Last Update 22 Dec 25

SSSS: Portfolio Momentum Will Drive Future Upside Following Price Objective Hike

Analysts raised their price target on SuRo Capital to $12 from $11, reflecting growing confidence as they point to building momentum across the company portfolio.

Analyst Commentary

Bullish analysts highlight the raised price target as a reflection of improving execution and growing confidence in SuRo Capital's ability to translate portfolio momentum into sustained net asset value growth.

Bullish Takeaways

- Bullish analysts view the higher price target as evidence that the market is still undervaluing the company relative to its underlying portfolio performance and earnings potential.

- Momentum across the portfolio is seen as a positive indicator for future realizations, potentially supporting higher returns on invested capital and upside to current valuation multiples.

- Improved visibility into portfolio company fundamentals after the Q3 report is interpreted as reducing execution risk, supporting an Outperform bias on the shares.

- The reaffirmed positive rating is taken as a sign that management's strategy of selectively deploying capital and managing exits is gaining traction and could drive multiple expansion over time.

Bearish Takeaways

- Bearish analysts caution that the price target increase is incremental, suggesting that while momentum is improving, upside may still be constrained by broader market volatility and liquidity conditions for private holdings.

- There is ongoing concern that portfolio momentum may not immediately translate into cash realizations, leaving returns sensitive to exit timing and valuation marks.

- Some analysts flag that the shares may already embed a portion of the improved outlook, limiting near term rerating potential if execution or market conditions disappoint.

- Uncertainty around future interest rate paths and risk appetite for growth assets is seen as a potential headwind to both portfolio valuations and investor sentiment toward the stock.

What's in the News

- Extended share repurchase program, with SuRo Capital announcing on October 29, 2025 that its buyback plan duration has been pushed out to October 31, 2026 (Key Developments).

- Completion of a substantial portion of the longstanding buyback, with a total of 5,990,501 shares repurchased to date, representing 28.34% of shares for $39.17 million under the program first announced on August 8, 2017 (Key Developments).

- No additional shares repurchased between July 1, 2025 and November 5, 2025, as the company reported zero buybacks and zero dollars deployed during this period despite the program extension (Key Developments).

Valuation Changes

- Fair Value: Unchanged at $11.15, indicating no adjustment to the intrinsic value estimate despite recent developments.

- Discount Rate: Fallen slightly from 8.91% to 8.86%, suggesting a marginally lower perceived risk profile or cost of capital.

- Revenue Growth: Essentially unchanged at approximately -18.29%, indicating expectations for continued revenue contraction remain intact.

- Net Profit Margin: Stable at roughly 39.18%, reflecting no material revision to long term profitability assumptions.

- Future P/E: Edged down slightly from 858.5x to 857.3x, implying a negligible adjustment to forward earnings valuation multiples.

Key Takeaways

- Strategic investments in AI and pre-IPO companies are poised to enhance earnings and boost investor confidence through potential value realization.

- Anticipated IPO successes in portfolio companies like CoreWeave and WHOOP are expected to significantly bolster revenue growth and increase capital distributions.

- The company's high concentration in a few major investments and reliance on uncertain IPO timelines pose significant financial risks to valuation and earnings stability.

Catalysts

About SuRo Capital- A venture capital, mezzanine, secondary(direct) and business development company specializing in growth capital, emerging growth, late stage and venture capital-backed private companies.

- SuRo Capital expects significant value from upcoming IPOs in its portfolio, including CoreWeave, Canva, WHOOP, and Liquid Death, which could boost revenue upon successful listings.

- CoreWeave's partnership with OpenAI and its substantial growth trajectory, including a significant contract and acquisition of Weights and Biases, are poised to elevate earnings.

- The investment in AI companies like OpenAI and VAST Data positions SuRo Capital to benefit from rapid growth and valuation increases, potentially enhancing net margins.

- The firm anticipates growth in other key portfolio companies like ServiceTitan, WHOOP, and Liquid Death, supporting long-term revenue increases and improving investor confidence.

- Strategic investments in notable pre-IPO companies provide opportunities for capital gains, which may lead to higher distributions, impacting earnings per share positively.

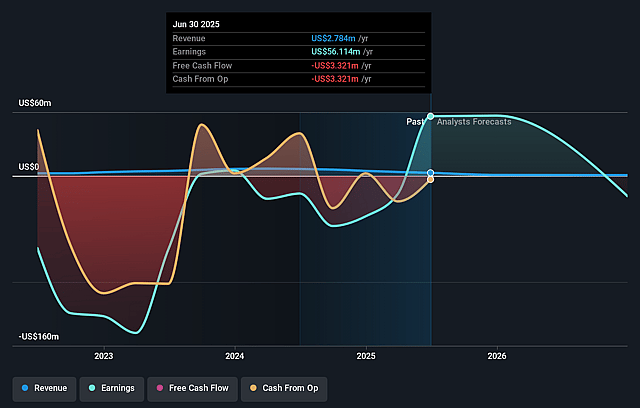

SuRo Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SuRo Capital's revenue will grow by 2.6% annually over the next 3 years.

- Analysts are not forecasting that SuRo Capital will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate SuRo Capital's profit margin will increase from -815.8% to the average US Capital Markets industry of 25.6% in 3 years.

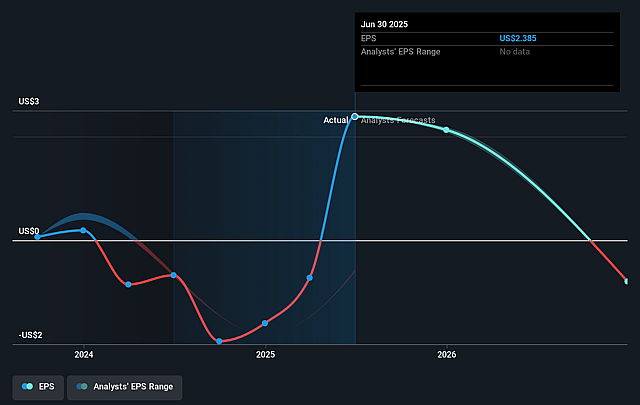

- If SuRo Capital's profit margin were to converge on the industry average, you could expect earnings to reach $1.3 million (and earnings per share of $0.05) by about May 2028, up from $-38.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 188.7x on those 2028 earnings, up from -2.9x today. This future PE is greater than the current PE for the US Capital Markets industry at 24.5x.

- Analysts expect the number of shares outstanding to grow by 0.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.65%, as per the Simply Wall St company report.

SuRo Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in NAV by 16% in 2024 raises concerns about future valuation of portfolio assets, which can impact financial metrics such as net asset value and possibly affect investor sentiment.

- Market volatility creates uncertainty about IPO timelines and valuations, which might impact potential revenue from monetizing these investments.

- Several significant investments depend heavily on AI infrastructure, which may not grow as anticipated due to rapidly changing technology landscapes, potentially affecting future earnings.

- The sizable investment and reliance on CoreWeave’s IPO may pose a financial risk if the IPO does not achieve anticipated valuation, affecting net margins negatively.

- The high concentration of investments in a few companies (top five make up 44% of the portfolio) could lead to increased portfolio risk if any of these companies underperform or face market challenges, which would impact portfolio valuation and earnings reliability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.925 for SuRo Capital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.7, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.0 million, earnings will come to $1.3 million, and it would be trading on a PE ratio of 188.7x, assuming you use a discount rate of 8.6%.

- Given the current share price of $4.67, the analyst price target of $7.92 is 41.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on SuRo Capital?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.