowns and political/trade tensions-could constrain consumer discretionary spending, increasing volatility in core revenue streams.

- The prospect of regulatory changes (e.g., labor laws affecting driver classification, fintech/lending oversight) or licensing hurdles in Southeast Asian markets threatens to increase compliance costs and operational complexity, pressuring long-term profitability.

- High capital expenditure required for autonomous vehicle rollout and electrification, as well as the uncertain timeline and monetization path for these technologies, could strain free cash flow, raise fixed costs, and dilute returns if adoption or regulatory frameworks do not progress as expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.1 for Grab Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $5.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.4 billion, earnings will come to $802.4 million, and it would be trading on a PE ratio of 40.1x, assuming you use a discount rate of 7.7%.

- Given the current share price of $4.92, the analyst price target of $6.1 is 19.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Grab Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.