Last Update26 Aug 25Fair value Increased 6.57%

Analysts have raised Lowe’s price target to $277.71, citing stronger Q2 earnings, improved margin performance, enhanced guidance, and Pro segment expansion, though offset by continued DIY softness.

Analyst Commentary

- Bullish analysts cite Lowe's Q2 earnings beat, with improved comps and stronger margins, as a primary reason for upward price target revisions.

- Improved guidance for the back half of the year, with reiterated or enhanced full-year outlooks, has increased analyst confidence in the company's trajectory.

- Expansion into the Pro customer segment—including the FBM acquisition and increased large-ticket purchases—is seen as broadening exposure to market recovery and driving upside leverage.

- Positive near-term trends and a solid July exit-rate are reinforcing estimates and supporting higher valuation multiples extended to the next fiscal periods.

- Bearish analysts highlight ongoing challenges in the do-it-yourself segment, prompting downward revisions in same-store sales projections for the remainder of 2025.

What's in the News

- Lowe's updated full-year 2025 guidance, raising sales expectations to $84.5-$85.5 billion but lowering operating margin and diluted EPS projections slightly due to the inclusion of ADG; core business outlook remains unchanged.

- A new 130,000-square-foot Lowe's store opened at South Bridge Marketplace in Maricopa, reflecting expansion into a fast-growing market.

- Lowe's was dropped from the Russell 1000 Dynamic Index.

- The company launched the Lowe's Creator Network, partnering with creators like MrBeast to engage Millennial and Gen Z audiences and boost digital brand presence.

- Lowe's increased its quarterly dividend by 4% to $1.20 per share and reported no new buybacks in the recent tranche, having completed repurchases totaling 3.07% of shares under the current program.

Valuation Changes

Summary of Valuation Changes for Lowe's Companies

- The Consensus Analyst Price Target has risen from $264.45 to $277.71.

- The Consensus Revenue Growth forecasts for Lowe's Companies has significantly risen from 3.3% per annum to 4.4% per annum.

- The Future P/E for Lowe's Companies remained effectively unchanged, moving only marginally from 22.81x to 23.08x.

Key Takeaways

- Expansion into the Pro contractor market and integration of new digital capabilities position Lowe's for sustained growth, operational efficiency, and greater customer wallet share.

- Market consolidation and scale advantages are set to enhance supplier bargaining power and cost efficiencies, supporting long-term margin improvement.

- Major acquisitions, debt-related risks, tepid sales growth, labor pressures, and digital competition together threaten Lowe's operational margins, revenue growth, and long-term earnings potential.

Catalysts

About Lowe's Companies- Operates as a home improvement retailer in the United States.

- The acquisition of Foundation Building Materials (FBM) sharply accelerates Lowe's access to the large Pro contractor market-especially in key underserved regions (California, Northeast, Midwest)-unlocking new revenue streams, greater ticket sizes, and a larger share of the $250 billion Pro market, which is expected to drive above-market sales growth and improved diversification of revenue over the coming years.

- Ongoing pent-up demand from delayed home improvement projects, combined with record-high aging U.S. housing stock and an estimated 18 million new homes needed by 2033, points to a significant runway for future growth in renovation, repair, and new construction; this will positively affect revenue and support sustained top-line expansion as the housing cycle recovers.

- Continued investment in digital and omnichannel capabilities-including AI-powered tools for associates and new digital solutions brought through FBM's technology (e.g., MyFBM app, digital blueprint takeoff)-is expected to enhance operational efficiency, improve service levels for Pro and DIY customers, and drive incremental margin expansion through productivity gains.

- Cross-selling opportunities arising from the integration of FBM and ADG (flooring, cabinets, countertops) enable Lowe's to offer comprehensive interior solutions to large builders, boosting wallet share per customer and supporting margin and earnings growth through higher attachment rates and bundled sales.

- Market consolidation trends and Lowe's growing scale in both retail and distribution are poised to strengthen its bargaining power with suppliers, optimize procurement, and improve cost efficiencies, helping to defend and potentially expand both gross and operating margins over the long term.

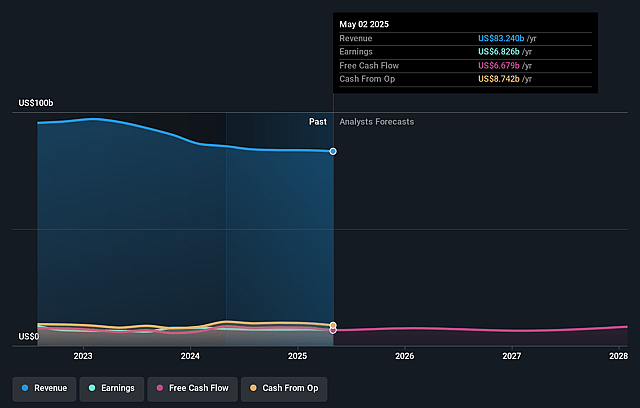

Lowe's Companies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lowe's Companies's revenue will grow by 4.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.2% today to 8.9% in 3 years time.

- Analysts expect earnings to reach $8.4 billion (and earnings per share of $15.27) by about September 2028, up from $6.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $7.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.5x on those 2028 earnings, up from 22.1x today. This future PE is greater than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 1.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.8%, as per the Simply Wall St company report.

Lowe's Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The success of Lowe's major acquisitions (FBM and ADG) hinges on complex integration and execution; failure to effectively merge operations, technology, and cultures could lead to higher costs, operational disruptions, and lower-than-anticipated synergy realization, negatively affecting net margins and long-term earnings.

- The significant debt financing required for the $8.8 billion FBM acquisition will suspend share repurchases until 2027 and temporarily elevate leverage, increasing the company's exposure to interest rate changes and financial risk, which may weigh on earnings growth and shareholder returns.

- Flat to low single-digit comparable sales guidance and management's cautious commentary on a "flat home improvement market" signal that housing turnover and discretionary big-project demand remain suppressed by high mortgage rates and affordability concerns-potentially limiting revenue growth despite favorable secular trends.

- Persistent labor shortages and rising labor costs among both Pro customers and Lowe's workforce threaten to pressure operating margins and erode customer service advantages, possibly leading to margin compression and reduced earnings power long term.

- Ongoing market risk from digital disruption, large supplier bargaining power, and direct-to-consumer competition (including e-commerce channel rivalry and major brands bypassing retailers) may threaten Lowe's in-store and online sales growth, undermining both revenue expansion and margin improvement initiatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $281.839 for Lowe's Companies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $325.0, and the most bearish reporting a price target of just $221.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $94.0 billion, earnings will come to $8.4 billion, and it would be trading on a PE ratio of 23.5x, assuming you use a discount rate of 8.8%.

- Given the current share price of $269.03, the analyst price target of $281.84 is 4.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.