Last Update 10 Nov 25

ASB: Dividend Increase and Share Buyback Are Expected to Drive Upside

Analysts have maintained their price target for Associated Banc-Corp at $29.20 per share. They cite slight shifts in forecasted discount rate, revenue growth, and profit margin estimates as factors supporting their unchanged outlook.

What's in the News

- Grand opening of a new IDS Center branch in downtown Minneapolis. The location offers expanded retail and office space to enhance customer service and attract new business (Key Developments)

- The Board of Directors increased the regular quarterly cash dividend to $0.24 per common share, up by $0.01 from the previous quarter (Key Developments)

- Completion of the repurchase of 2,692,276 shares, totaling $60.93 million under the ongoing buyback program (Key Developments)

- Reported third quarter 2025 net charge offs of $13.17 million, nearly unchanged from the previous year (Key Developments)

Valuation Changes

- Consensus Analyst Price Target remains unchanged at $29.20 per share.

- The discount rate has risen slightly from 7.65% to 7.74%.

- The revenue growth estimate has decreased marginally, moving from 19.64% to 19.37%.

- The net profit margin estimate has decreased slightly, from 35.23% to 34.95%.

- The future P/E ratio is expected to increase moderately, from 11.00x to 11.19x.

Key Takeaways

- Strategic shift to higher-yielding, relationship-focused lending and strong deposit growth is supporting improved margins and sustained profitability.

- Investments in digital technology, disciplined expense management, and strong Midwest market dynamics are driving efficiency, earnings growth, and long-term revenue opportunities.

- Expansion into commercial lending and reliance on deposit growth heighten risk exposure, while digital limitations, cost challenges, and regulatory pressures threaten long-term profitability.

Catalysts

About Associated Banc-Corp- A bank holding company, provides various banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, Missouri, and Minnesota.

- The company's strategic pivot toward growing commercial and industrial (C&I) lending, replacing lower-yielding residential balances with higher-yielding, relationship-focused assets, is driving record net interest income and margin expansion, positioning the balance sheet for sustained profitability growth. Likely to positively impact revenue and net margins.

- Ongoing organic customer acquisition-demonstrated by record primary checking household growth-and effective new RM hiring is fueling strong core deposit inflows, which supports lower funding costs, reduces reliance on wholesale funding, and enhances net interest margin. Likely to increase revenue and improve net margins.

- Continued investments in digital platforms and operational technology are streamlining costs and improving customer satisfaction, evidenced by a sub-56% efficiency ratio, which sets up for sustained positive operating leverage and margin expansion. Likely to lift net margins and earnings.

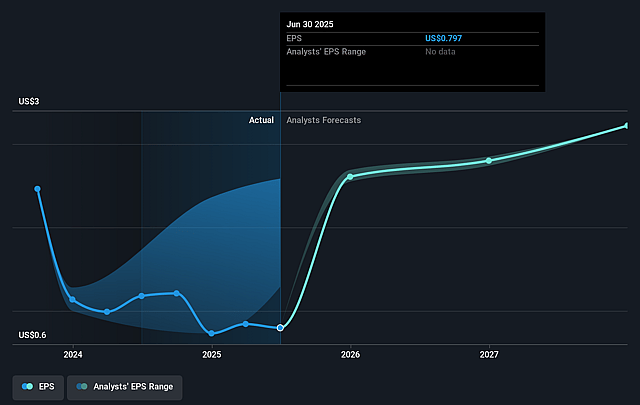

- Management's tightening focus on disciplined expense management, alongside incremental share buybacks, supports EPS growth and boosts return on equity, further bolstered by a strong capital position and above-target CET1 ratios. Likely to drive EPS and ROE.

- Regional economic resilience in the Midwest, combined with migration trends into key markets, is projected to stimulate demand for mortgages, commercial lending, and local business services-expanding opportunities for loan growth and fee income. Likely to increase revenue over the long term.

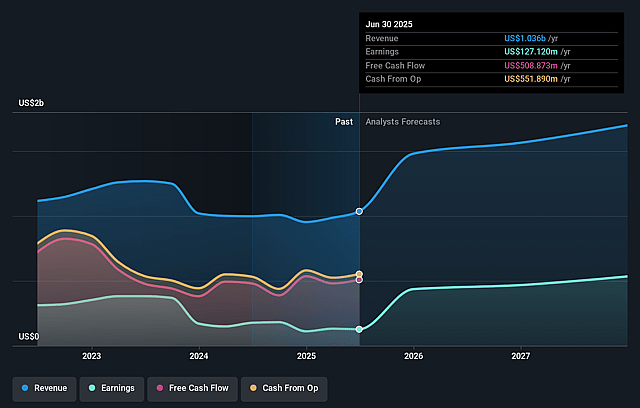

Associated Banc-Corp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Associated Banc-Corp's revenue will grow by 23.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.3% today to 37.0% in 3 years time.

- Analysts expect earnings to reach $720.3 million (and earnings per share of $3.22) by about September 2028, up from $127.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, down from 33.6x today. This future PE is lower than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.73%, as per the Simply Wall St company report.

Associated Banc-Corp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued expansion into commercial and CRE lending, while driving profitability in the near term, increases long-term exposure to regional economic downturns and potential sector-specific stress (such as in office CRE), heightening risks of credit losses and compressing future net margins and earnings.

- The company's reliance on sustained deposit growth, especially through seasonal inflows and optimistic pipeline projections, exposes it to potential funding shortfalls if consumer or commercial behavior shifts, regulatory pressures increase, or competition for deposits from fintechs and larger banks intensifies, challenging revenue stability and net interest income.

- While management emphasizes progress in digital investments and operational efficiency, Associated Banc-Corp may face structural disadvantages in digital innovation and customer acquisition compared to larger, national players and agile fintech competitors, potentially eroding long-term top-line revenue and margin improvements.

- Persistent efficiency ratio challenges due to Associated Banc-Corp's smaller scale and higher fixed costs, if not further managed, could impede further operating leverage gains and suppress net margins relative to larger regional peers, putting continued profit expansion at risk.

- Ongoing uncertainties in the regulatory environment (e.g., evolving capital requirements, compliance expenses, shifting CECL credit loss estimates), and increased cyber risks across the sector, could drive noninterest expense higher over the long term, offsetting gains from operating leverage and negatively impacting net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $28.6 for Associated Banc-Corp based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $720.3 million, and it would be trading on a PE ratio of 9.9x, assuming you use a discount rate of 7.7%.

- Given the current share price of $26.18, the analyst price target of $28.6 is 8.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.