Last Update 07 May 25

Fair value Increased 1.13%Key Takeaways

- Expansion in emerging markets and focus on advanced digital solutions support growth, diversification, and increased market share across global energy regions.

- Portfolio streamlining and operational efficiency initiatives drive improved margins, stronger cash flow, and position the company for evolving energy market trends.

- Weatherford faces industry contraction, higher compliance costs, debt constraints, competitive pressures, and geopolitical risks, all threatening margins, growth opportunities, and operational stability.

Catalysts

About Weatherford International- An energy services company, provides equipment and services for the drilling, evaluation, completion, production, and intervention of oil, geothermal, and natural gas wells worldwide.

- Weatherford’s strong positioning in the Middle East, Asia, and other underdeveloped oilfield regions, where activity is holding steady or growing due to national priorities for domestic energy supply, provides a platform for international revenue growth and geographic diversification, particularly as emerging markets drive sustained global energy demand.

- Investment and expansion in digital and automation solutions for well construction and production optimization—demonstrated by high-impact contracts and growing adoption of technologies such as ForeSite Power—are expected to enable Weatherford to capture greater market share and drive margin expansion, as energy operators increase focus on advanced technology to optimize output and lower costs.

- Portfolio optimization through divestment of low-return, capital-intensive businesses, such as the Argentina Pressure Pumping and wireline operations, allows Weatherford to redeploy capital towards differentiated, high-margin product lines and new technology offerings, improving overall earnings quality and long-term free cash flow generation.

- Continued cost restructuring and operational efficiency initiatives, including modernizing the fulfillment network, scalable cost structures, automation, and discipline in working capital management, are expected to drive recurring improvements in net margins and further strengthen the company’s balance sheet.

- Secular trends in brownfield enhancements, mature field recovery, and new sustainability-focused markets like carbon capture and emissions-reducing solutions create ongoing opportunities for Weatherford’s well intervention, artificial lift, and related services, supporting resilient and diversified revenue streams into late-cycle periods and positioning the company to benefit from structural changes in the global energy market.

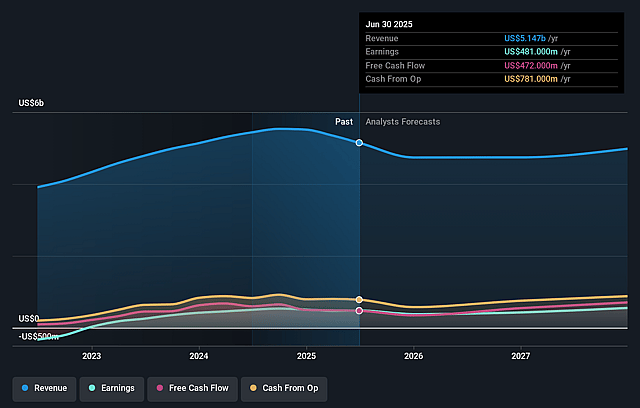

Weatherford International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Weatherford International compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Weatherford International's revenue will grow by 1.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.8% today to 12.0% in 3 years time.

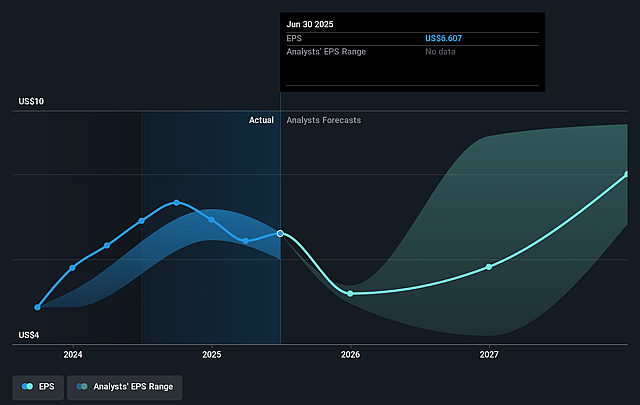

- The bullish analysts expect earnings to reach $679.0 million (and earnings per share of $9.52) by about May 2028, up from $470.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.7x on those 2028 earnings, up from 6.7x today. This future PE is greater than the current PE for the US Energy Services industry at 10.6x.

- Analysts expect the number of shares outstanding to decline by 0.82% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.89%, as per the Simply Wall St company report.

Weatherford International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global transition toward renewable energy and decarbonization is likely to reduce long-term demand for oilfield services, which could shrink Weatherford’s addressable market and eventually lead to lower revenues and reduced earnings power.

- Increasing regulatory and societal pressure to curb carbon emissions, as well as mounting investor reluctance to finance fossil fuel-related activities, could raise Weatherford’s compliance and capital costs, negatively affecting net margins and limiting the company’s ability to fund growth.

- Heavy debt burden and a history of financial restructuring remain a risk, as it may constrain Weatherford’s future access to capital markets, stifle investment in R&D or acquisitions, and pressure earnings and free cash flow if industry conditions deteriorate.

- Persistent challenges in gaining market share relative to larger, better-capitalized competitors, combined with rising pricing pressure and customer consolidation among E&Ps, could drive ongoing margin compression and stagnant or declining revenue over the decade.

- Exposure to geographies with chronic political or economic instability (such as Mexico and Argentina, both cited for recent operational and revenue declines) makes Weatherford vulnerable to operational disruptions, unpredictable cash flows, and negative impacts on net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Weatherford International is $90.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Weatherford International's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $90.0, and the most bearish reporting a price target of just $60.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.6 billion, earnings will come to $679.0 million, and it would be trading on a PE ratio of 11.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of $43.72, the bullish analyst price target of $90.0 is 51.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.