Last Update 11 Dec 25

Fair value Increased 0.15%SCHW: Forge Global Deal Will Expand Private Market Access And Capital Return Capacity

Analysts nudged their average price target for Charles Schwab slightly higher to approximately $112 from about $111, citing solid Q3 earnings beats, improving balance sheet flexibility, and a clearer path to capital returns and earnings growth into 2025 and 2026.

Analyst Commentary

Street research following the Q3 report reflects a broadly constructive stance on Charles Schwab, with multiple price target increases and a focus on the firm’s capital return capacity, earnings trajectory, and competitive positioning.

Bullish Takeaways

- Bullish analysts highlight that the Q3 beat, with upside in most key line items, reinforces confidence in Schwab’s ability to deliver above consensus earnings and support multiple expansion.

- Several notes point to improving balance sheet flexibility and a shift toward reinvesting maturing securities at higher yields. This is expected to offset pressure from lower Fed Funds rates and underpin net interest income.

- Commentary emphasizes solid client engagement, healthy transactional cash trends, and steady new asset and account growth. All of these are viewed as drivers of sustainable fee and spread based revenue growth into 2025 and 2026.

- Some bullish analysts see Schwab’s evolving, more capital efficient balance sheet strategy and ongoing capital return as key to unlocking further valuation upside, particularly as perception risk around funding and liquidity continues to fade.

Bearish Takeaways

- Bearish analysts argue that, despite recent earnings strength, Schwab’s account growth still trails faster growing digital peers. This raises questions about its ability to capture the next wave of retail investors and traders.

- Concerns persist that a lower rate environment will weigh on net interest income and compress earnings power. This could limit upside to current valuation if fee based growth does not accelerate meaningfully.

- Some research notes flag a more expensive entry point after the recent rally. They suggest that near term risk reward may be less favorable even if the long term industry backdrop for online brokers remains attractive.

- There is also skepticism about Schwab’s ability to meaningfully penetrate user bases of newer platforms and crypto native exchanges. This could cap longer term growth relative to high growth competitors.

What's in the News

- Charles Schwab is expected to announce a deal to acquire private share marketplace Forge Global for up to $600 million, or as much as $45 per share, implying roughly a 75% premium to its recent closing price, with no assurance the transaction will be finalized (Financial Times / M&A Rumors and Discussions).

- Raymond James raised its price target on Charles Schwab to $110 from $104 and reiterated an Outperform rating, citing lower high cost funding, reinvestment at higher yields, and solid new asset and account growth that the firm believes support potential EPS upside into 2025 and 2026 (Raymond James periodical).

- Schwab completed a major share repurchase tranche, buying back 28,909,000 shares, or 1.59% of outstanding, for approximately $2.75 billion under the buyback program announced July 24, 2025 (Buyback Tranche Update).

- The company launched Schwab Private Issuer Equity Services, a late stage private company equity management solution offering cap table tools, employee education, and a scalable platform powered by Qapita to support clients ahead of IPOs (Product Related Announcement).

- Schwab detailed a significant U.S. branch network expansion, adding 16 new branches and expanding or relocating 25 locations, alongside hiring more than 400 branch related roles and additional corporate positions to support robust client and asset growth (Business Expansions).

Valuation Changes

- The fair value estimate has risen slightly to approximately $111.78 from about $111.61, reflecting a marginally higher intrinsic value assessment.

- The discount rate has increased modestly to roughly 8.90% from about 8.84%, implying a slightly higher required return and risk assumption.

- Revenue growth has remained effectively unchanged at around 12.62%, indicating a stable outlook for top line expansion.

- The net profit margin is essentially flat at roughly 35.15%, suggesting no material revision to long term profitability expectations.

- The future P/E has edged higher to about 21.0x from roughly 20.9x, signaling a marginal uptick in the valuation multiple applied to forward earnings.

Key Takeaways

- Expanding client base and digital adoption are driving sustained asset growth, deeper client engagement, and increasingly diversified revenue streams.

- Operational efficiencies, innovative product launches, and industry scale are enhancing margins, competitive position, and long-term earnings resilience.

- Rising competition, technology investments, regulatory pressures, interest rate exposure, and shifting client demographics pose challenges to Schwab's long-term profitability and organic growth.

Catalysts

About Charles Schwab- Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

- Continued robust growth in U.S. household wealth and generational wealth transfer is expanding Schwab's addressable client base, as evidenced by accelerated net new asset (NNA) growth (up 46% YoY in June) and strong new account openings, which are likely to support persistent AUM and revenue growth over the long term.

- Increasing adoption of digital platforms, self-directed investing, and demand from younger demographics-over 60% of new-to-firm clients are under 40-are leading to deepening client engagement and expansion of Schwab's solutions across wealth management, lending, and trading, supporting higher fee income and diversified revenue streams.

- Success in cross-selling advisory, banking, and lending products to existing and newly integrated Ameritrade clients is driving higher engagement, utilization, and non-transactional fee income, with pledged asset line originations and bank lending balances both up over 100% YoY, supporting improved net margins and earnings durability.

- Ongoing digital transformation and operational enhancements (e.g., AI-powered efficiency and automation) are expected to sustainably reduce cost-to-serve and improve client experience at scale, underpinning long-term operating margin expansion.

- Schwab's industry-leading scale, continued penetration with independent advisors via its custody platform, and launch of new offerings (such as retail alternatives and digital asset products) are expected to enhance recurring fee-based revenues and cement competitive positioning, supporting earnings resilience and long-term profitability.

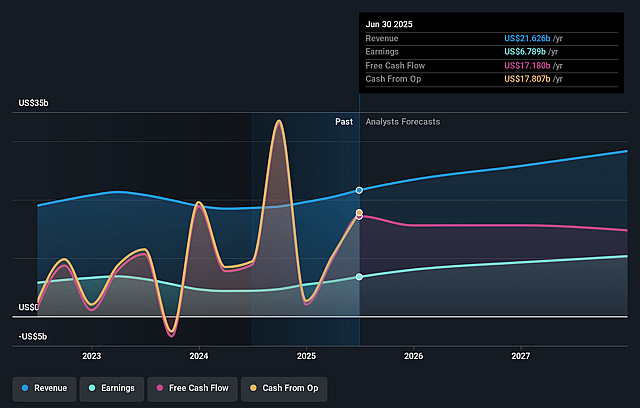

Charles Schwab Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Charles Schwab's revenue will grow by 11.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 31.4% today to 36.3% in 3 years time.

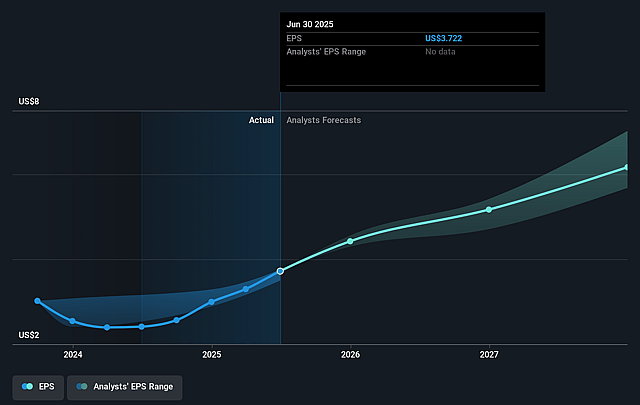

- Analysts expect earnings to reach $11.0 billion (and earnings per share of $6.78) by about September 2028, up from $6.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.5x on those 2028 earnings, down from 25.0x today. This future PE is lower than the current PE for the US Capital Markets industry at 26.7x.

- Analysts expect the number of shares outstanding to decline by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.9%, as per the Simply Wall St company report.

Charles Schwab Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from low-cost and digital-first brokerage platforms such as Robinhood and Webull, coupled with ongoing industry fee compression and the rise of passive investing, may erode Schwab's ability to capture trading-related revenues and threaten long-term net margin expansion.

- Schwab's increasing investments in technology, digital infrastructure (including artificial intelligence), and new product capabilities to keep pace with fintech disruption could drive up expenses faster than revenue growth, putting sustained pressure on net margins even as the firm touts near-term operating leverage.

- Heavy reliance on net interest income-bolstered recently by high interest rates and favorable client cash trends-exposes Schwab to significant earnings volatility in the event of adverse shifts in the interest rate environment or yield curve inversion, despite recently enhanced hedging programs.

- Regulatory risks remain elevated, especially regarding Schwab's cash management practices and future reforms around payment for order flow, which could increase compliance costs or restrict lucrative practices, thereby directly impacting profitability and operating margins.

- Demographic shifts, such as the slower accumulation of assets among younger generations or preferences for alternative digital platforms for investment, may moderate Schwab's long-term organic asset growth rate and limit the expansion of assets under management, thereby constraining revenue and earnings growth in the years ahead.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $108.0 for Charles Schwab based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $131.0, and the most bearish reporting a price target of just $84.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $30.2 billion, earnings will come to $11.0 billion, and it would be trading on a PE ratio of 22.5x, assuming you use a discount rate of 8.9%.

- Given the current share price of $93.67, the analyst price target of $108.0 is 13.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Charles Schwab?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.