Last Update 04 Aug 25

Fair value Decreased 14%A sharp deterioration in Innolux’s net profit margin has driven a steep rise in its future P/E, prompting analysts to lower the company’s fair value from NT$16.08 to NT$14.36.

What's in the News

- May 2025 unaudited consolidated revenue was TWD 18.7 billion, down 1.44% month-on-month and 0.75% year-on-year.

- Innolux and CarUX unveiled next-gen AI-driven automotive and smart city display innovations, including advanced MicroLED, AR windshield, transparent displays, privacy screens, and AI-powered monitoring solutions.

- April 2025 unaudited consolidated revenue was TWD 19.0 billion, up 1.2% month-on-month but down 1.3% year-on-year.

- Amendments to the corporate charter were approved at the annual general meeting.

- Board meeting scheduled to approve the 2025 first quarter financial report.

Valuation Changes

Summary of Valuation Changes for Innolux

- The Consensus Analyst Price Target has significantly fallen from NT$16.08 to NT$14.36.

- The Future P/E for Innolux has significantly risen from 5.50x to 195.25x.

- The Net Profit Margin for Innolux has significantly fallen from 10.62% to 0.27%.

Key Takeaways

- Investing in premium, advanced panels and strategic technology collaborations could boost revenue growth and enhance net margins in high-value sectors.

- Diversifying into high-margin non-commodity markets aims to stabilize earnings and increase profitability by reducing volatility exposure.

- Heavy reliance on subsidies, risks in tech transitions, and potential downturns threaten Innolux's revenue stability and long-term financial flexibility.

Catalysts

About Innolux- Researches, designs, develops, manufactures, and sells modules and monitors of liquid crystal displays (LCD), color filters, low temperature poly-silicon thin film transistor (TFT)-LCDs, and TFT-LCD panels.

- Innolux is focusing on value-added manufacturing and premium products such as larger-size and advanced display panels, which could drive future revenue growth.

- The company's strategic collaboration on OLED products and environment-friendly eLEAP technology promises lower power consumption and innovative user experiences, which could enhance net margins by attracting high-value contracts in the automotive sector.

- Investment in microLED technology and its applications in high-end markets, along with projected cost reductions, could elevate earnings as production scales and costs decrease.

- The adoption of Fan-Out PLP technology, utilizing existing factory infrastructure with a 60% process overlap, offers a competitive advantage by reducing CapEx and enhancing ROE, which should positively impact profitability margins.

- The diversified product and customer portfolio strategy, focusing on high-margin non-commodity segments like automotive and medical, aims to stabilize earnings, reduce exposure to volatility, and improve net margins over time.

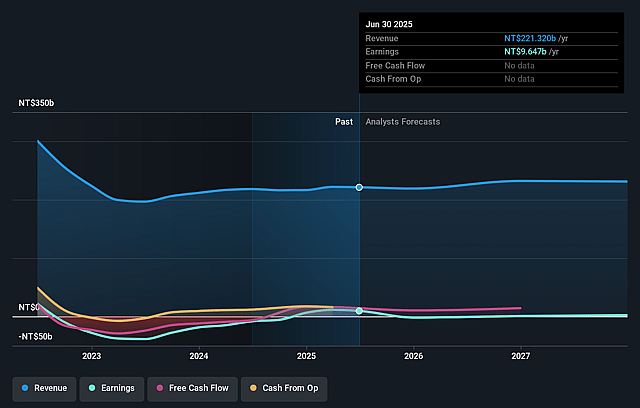

Innolux Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Innolux's revenue will grow by 2.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 4.4% today to 0.1% in 3 years time.

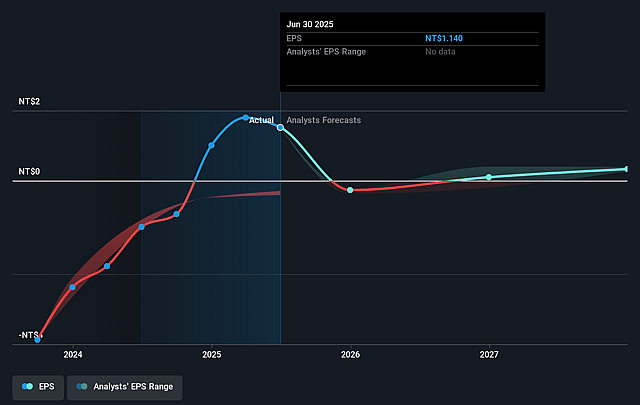

- Analysts expect earnings to reach NT$283.9 million (and earnings per share of NT$0.25) by about August 2028, down from NT$9.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 386.8x on those 2028 earnings, up from 10.2x today. This future PE is greater than the current PE for the TW Electronic industry at 21.2x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

Innolux Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on government subsidies, particularly from China, to boost demand for larger-sized TV panels may pose a risk if such subsidies are reduced or withdrawn, which could negatively impact revenue and market stability.

- Although demand for AI-related applications in the notebook sector is projected to grow, the forecast is dependent on inventory normalization and broader AI integration, presenting potential risks to revenue if these conditions are not met as anticipated.

- The transition to advanced technologies like microLED and eLEAP involves significant investment and may face delays or cost overruns, which could affect earnings and profitability if the technology does not meet market expectations or adoption rates fall short.

- The competitive panel manufacturing industry is historically cyclical, posing risks to revenue and profit margins during downturns, especially if diversification efforts don't mitigate the impact of these cycles effectively.

- The company's capital reduction strategy, while potentially improving return on equity, may limit financial flexibility and available resources for further growth initiatives or to withstand industry volatility, impacting long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$13.788 for Innolux based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$17.5, and the most bearish reporting a price target of just NT$11.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$237.5 billion, earnings will come to NT$283.9 million, and it would be trading on a PE ratio of 386.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of NT$12.3, the analyst price target of NT$13.79 is 10.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.