Last Update 01 Aug 25

Fair value Increased 18%The significant rise in MIXI’s future P/E multiple suggests improved earnings expectations or increased market confidence, driving the consensus analyst price target up from ¥2800 to ¥3300.

What's in the News

- MIXI completed a buyback of 450,800 shares (0.67% of outstanding) for ¥1,491.92 million, as part of a larger ongoing share repurchase program authorized for up to 4,750,000 shares (7.01%) or ¥9,500 million, valid through March 2026.

- The board is considering disposal of treasury shares as restricted stock compensation.

- The board reviewed increasing the purchase price of PointsBet's ordinary shares to secure its acquisition under the SOA.

- Mercury Leaf K.K. and Mercury Sprout K.K. acquired a 5.43% stake in MIXI (4 million shares) from Kenji Kasahara for ¥12.9 billion.

- MIXI raised its year-end dividend for FY25 to ¥65 per share (from ¥55) but guided for a lower annual dividend for FY26 of ¥60 per share (down from ¥65). FY26 company guidance: net sales ¥155 billion, operating income ¥20 billion, profit ¥13 billion, EPS ¥191.84.

Valuation Changes

Summary of Valuation Changes for MIXI

- The Consensus Analyst Price Target has significantly risen from ¥2800 to ¥3300.

- The Future P/E for MIXI has significantly risen from 11.80x to 13.91x.

- The Discount Rate for MIXI remained effectively unchanged, at 7.33%.

Key Takeaways

- Integration of AI, advanced analytics, and personalization enhances operational efficiency, monetization, and margin expansion across MIXI's digital entertainment and community segments.

- Diversification through acquisitions and new growth verticals reduces reliance on legacy IP and positions the company for sustained user growth and improved revenue stability.

- Heavy investment in marketing and overseas expansion, reliance on aging titles, and M&A risks could compress margins and threaten sustainable profitability amid rising competition and AI adoption.

Catalysts

About MIXI- Engages in the sports, digital entertainment, lifestyle, and investment businesses in Japan.

- Ongoing integration of advanced AI across company workflows is driving significant improvements in operational efficiency, with 99% employee adoption and over 250 AI-based measures implemented, supporting cost reductions and margin expansion, which should positively impact EBITDA and net income.

- Accelerating growth in the sports and lifestyle segments, exemplified by strong MAU gains and aggressive user acquisition (e.g., TipStar MAU +60%, FamilyAlbum premium plans >1.5x), positions MIXI to capitalize on expanding digital entertainment and online community engagement, boosting future revenue growth and user retention.

- Enhanced monetization strategies, such as expanding subscription-based premium plans and optimizing payment processes in FamilyAlbum, allow for increased customer lifetime value and higher ARPU, potentially driving sustained top-line growth and improved profitability.

- Strategic expansion through M&A activity, including the acquisition of PointsBet, broadens MIXI's addressable market and revenue streams, further supporting diversified growth and reducing reliance on aging core IP, positively impacting long-term revenue and earnings stability.

- Successful deployment of data analytics and AI-powered personalization across consumer platforms is expected to further augment targeted in-app monetization and operational agility, supporting higher net margins and value creation over the medium-to-long term.

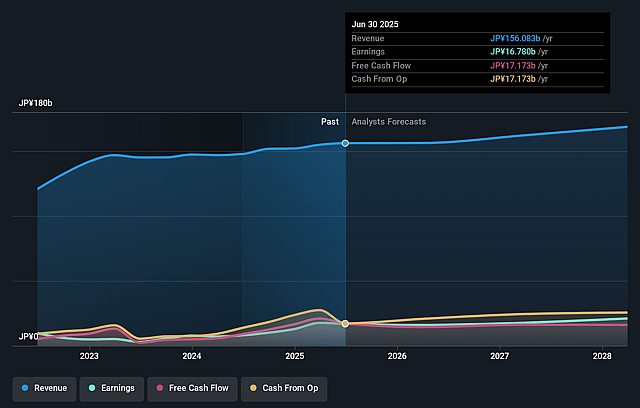

MIXI Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MIXI's revenue will grow by 2.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.8% today to 11.9% in 3 years time.

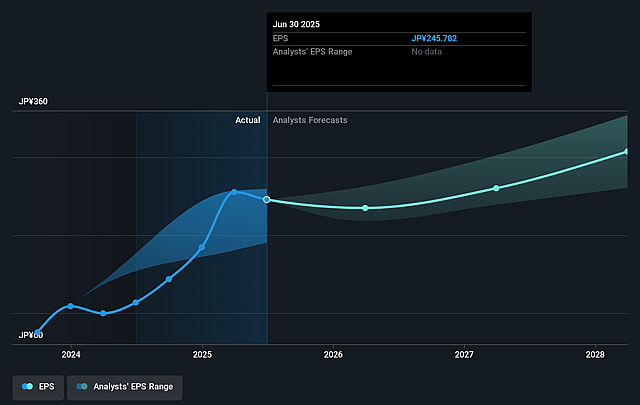

- Analysts expect earnings to reach ¥20.1 billion (and earnings per share of ¥295.67) by about September 2028, up from ¥16.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥24.0 billion in earnings, and the most bearish expecting ¥18.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, down from 13.1x today. This future PE is lower than the current PE for the JP Entertainment industry at 22.3x.

- Analysts expect the number of shares outstanding to decline by 1.92% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.36%, as per the Simply Wall St company report.

MIXI Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Digital Entertainment segment, which includes Monster Strike, saw an 11.4% year-on-year decline in sales and a drop in MAU (monthly active users), indicating possible over-reliance on aging core titles and suggesting further revenue and net margin pressure as the franchise matures.

- Sustained negative EBITDA in the Lifestyle segment due to continued investments in overseas user acquisition may result in persistent earnings dilution if international expansion fails to deliver profitable growth.

- The company's aggressive marketing investments, particularly in TipStar, have driven MAU and sales growth, but this approach risks escalating user acquisition costs as digital entertainment competition intensifies, potentially compressing future profit margins.

- Ongoing M&A activity with PointsBet introduces integration risks and potential regulatory or execution uncertainties, which could affect consolidated earnings if synergies are not realized or acquisition costs escalate.

- While the company highlights substantial AI utilization, there is a risk that competitors may adopt similar or superior AI-driven efficiency improvements, eroding MIXI's operational advantages and muting the expected positive impact on future EBITDA or net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥3300.0 for MIXI based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥168.5 billion, earnings will come to ¥20.1 billion, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of ¥3270.0, the analyst price target of ¥3300.0 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.