Last Update 07 Feb 26

Fair value Decreased 0.34%SFL: Board Timetable And P/E Framework Will Shape Fairly Balanced Outlook

Analysts have inched their price target for Safilo Group lower to about €1.94 from €1.95, citing updated assumptions around revenue growth, profit margins, discount rate and future P/E, which collectively point to a slightly more conservative valuation framework.

What's in the News

- Board meeting scheduled for January 28, 2026 to approve preliminary key performance indicators for FY 2025, giving investors an early read on full year figures (company event)

- Board meeting on March 11, 2026 planned to approve the draft financial statements and consolidated financial statements as at December 31, 2025, a key checkpoint for audited results (company event)

- Board meeting set for May 6, 2026 to approve key performance indicators for the first quarter of 2026, updating the market on how the new year is tracking (company event)

- Board meeting scheduled for August 3, 2026 to approve the interim financial report as at June 30, 2026, covering the first half of the year (company event)

- Board meeting planned for November 9, 2026, expected to provide another formal update from the board later in the year (company event)

Valuation Changes

- Fair Value Estimate: trimmed slightly to about €1.94 from €1.95, reflecting a marginally more conservative stance.

- Discount Rate: moved lower to about 11.77% from 12.19%, implying a modest adjustment to the risk assumption used in the model.

- Revenue Growth: set at about 1.54% versus 1.73% previously, pointing to a slightly softer top line outlook in the assumptions.

- Net Profit Margin: held broadly stable, at about 4.93% versus 4.90% before, indicating only a minimal change in expected profitability.

- Future P/E: adjusted to about 21.80x from 22.10x, suggesting a small reduction in the valuation multiple applied to future earnings.

Key Takeaways

- Safilo faces risks from emerging market expansion, inflation, and digital disruption, which may limit future revenue and margin growth amid shifting industry dynamics.

- Investor optimism could be misplaced if Safilo struggles with acquisitions, license renewals, or defending premium pricing, which could hurt earnings and shareholder value.

- Effective cost controls, strategic licensing renewals, focused expansion in women's eyewear, rapid deleveraging, and supply chain diversification strengthen profitability and long-term growth prospects.

Catalysts

About Safilo Group- Engages in the design, manufacture, and distribution of optical frames, sunglasses, sports eyewear, goggles, and helmets in North America, Europe, the Asia Pacific, and internationally.

- The stock may be priced for continued robust growth in key emerging markets (notably Asia Pacific, which saw 14.7% sales growth in H1), but future expansion could be challenged by rising geopolitical risks, regulatory changes, or shifting local demand, potentially causing future revenues to underperform optimistic projections.

- Safilo's recent ability to offset tariffs and raise prices to support record-high gross margins may not be sustainable as inflationary pressures, competitive pricing, and further regulatory/headwind risks could constrain further margin expansion, leading to potential flattening or compression of net margins going forward.

- The sustained growth in demand for branded and fashion-forward eyewear, as well as a broader global preference for optical and prescription frames fueled by aging populations and increased screen time, may already be fully reflected in the share price, increasing risk if sales growth moderates or if consumer preferences shift to new tech-integrated smart eyewear, impacting future top-line growth.

- Rising digital disruption, DTC channel growth, and potential industry consolidation may intensify margin pressure for mid-tier players like Safilo, as larger competitors leverage scale while new entrants compete aggressively on cost and innovation, threatening both market share and earnings momentum.

- The company's improved financial profile, recent deleveraging, and ongoing share buyback program may prompt investors to overestimate Safilo's capacity for accretive M&A or capital returns; however, any failure to successfully execute value-enhancing acquisitions, secure favorable license renewals, or maintain premium pricing could negatively impact EPS growth and long-term shareholder value.

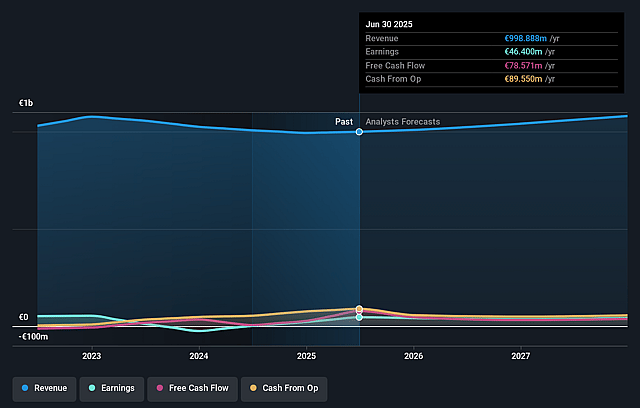

Safilo Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Safilo Group's revenue will grow by 3.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 4.6% today to 4.1% in 3 years time.

- Analysts expect earnings to reach €44.6 million (and earnings per share of €0.11) by about August 2028, down from €46.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €62 million in earnings, and the most bearish expecting €39.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.4x on those 2028 earnings, up from 13.5x today. This future PE is lower than the current PE for the GB Luxury industry at 22.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.13%, as per the Simply Wall St company report.

Safilo Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Safilo Group has achieved all-time high gross margin and significant operating profit growth through effective tariff mitigation, price mix optimization, and operational discipline, indicating stronger profitability and resilience that may support sustained or rising net margins.

- The group completed early renewal of its key long-term licensing agreements, including a five-year extension with Carolina Herrera, securing long-term revenue streams and brand stability, which reduces risk of earnings volatility.

- Safilo's accelerated strategic expansion into women's eyewear, including the addition of the Victoria Beckham license (expected to contribute 2–3% of sales), leverages the largest segment of the eyewear market, presenting long-term revenue growth opportunities.

- The company's rapid deleveraging-halving net debt and operating nearly net debt-free (excluding leases)-combined with strong, improved free cash flow, significantly enhances financial flexibility for future growth investments or potential shareholder returns, positively influencing net earnings and value creation.

- Ongoing diversification of the supply chain across Vietnam, Philippines, Cambodia, and Thailand increases flexibility and mitigates geopolitical and tariff risks from China, supporting operating efficiency and potential margin stability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €1.33 for Safilo Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €1.62, and the most bearish reporting a price target of just €1.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.1 billion, earnings will come to €44.6 million, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 12.1%.

- Given the current share price of €1.51, the analyst price target of €1.33 is 13.5% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Safilo Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.