Last Update 10 Dec 25

Fair value Decreased 0.086%AXS: Share Repurchases Will Support Upside As Fundamentals Remain Stable

Analysts have nudged their price target on AXIS Capital Holdings slightly lower to approximately $116.10 per share from about $116.20, reflecting only marginal tweaks to discount rate, revenue growth, profit margin, and future P E assumptions, while maintaining a broadly stable outlook.

What's in the News

- Board of Directors authorizes a new share repurchase plan for AXIS Capital Holdings, setting the framework for future buybacks as of September 17, 2025 (company announcement).

- AXIS Capital Holdings launches a share repurchase program of up to $400 million in common shares, indicating a continued focus on returning capital to shareholders (company announcement).

- Between July 1, 2025 and September 3, 2025, the company repurchases 1,139,000 shares, equal to about 1.46% of shares outstanding, for roughly $109.93 million. This brings total buybacks under the February 19, 2025 authorization to 4,205,815 shares, or 5.19%, for $396.42 million (buyback tranche update).

- From September 17, 2025 to September 30, 2025, the company reports no shares repurchased and no additional capital deployed under the newly announced buyback plan (buyback tranche update).

Valuation Changes

- Fair Value Estimate: edged down slightly from $116.20 to $116.10 per share, reflecting a minor reassessment of underlying assumptions.

- Discount Rate: remained unchanged at 6.956 percent, implying effectively steady risk and return expectations.

- Revenue Growth: remained essentially flat at approximately 4.08 percent, signaling no material change in top line growth assumptions.

- Net Profit Margin: held effectively steady at about 15.81 percent, indicating a stable outlook for underlying profitability.

- Future P/E: slipped slightly from 8.36x to 8.35x, suggesting a modestly lower valuation multiple applied to projected earnings.

Key Takeaways

- Increasing demand for specialty insurance and a shift to higher-margin lines are strengthening AXIS's revenue growth and profitability prospects.

- Technological investments and rising regulatory barriers are enhancing risk management, operational efficiency, and market stability for AXIS.

- Evolving risk landscape, intense competition, rising costs, and selective market retrenchment threaten profitability, growth prospects, and industry-relative margins.

Catalysts

About AXIS Capital Holdings- Through its subsidiaries, provides various specialty insurance and reinsurance products in Bermuda, the United States, and internationally.

- Accelerating demand for specialty insurance solutions-including cyber, Allied Health, and environmental products-driven by an increasingly complex global risk landscape is expanding AXIS's customer base and supporting strong premium growth, which is likely to positively impact top-line revenue and long-term earnings.

- Ongoing investments in technology, AI-driven underwriting, and data analytics are improving AXIS's risk selection and operational efficiency, which should drive favorable loss ratios and sustainable improvements in underwriting margins and net profitability.

- Shifting focus toward higher-margin specialty lines, such as U.S. excess casualty and professional liability, while strategically reducing exposure to legacy, volatile, or commoditized lines, is expected to boost overall combined ratios and lead to higher net income.

- Robust global regulatory requirements and rising compliance complexity are creating higher barriers to entry, which favor well-capitalized and diversified insurers like AXIS, likely supporting stable market share and providing resilience to future earnings.

- Emerging opportunities in global economic development, particularly in the lower middle market and emerging economies, are expanding AXIS's insurance pool and offering significant avenues for long-term, profitable revenue growth.

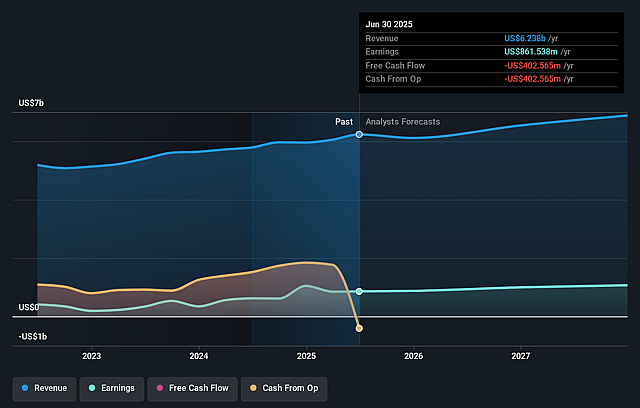

AXIS Capital Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AXIS Capital Holdings's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.8% today to 16.2% in 3 years time.

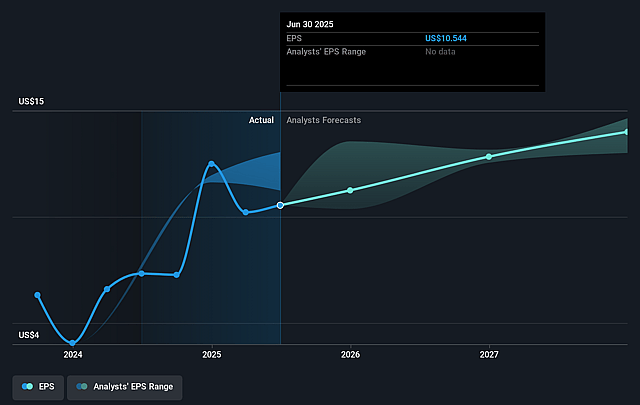

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $14.0) by about September 2028, up from $861.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.7x on those 2028 earnings, down from 8.8x today. This future PE is lower than the current PE for the US Insurance industry at 14.3x.

- Analysts expect the number of shares outstanding to decline by 6.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

AXIS Capital Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened exposure to evolving cyber and ransomware risks-where loss frequency and severity are increasing and pricing pressure is acute-could result in higher-than-expected claims and inadequate reserving, adversely impacting underwriting profitability and earnings.

- Competitive market dynamics, particularly in property and MGA-driven business lines, are causing pricing reductions, limited growth, and potential commoditization, which can erode revenue and compress future net margins.

- Persistent social inflation and higher litigation costs, especially in U.S. casualty and liability segments, introduce claims unpredictability and may force continued upward adjustments to loss ratios and reserves, straining profitability and reducing net income.

- Ongoing technology and AI investments, while necessary, have driven up general and administrative expenses; underperformance or slower-than-expected efficiency gains could result in lasting expense ratio elevation and margin compression relative to industry peers.

- Strategic retreat from property catastrophe reinsurance and select lines caps growth avenues in years where market disruptions present outsized profit potential, limiting revenue expansion and potentially ceding market share to more diversified competitors.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $113.5 for AXIS Capital Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $100.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.0 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 7.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $97.0, the analyst price target of $113.5 is 14.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AXIS Capital Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.