Key Takeaways

- Advanced technology solutions and a shift to higher-margin services position the company for margin expansion amid rising industry complexity and evolving customer needs.

- Balance sheet strength and disciplined capital allocation enable investment in innovation, cost optimization, and attractive market opportunities, enhancing resilience and long-term returns.

- Prolonged market weakness, cash flow risks, pricing pressures, and operational divestitures could challenge Weatherford's margins, profitability, and long-term growth prospects.

Catalysts

About Weatherford International- An energy services company, provides equipment and services for the drilling, evaluation, completion, production, and intervention of oil, geothermal, and natural gas wells worldwide.

- Weatherford's expanding portfolio of advanced technologies (e.g., managed pressure drilling, TITAN RS for well abandonment, CO2 storage project contracts) is positioning the company to benefit as oilfield operations become more complex and customers seek solutions for challenging reservoirs, supporting future revenue and margin expansion as global energy producers prioritize efficiency.

- Stabilization or future growth in key emerging and international markets-such as Mexico (with PEMEX's anticipated payment improvements), the Middle East, and Asia Pacific-aligns with long-term global energy demand growth, setting the stage for revenue rebounds as regional activity bottoms out and investments resume.

- Ongoing company transformation-shifting from legacy, low-margin businesses (recent divestitures in Argentina and slimming down unprofitable offerings) toward higher-margin, technology-enabled services, digitalization, and integrated projects-should drive both net-margin expansion and earnings resilience through the cycle.

- Strong balance sheet, high liquidity, and disciplined capital allocation-including continued share repurchases, opportunistic debt reduction, and capacity for M&A-provide the flexibility to invest in innovation, enter attractive new markets, and enhance shareholder returns, with positive impacts on free cash flow and long-term EPS.

- Accelerated multiyear cost optimization-embedding automation, productivity gains, and lean process improvements-will yield ongoing structural reductions in operating costs, supporting free cash flow conversion and EBITDA margin improvement even if near-term volumes remain pressured.

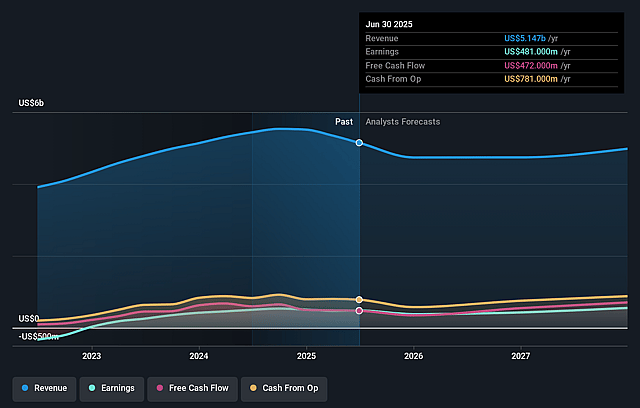

Weatherford International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Weatherford International's revenue will decrease by 0.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.3% today to 11.2% in 3 years time.

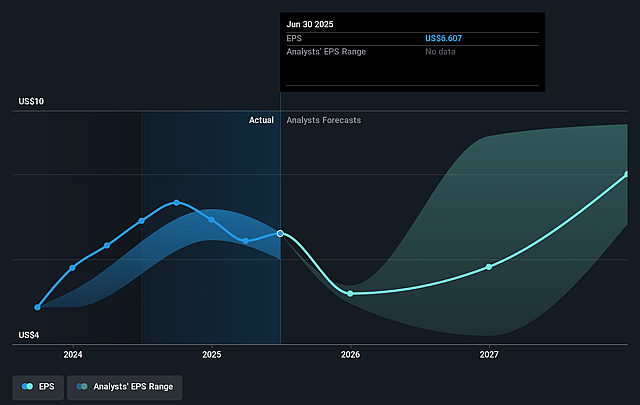

- Analysts expect earnings to reach $565.4 million (and earnings per share of $8.13) by about August 2028, up from $481.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $647 million in earnings, and the most bearish expecting $452.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.6x on those 2028 earnings, up from 8.4x today. This future PE is lower than the current PE for the US Energy Services industry at 13.6x.

- Analysts expect the number of shares outstanding to decline by 1.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.27%, as per the Simply Wall St company report.

Weatherford International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Weatherford is facing significant near-term and potentially prolonged international market softness (notably in Saudi Arabia and other key geographies) with expectations for suppressed activity and revenue through at least mid-to-late 2026, suggesting long-term revenue and earnings could underperform if global oilfield spending remains weak.

- The company remains heavily exposed to payment delays and volatility in markets like Mexico, where visibility on receivables and cash collections is low and dependency on government/Pemex funding introduces ongoing working capital and free cash flow risk.

- There is heightened pricing pressure in both North American and select international markets, particularly in service businesses with declining activity; this could drive continued margin compression and impact net earnings, especially if oversupply and industry competition intensify.

- Uncertainty surrounding tariffs and trade disruptions (including inventory timing in the U.S.) may lead to further margin dilution and demand reduction, creating unpredictable swings in cost structure and impacting overall profitability and cash generation.

- Continued divestitures and exits from unprofitable or capital-intensive businesses (e.g., Argentina), though intended to streamline operations, may reduce scale and impair long-term growth potential if not offset by organic or inorganic expansion, thereby possibly limiting top-line growth and sustained earnings improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $68.5 for Weatherford International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $73.0, and the most bearish reporting a price target of just $58.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.1 billion, earnings will come to $565.4 million, and it would be trading on a PE ratio of 10.6x, assuming you use a discount rate of 8.3%.

- Given the current share price of $56.32, the analyst price target of $68.5 is 17.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.