Key Takeaways

- Premium women's brands and strong core segments position Safilo for above-market revenue and margin growth, with M&A poised to accelerate brand portfolio and distribution expansion.

- Emerging market strength, demographic trends, and digital initiatives are likely to drive outsized sales, operating margin gains, and increased reinvestment capacity.

- Safilo's reliance on traditional channels, limited digital investment, and lagging ESG progress expose it to competitive, profitability, and reputational risks as industry trends shift.

Catalysts

About Safilo Group- Engages in the design, manufacture, and distribution of optical frames, sunglasses, sports eyewear, goggles, and helmets in North America, Europe, the Asia Pacific, and internationally.

- Analyst consensus expects growth stemming from license renewals and flagship brands, but the powerful combination of Victoria Beckham, Carolina Herrera, and Carrera Women positions Safilo for outsized share capture in the fastest-growing and highest-margin segment of global eyewear-premium women's brands-driving both revenue and margin expansion above current expectations.

- While analysts broadly see stabilized licensing deals providing revenue visibility, the current environment allows Safilo to accelerate highly accretive M&A in optical, sport, and women's segments, potentially expanding its core brand portfolio and distribution reach more quickly, leading to a step-change in top-line growth and future earnings power.

- Safilo is uniquely poised to benefit from structural demographic shifts-specifically, rising demand for vision correction among the global aging population-fueling persistent prescription frame growth, which is already the company's main volume and margin driver and likely to beat market growth rates.

- With rapid expansion in Asia-Pacific and Latin America, regions experiencing surging middle-class consumption and a greater appetite for branded eyewear, Safilo's diversified regional exposure and robust distributor relationships can deliver disproportionately strong sales and profitability growth from these high-potential markets.

- Ongoing digitalization, DTC initiatives, and B2B platforms are not just incremental margin levers-by deepening customer engagement and automating inventory management and supply chain flexibility, Safilo is set for structurally higher operating margins and improved cash flow conversion, providing more room for reinvestment and shareholder returns.

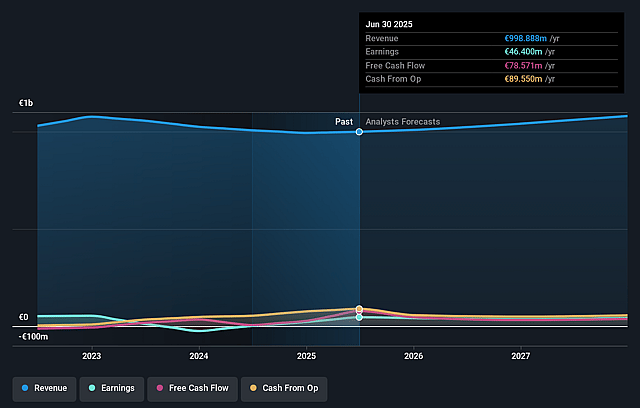

Safilo Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Safilo Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Safilo Group's revenue will grow by 3.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.6% today to 5.7% in 3 years time.

- The bullish analysts expect earnings to reach €63.3 million (and earnings per share of €0.16) by about September 2028, up from €46.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.4x on those 2028 earnings, up from 13.8x today. This future PE is lower than the current PE for the GB Luxury industry at 22.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.08%, as per the Simply Wall St company report.

Safilo Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Safilo's heavy reliance on traditional wholesale and retail distribution leaves it vulnerable to the growing consumer shift toward e-commerce-driven, direct-to-consumer eyewear brands, which could steadily erode its revenue base as these channels gain market share.

- The company continues to face persistent margin pressures, as highlighted by management's focus on operational efficiency and the struggle to offset rising tariff and input costs, suggesting that its structurally lower EBITDA margins versus industry leaders may persist over the long term, weighing on overall profitability.

- Ongoing changes in consumer tastes and demographic shifts could reduce the value of legacy luxury and licensed brands in Safilo's portfolio, making it harder to maintain pricing power and top-line growth, especially if consumers move toward more affordable or tech-forward alternatives.

- Safilo's ability to invest in digital transformation and direct-to-consumer innovation appears constrained by historically tight free cash flow and light maintenance capex, which could result in a sustained competitive disadvantage and limit future earnings growth as the industry consolidates around digitally native and vertically integrated players.

- There is heightened risk that increased ESG and sustainability scrutiny-paired with Safilo's limited commentary and progress in these areas-could negatively affect the company's brand reputation, access to capital, and ultimately, investor demand for its shares, impacting long-term valuation and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Safilo Group is €2.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Safilo Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €2.0, and the most bearish reporting a price target of just €1.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €1.1 billion, earnings will come to €63.3 million, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 12.1%.

- Given the current share price of €1.54, the bullish analyst price target of €2.0 is 22.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.