Last Update 30 Nov 25

ANURAS: Auditor Transition And Board Actions Will Pressure Sentiment Through 2025

Analysts have maintained their fair value estimate for Anupam Rasayan India at ₹905.00, citing stable forecast assumptions, even with minor adjustments in financial metrics.

What's in the News

- The company scheduled a Special/Extraordinary Shareholders Meeting on December 22, 2025, to be conducted via postal ballot in India. (Key Developments)

- On November 21, 2025, the Board approved the Postal Ballot Notice and set the cut-off date for member eligibility as November 20, 2025. The e-voting period is set from November 23 to December 22, 2025. (Key Developments)

- A Board Meeting held on October 17, 2025, considered and approved the unaudited financial results for the quarter and half-year ended September 30, 2025. (Key Developments)

- The company approved the appointment of Ms. Natvarlal Vepari and Co., Chartered Accountants, Surat, as Statutory Auditor at the AGM on September 26, 2025. (Key Developments)

- The resignation of M/s. Rajendra & Co., Chartered Accountants, Mumbai, was accepted at the meeting held on September 01, 2025, concluding their term at the 22nd AGM. (Key Developments)

Valuation Changes

- Fair Value Estimate remains unchanged at ₹905.00 per share.

- Discount Rate has decreased marginally from 13.63% to 13.61%.

- Revenue Growth projection is virtually unchanged, remaining at approximately 13.10%.

- Net Profit Margin expectation is stable, holding steady at around 12.66%.

- Future P/E ratio has dipped slightly from 42.22x to 42.20x.

Key Takeaways

- Elevated growth expectations are supported by robust custom synthesis agreements, but heavy client concentration increases vulnerability to contract shifts and global market volatility.

- Regulatory, supply chain, and industry consolidation pressures could squeeze margins and require costly product or process adaptations amid changing global chemistry standards.

- Diversified growth in high-value chemicals, strategic global partnerships, and improved balance sheet resilience position Anupam Rasayan for sustained earnings strength and margin expansion.

Catalysts

About Anupam Rasayan India- Engages in the custom synthesis and manufacturing of specialty chemicals in India, Europe, Japan, Singapore, China, North America, and internationally.

- The rapid expansion in custom synthesis and contract manufacturing, reflected by newly signed long-term agreements with leading global clients in high-growth sectors (e.g., fluorochemicals for semiconductors and energy storage), has driven order visibility to record highs and resulted in significantly elevated forward revenue growth expectations-this could justify an overvalued stock price if execution or ramp-up falls short.

- Growing concentration of revenues from a small set of multinational clients (with top 10 contributing 79% of Q1 FY26 revenue) and heavy reliance on LOIs creates vulnerability to contract renegotiations, customer-specific downturns, and associated revenue risk, especially concerning if these client dynamics shift amid evolving global regulatory and macro environments.

- The global regulatory push towards green and sustainable chemistries could accelerate compliance and capital expenditure needs, putting pressure on margins and free cash flow if Anupam Rasayan's current product mix and processes face stiffer future scrutiny or require pivoting to more bio-based chemistries.

- Tightening global trade policies, ongoing geopolitical instability, and new tariffs (including recent U.S. penalties) increase the risk of supply chain disruptions, raw material price volatility, and margin uncertainty-potentially leading to higher operating costs and pressured earnings.

- Intensifying consolidation among global specialty chemical buyers and suppliers can shift bargaining power away from mid-sized players like Anupam Rasayan, placing future pricing and volume growth at risk and potentially eroding long-term EBITDA margins and earnings potential.

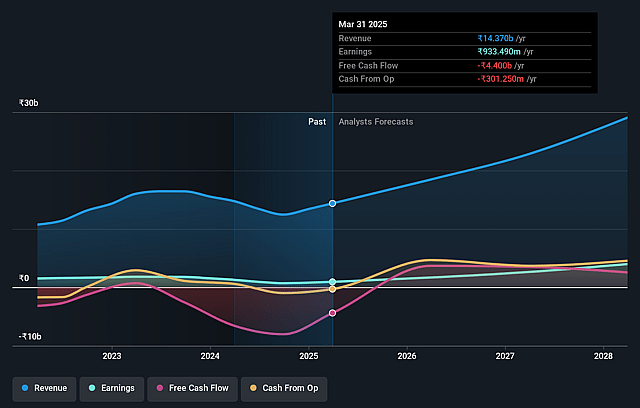

Anupam Rasayan India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Anupam Rasayan India's revenue will grow by 19.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 12.4% in 3 years time.

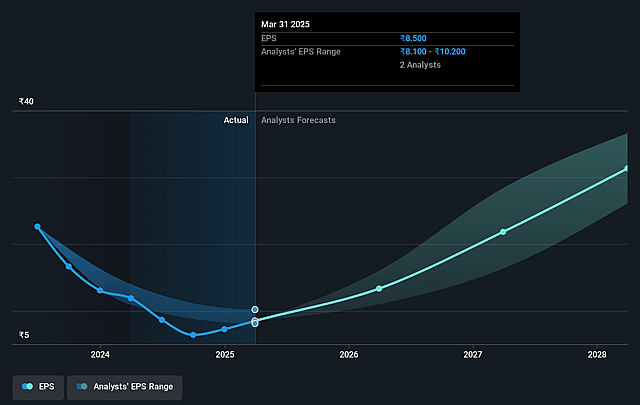

- Analysts expect earnings to reach ₹3.5 billion (and earnings per share of ₹26.37) by about September 2028, up from ₹1.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹4.2 billion in earnings, and the most bearish expecting ₹2.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.1x on those 2028 earnings, down from 102.0x today. This future PE is greater than the current PE for the IN Chemicals industry at 26.8x.

- Analysts expect the number of shares outstanding to decline by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.76%, as per the Simply Wall St company report.

Anupam Rasayan India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Anupam Rasayan's strong revenue and profit rebound reflects successful commercialization of new molecules in Pharma, Polymer, and Performance Materials, supported by new long-term contracts and LOIs, which is likely to drive sustained top line and margin expansion contrary to long-term decline expectations; this suggests revenue and net margin resilience.

- The company's diversification into high-value, niche fluorochemicals and strategic entry into the rapidly growing EV and battery ecosystem (via electrolyte production) positions it to capture secular demand in emerging sectors, supporting future earnings stability and potential growth.

- Robust export order book (58% of revenue from exports) including multi-year contracts with blue-chip Japanese and US multinationals provides enhanced visibility and stickiness of revenues, buffering against short-term sectoral headwinds and supporting multi-year cash flow and earnings predictability.

- Significant improvement in working capital efficiency, reduction in inventory days, and the repayment of long-term debt (becoming net-term debt free), puts Anupam Rasayan in a stronger balance sheet position, enhancing its ability to reinvest in growth and improve net margins.

- Secular trends of global companies increasingly outsourcing specialty chemical manufacturing to India, the company's successful ramp-up of new products, and higher margins in custom synthesis create long-run barriers to revenue decline and support premium pricing, which could drive higher-than-expected EPS and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹837.857 for Anupam Rasayan India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1305.0, and the most bearish reporting a price target of just ₹520.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹28.3 billion, earnings will come to ₹3.5 billion, and it would be trading on a PE ratio of 39.1x, assuming you use a discount rate of 13.8%.

- Given the current share price of ₹1105.8, the analyst price target of ₹837.86 is 32.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.