Last Update 06 Nov 25

Fair value Increased 20%SANM: Full Rack Assembly Expansion Will Balance Opportunity And Macroeconomic Risk

Sanmina's analyst price target has been raised significantly from $158.50 to $190.00. This increase reflects renewed optimism from analysts who highlight strong sector recovery and new business opportunities, despite ongoing macroeconomic and integration challenges.

Analyst Commentary

Analysts continue to update their perspectives on Sanmina's prospects following recent financial results and new strategic partnerships. Their commentaries reflect both optimism about the company’s growth trajectory and caution regarding certain market and execution risks.

Bullish Takeaways- Recent increases in price targets highlight renewed confidence in Sanmina’s valuation, with analysts responding positively to the company exceeding expectations in its latest fiscal report.

- Strong momentum in the communications end market, especially after the sector emerged from an inventory correction, has contributed to a more favorable growth outlook.

- The company is positioned to benefit from its expanded capabilities in full rack assembly and its partnership in supporting advanced AI datacenter projects. These developments could drive incremental business opportunities.

- Sanmina’s designation as a preferred NPI partner for leading semiconductor companies points to its solid execution capability and a likely expansion of its role in next-generation technology deployments.

- Uncertainty remains around the broader macroeconomic environment, which could impact demand visibility and overall revenue growth.

- The ongoing integration of the ZT business and the subsequent need to ramp operations with major industry players adds execution risk for the company in the near term.

- Analysts note difficulty in precisely forecasting the financial impact from new partnerships, as much depends on Sanmina’s share of new project awards and customer choices among competing solutions.

- Despite the raised targets, a neutral stance reflects recognition of both strong opportunities and significant challenges present in Sanmina’s current operating landscape.

What's in the News

- Sanmina Corporation has issued earnings guidance for the first quarter ending December 27, 2025, projecting revenue in the range of $2.9 billion to $3.2 billion (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has increased substantially from $158.50 to $190.00, reflecting a more optimistic valuation outlook.

- Discount Rate has decreased slightly, moving from 8.37% to 8.29%. This can indicate lower perceived risk in Sanmina's future cash flows.

- Revenue Growth assumptions have risen sharply, from 6.38% to 37.29%. This suggests significantly higher expectations for top-line expansion.

- Net Profit Margin projections have declined from 3.88% to 3.17%, which points to a more conservative assessment of earnings efficiency.

- Future P/E Ratio estimates have dropped from 27.39x to 18.81x. This implies that the stock is potentially seen as more attractively valued based on forward earnings.

Key Takeaways

- Recent strategic acquisitions and investments in automation position Sanmina to capitalize on robust demand for advanced electronics manufacturing in high-growth sectors.

- Expansion of capabilities and a strong financial position enable sustained margin improvement, operational efficiency, and long-term earnings growth across diverse markets.

- Customer concentration, supply chain risks, and execution challenges from acquisitions and expansion threaten future growth, margins, and revenue stability amid shifting industry and geopolitical pressures.

Catalysts

About Sanmina- Provides integrated manufacturing solutions, components, products and repair, logistics, and after-market services in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

- The imminent acquisition of ZT Systems is expected to add $5–6 billion of annual run-rate revenue, positioning Sanmina to double its net revenue within three years and capitalize on explosive growth in data center and AI infrastructure investment; this should provide a multi-year boost to overall revenue and EPS accretion from synergies and integration.

- Broad-based demand for complex electronics manufacturing remains strong across end-markets, especially in communications networks, cloud infrastructure, medical, defense, aerospace, and industrial segments; these markets favor sophisticated EMS providers like Sanmina and are expected to support long-term revenue growth and earnings stability.

- Sanmina's expanding footprint in North America and investment in automation/advanced capabilities directly align with the rising demand for regionalized, resilient supply chains and higher-value engineering-driven services, underpinning both future volume growth and potential margin improvement.

- Strategic investments in automation, digital transformation, and the shift toward full system integration (highlighted by the buildout of end-to-end solutions for data center AI, liquid cooling, advanced circuit boards, etc.) are already showing benefits in operational efficiencies and gross margin expansion, which should compound over time and lift net margins.

- The company is redeploying free cash flow and maintains a robust balance sheet, enabling ongoing investment in growth markets such as India and sustained share repurchases; this financial flexibility supports long-term earnings per share growth and allows the company to capture opportunities presented by the proliferation of IoT, increased electronics content in diverse industries, and ongoing sector consolidation.

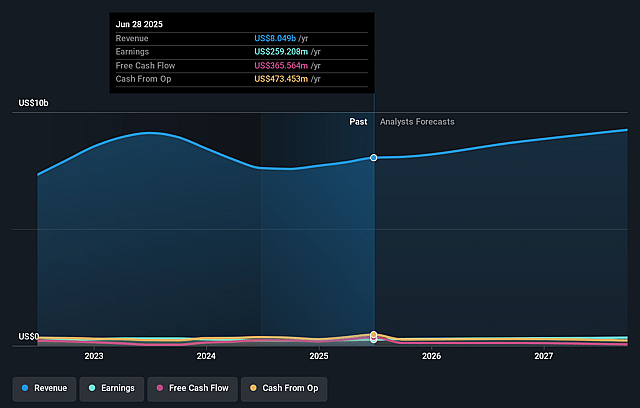

Sanmina Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sanmina's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.2% today to 3.9% in 3 years time.

- Analysts expect earnings to reach $375.6 million (and earnings per share of $7.33) by about September 2028, up from $259.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.6x on those 2028 earnings, down from 24.2x today. This future PE is lower than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to decline by 1.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.31%, as per the Simply Wall St company report.

Sanmina Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The planned acquisition of ZT Systems brings significant working capital and inventory risk, including the potential for write-downs on lagging-generation products and possible overvaluation of $2 billion in inventory, which could impact future net margins and earnings if market demand or product mix shifts unfavorably.

- Customer concentration remains high, with the top 10 customers accounting for 52.8% of revenue; any loss or reduction in orders from these major clients could cause outsized declines in revenue and net income.

- Geopolitical uncertainties, tariffs, and regionalization pressures may complicate global operations and force costly relocation or reorganization of manufacturing, potentially squeezing margins and reducing operational efficiency over the long term.

- The integration of ZT Systems and expansion into new markets (U.S., India, Mexico) require ongoing, substantial investment in both technology and talent; if these investments do not yield sufficient returns or if execution falters, long-term revenue and margin expansion targets may be missed.

- There are industry risks of accelerating OEM vertical integration and insourcing, especially as customers seek more control over supply chains and intellectual property, which could reduce Sanmina's addressable market and future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $119.5 for Sanmina based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.7 billion, earnings will come to $375.6 million, and it would be trading on a PE ratio of 20.6x, assuming you use a discount rate of 8.3%.

- Given the current share price of $117.76, the analyst price target of $119.5 is 1.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.