Key Takeaways

- Intensifying online competition and demographic shifts threaten Safilo's traditional revenue streams and weaken growth prospects in key markets.

- Heavy dependence on licensed brands and slow adaptation to industry trends expose the company to revenue instability and erosion of profitability.

- Strong brand growth, operational flexibility, improved financial health, and strategic initiatives position Safilo Group for sustained revenue, profit growth, and long-term value creation.

Catalysts

About Safilo Group- Engages in the design, manufacture, and distribution of optical frames, sunglasses, sports eyewear, goggles, and helmets in North America, Europe, the Asia Pacific, and internationally.

- The continued rise of low-cost direct-to-consumer eyewear brands and online pure-play competitors is expected to erode traditional wholesale revenues, threatening Safilo's core business model and driving persistent pressure on top-line growth despite recent strong results.

- Slowing population growth in developed regions such as Europe, combined with demographic shifts, signals weak long-term demand for eyewear in two of Safilo's largest markets, severely limiting structural revenue expansion as the customer base ages and contracts.

- Safilo's heavy reliance on licensed brands exposes it to ongoing risk of license terminations or unfavorable renegotiations, creating significant revenue instability and a lack of control over the most profitable growth levers, which threatens both revenue and net earnings visibility.

- Increasing regulatory focus on sustainability is expected to result in rising compliance and manufacturing costs; Safilo's recent disposals and modest investment in proprietary brand development highlight the risk that it cannot adapt rapidly enough, putting sustained margin expansion at risk.

- As the eyewear industry moves toward integration and smart technology, Safilo is at risk of falling behind larger, vertically integrated peers and tech-savvy entrants, leading to product obsolescence and loss of pricing power, which will compress long-term earnings and profitability.

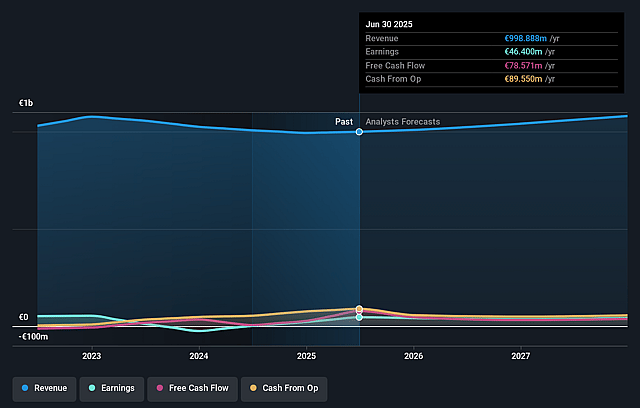

Safilo Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Safilo Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Safilo Group's revenue will grow by 3.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 4.6% today to 3.7% in 3 years time.

- The bearish analysts expect earnings to reach €40.4 million (and earnings per share of €0.1) by about September 2028, down from €46.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, up from 13.7x today. This future PE is lower than the current PE for the GB Luxury industry at 22.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.16%, as per the Simply Wall St company report.

Safilo Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Safilo Group's consistent revenue and operating margin growth-driven by double-digit brand growth (David Beckham, Boss, Tommy Hilfiger, Marc Jacobs), resilient demand for prescription frames, and robust performance in Asia-Pacific-suggests continued top-line and earnings momentum, which may sustain or increase the share price in the long term.

- Effective management of recent tariff headwinds and supply chain risk-including successful supplier diversification from China to Vietnam, Philippines, Cambodia, and Thailand, as well as agile pricing actions-demonstrates operational flexibility that may protect and even improve margins over time.

- Strengthening of Safilo's brand portfolio, including the renewal of key licenses like Carolina Herrera through 2031 and the addition of Victoria Beckham for women's eyewear, enhances long-term revenue visibility, provides access to new customer segments, and improves pricing power, all supporting future revenue and profit growth.

- Significant improvement in free cash flow and a sharp reduction in net debt (halved to €42.4 million), coupled with a robust balance sheet and disciplined working capital, increase the company's capacity for shareholder returns, M&A, and strategic investments, all of which can positively impact long-term earnings and valuation.

- The launch of a share buyback program and the stated focus on M&A-particularly with more favorable market conditions for acquisitions-reflect management's commitment to long-term value creation and signal confidence in the company's outlook, which could drive higher earnings per share and boost the share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Safilo Group is €1.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Safilo Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €2.0, and the most bearish reporting a price target of just €1.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €1.1 billion, earnings will come to €40.4 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 12.2%.

- Given the current share price of €1.53, the bearish analyst price target of €1.0 is 53.4% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.