Key Takeaways

- Rapid revenue growth, improved margins, and strong cash flows are driving outperformance, with operational efficiencies accelerating earnings and capital returns faster than analyst expectations.

- Strategic positioning in innovative chemistries, export-oriented partnerships, and automation efforts establish long-term market leadership and sustained premium growth opportunities.

- Heavy reliance on a few export customers, rising regulatory costs, limited innovation focus, and aggressive capacity expansion jointly heighten long-term revenue and margin vulnerability.

Catalysts

About Anupam Rasayan India- Engages in the custom synthesis and manufacturing of specialty chemicals in India, Europe, Japan, Singapore, China, North America, and internationally.

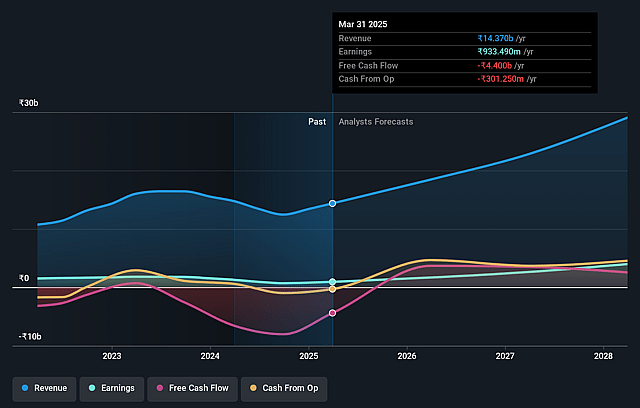

- Analyst consensus expects strong pharma and polymer segment growth, but current data reveals an even sharper revenue ramp-up, with pharma revenues tripling year-on-year and performance materials doubling-combined with immediate order book execution, this points to outperformance versus current consensus estimates and potential multi-year compounding of revenue growth beyond FY '26.

- While analysts broadly anticipate margin gains from green energy and operational efficiencies, recent evidence of a sharp fall in working capital requirements, rapid inventory liquidation, and a move to net debt-free status suggests Anupam Rasayan could unlock significantly higher net margins and free cash flows, accelerating earnings growth and materially improving return on capital even faster than expected.

- The company's strategic commercial partnerships in high-tech areas like semiconductors, EV/battery chemistries, and advanced fluorochemicals place it at the forefront of global supply chain shifts and import substitution, positioning Anupam to capture premium pricing and persistent export-led growth as global demand for innovation chemicals accelerates over the long term, directly bolstering top-line and margin expansion.

- Long-term, Anupam Rasayan's first-mover advantage in the specialty chemicals market-particularly in serving multinational clients through long-dated contracts and the China+1 opportunity-means sustained structural export growth and rising revenue visibility, with industry tailwinds supporting market share gains and custom synthesis scaling.

- Investments in plant automation, digitization, and supply chain integration are likely to dramatically improve cost competitiveness and reduce operational risk, setting the stage for superior operating leverage and sustained above-industry EBITDA margins as specialty chemicals adoption broadens globally.

Anupam Rasayan India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Anupam Rasayan India compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Anupam Rasayan India's revenue will grow by 28.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.4% today to 13.3% in 3 years time.

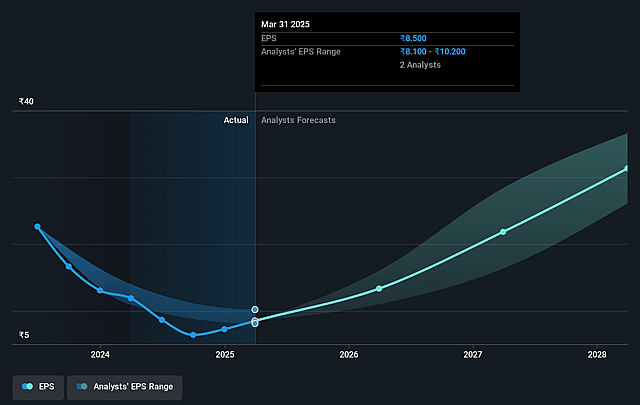

- The bullish analysts expect earnings to reach ₹4.7 billion (and earnings per share of ₹41.52) by about September 2028, up from ₹1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 45.1x on those 2028 earnings, down from 101.2x today. This future PE is greater than the current PE for the IN Chemicals industry at 26.9x.

- Analysts expect the number of shares outstanding to decline by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.83%, as per the Simply Wall St company report.

Anupam Rasayan India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's customer concentration remains high, with 79% of revenues in the quarter coming from its top 10 customers, which exposes it to significant risks if any major client reduces business, renegotiates contracts, or exercises pricing pressure, directly threatening revenue stability.

- Anupam Rasayan's business model is heavily export oriented, with 58% of revenues from exports, making it vulnerable to shifting global trade policies, such as the recently imposed 25% tariffs from the United States on Indian chemical imports, which could squeeze margins or hurt revenue if exemptions are not maintained or customers seek alternative suppliers.

- Despite strong recent growth, the company faces rising long-term compliance and capital outlay requirements due to increasing global environmental regulations, and this is likely to intensify as secular trends push the chemical industry toward greener, more sustainable alternatives, potentially increasing production costs and compressing net margins.

- Performance improvements are currently driven by scaling up manufacturing of existing or newly developed molecules, but the absence of discussion around substantial R&D investments or innovation strategy raises the risk that Anupam Rasayan will struggle to keep up as the industry shifts toward bio-based, less hazardous chemicals, increasing product commoditization and slowing long-term earnings growth.

- The rapid increase in capacity, indicated by two new commercial plants and orders ramping up, raises the risk of industry oversupply-especially as domestic and global competitors also add capacity-which may push down specialty chemical prices and erode profitability in the medium to long term, negatively impacting both revenue and earnings sustainability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Anupam Rasayan India is ₹1305.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Anupam Rasayan India's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1305.0, and the most bearish reporting a price target of just ₹520.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹35.6 billion, earnings will come to ₹4.7 billion, and it would be trading on a PE ratio of 45.1x, assuming you use a discount rate of 13.8%.

- Given the current share price of ₹1097.0, the bullish analyst price target of ₹1305.0 is 15.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.