Last Update 01 May 25

Fair value Decreased 19%US Household Formation And Digital Transformation Will Unlock Opportunities

Key Takeaways

- Vertically integrated operations and digital transformation enhance efficiency, enabling access to high-quality loans and driving potential revenue and earnings growth.

- Strategic investments in technology and partnerships foster operational scale, support stable earnings, and improve returns through high-quality assets and cost control.

- High exposure to interest rate risk, credit risk, unsustainable dividends, increased leverage, and declining loan growth threatens earnings stability and long-term investor confidence.

Catalysts

About PennyMac Mortgage Investment Trust- Through its subsidiary, primarily invests in residential mortgage-related assets in the United States.

- The continued growth in U.S. household formation and the steady demand for residential mortgages, combined with PennyMac's robust vertically integrated origination and servicing platform, position PMT to access a consistent pipeline of high-quality loans, supporting future revenue and earnings growth.

- Ongoing digital transformation and the ability to organically create securitizations through technology-enabled processes are enabling PMT to efficiently structure and retain higher-yielding credit-sensitive non-agency MBS and CRT assets, which could drive net margin expansion as operational efficiencies scale.

- A sustained increase in nonowner-occupied and jumbo loan volumes, facilitated by PMT's partnership with PFSI, is expected to create additional opportunities for the firm to deploy capital into attractive risk-adjusted return investments, potentially lifting future returns on equity (ROE) and net interest income.

- The strong demand from institutional investors for yield in a low interest rate environment is contributing to a resilient and active private label securitization market, providing PMT with favorable pricing and execution, which could support higher valuation multiples and improved capital access, benefitting long-term book value.

- Targeted strategic investments in loan servicing technology and infrastructure continue to reduce PMT's cost-to-service and enhance credit loss mitigation, supporting operational scale, contained operating expenses, and stable earnings, especially as the company benefits from low delinquency rates and high-quality underlying collateral.

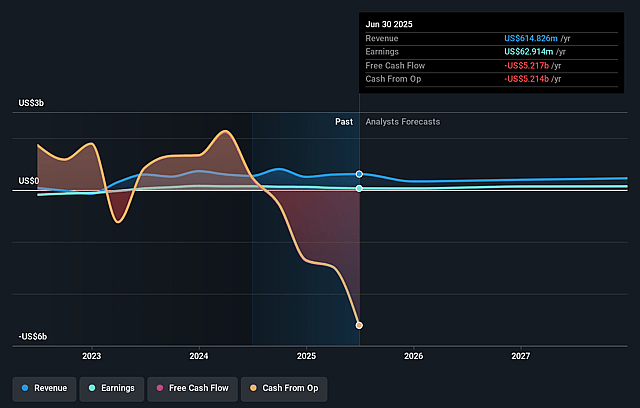

PennyMac Mortgage Investment Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PennyMac Mortgage Investment Trust's revenue will decrease by 16.8% annually over the next 3 years.

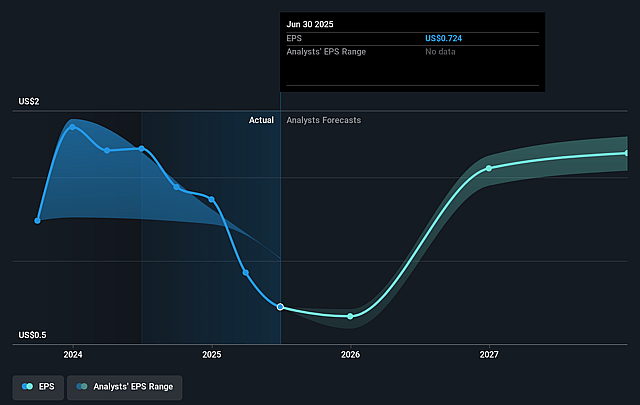

- Analysts assume that profit margins will increase from 10.2% today to 55.0% in 3 years time.

- Analysts expect earnings to reach $194.9 million (and earnings per share of $1.64) by about September 2028, up from $62.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, down from 17.1x today. This future PE is lower than the current PE for the US Mortgage REITs industry at 14.3x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.14%, as per the Simply Wall St company report.

PennyMac Mortgage Investment Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent exposure to interest rate and spread volatility, as seen in the most recent quarter's fair value declines and interest rate hedge losses, creates potential for ongoing book value declines and lower net interest income, especially if long-term rates rise or spreads widen.

- High reliance on non-Agency and jumbo securitizations increases credit risk; any deterioration in borrower credit or real estate values could increase delinquencies and default rates, adversely impacting revenue streams and net margins.

- Continued high dividend payout ratios remain unsupported by current run-rate earnings ($0.38 per share vs. $0.40 dividend), raising the risk of unsustainable dividends, possible dividend cuts, and reduced investor confidence, which would pressure share price multiples.

- The rapid increase in leverage, particularly via nonrecourse debt tied to retained securitizations, amplifies exposure to funding and liquidity risks in less robust MBS market environments, threatening earnings stability and capital structure robustness.

- Structural decline in mortgage refinancing and potential for persistent home affordability issues could limit the pool of new loans and dampen future correspondent production growth, putting pressure on PMT's origination-driven revenue and long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.429 for PennyMac Mortgage Investment Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.5, and the most bearish reporting a price target of just $12.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $354.4 million, earnings will come to $194.9 million, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 9.1%.

- Given the current share price of $12.39, the analyst price target of $13.43 is 7.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.