Last Update 18 Dec 25

Fair value Increased 2.49%BBAR: Reduced Political Risk Will Support Virtuous Credit Cycle Into 2027

Analysts have modestly raised their price target on Banco BBVA Argentina, with fair value increasing from ARS 16,396 to ARS 16,805. They cite improved revenue growth expectations and a more supportive post election banking backdrop, despite ongoing concerns around profitability and capital ratios.

Analyst Commentary

Street research on Banco BBVA Argentina has become more polarized, with some bullish analysts highlighting improving macro conditions and bank specific upside, while bearish analysts caution that the name still screens weaker than peers on capital and profitability.

Bullish Takeaways

- Bullish analysts see the post election environment as a catalyst for a more stable policy framework. They view this as supporting a virtuous credit cycle and faster loan growth, which in turn underpins higher valuation multiples.

- Recent upgrades with materially higher price targets suggest that prior risk premia embedded in the stock were excessive relative to the bank's growth opportunity and easing political uncertainty.

- The reduced perception of political interference in the sector is viewed as improving execution visibility on balance sheet expansion and fee income initiatives through 2027.

- Supportive macro signals, including lower inflation and better growth expectations, are seen as tailwinds that could translate into better asset quality and higher returns on equity over the medium term.

Bearish Takeaways

- Bearish analysts argue that Banco BBVA Argentina remains structurally weaker than domestic peers on profitability, which they see as limiting the scope for sustainable rerating despite the improved backdrop.

- Concerns center on the bank's capital position, with one major brokerage flagging its relatively low Tier 1 ratio and higher loan exposure as constraints on aggressive balance sheet growth.

- There is skepticism that the bank can close its return gap versus peers without taking on additional risk, which could pressure capital ratios further and justify a valuation discount.

- Some see the recent share rally, driven by macro optimism, as overextending fundamentals, with current prices already incorporating an optimistic execution and credit quality scenario.

What's in the News

- Major U.S. lenders, including JPMorgan, Citi, and Bank of America, have shelved plans for a $20B bailout package to Argentina in favor of a smaller short term loan. This has affected sentiment around Argentine banks such as Banco BBVA Argentina (Wall Street Journal).

- Banco BBVA Argentina has been notified of a class action lawsuit by consumer group Protegiendo al Consumidor, challenging the constitutionality of Decree 70/2023 provisions that removed limits on punitive interest for credit cards in Buenos Aires Province, and seeking reimbursement of alleged excess charges plus interest and costs (company filing).

- The bank has stated that the claim is for an indeterminate amount and that, even in a hypothetical adverse ruling, it does not expect a significant impact on its assets or activities. The bank continues to analyze the lawsuit and define its legal strategy (company filing).

Valuation Changes

- Fair Value: Raised slightly from ARS 16,396 to ARS 16,805, reflecting a modest upgrade to the intrinsic valuation.

- Discount Rate: Edged down marginally from 29.35% to 29.30%, implying a slightly lower perceived risk profile.

- Revenue Growth: Increased modestly from 42.11% to 43.23%, indicating incrementally stronger top line expectations.

- Net Profit Margin: Reduced slightly from 21.04% to 20.55%, signaling a minor deterioration in projected profitability.

- Future P/E: Nudged higher from 17.10x to 17.51x, suggesting a small expansion in the valuation multiple applied to forward earnings.

Key Takeaways

- Macroeconomic stabilization and digital transformation are driving stronger growth, improved efficiencies, and expanding customer acquisition for BBVA Argentina.

- Rising banking penetration, strong parental backing, and a focus on private sector lending are supporting long-term earnings stability and market share gains.

- Credit quality deterioration, shrinking margins, and ongoing exposure to macroeconomic and regulatory volatility threaten earnings stability and the sustainability of recent loan growth.

Catalysts

About Banco BBVA Argentina- Provides various banking products and services to individuals and companies in Argentina.

- The stabilization of Argentina's macroeconomic environment-highlighted by rapid disinflation, sustained fiscal balance, and relaxation of foreign exchange controls-positions the bank to benefit from renewed economic growth, increasing lending activity, and greater cross-border credit and investment flows, supporting future revenue and earnings growth.

- BBVA Argentina's ongoing digital transformation and market leadership in digital sales (with 84.5% of new customers acquired digitally and 95% of sales by unit through digital channels) are driving efficiencies, capturing younger and tech-savvy clients, and expanding the customer base more cheaply, which should improve operating leverage and net margins over time.

- The bank is outpacing the system in both loan and deposit growth (market share of private loans up by 107 bps and deposits by 215 bps year-over-year), capitalizing on rising formal banking penetration and financial inclusion efforts, which expands its TAM (total addressable market) and underpins structurally higher top-line growth prospects.

- Strong parent group backing supports continued investment in digital infrastructure and risk management, allowing BBVA Argentina to sustain lower-than-average nonperforming loan ratios and respond effectively to rising competition from fintechs and new entrants, protecting long-term earnings stability and margins.

- With Argentina's gradual economic normalization likely to yield lower inflation and interest rates in the coming years, BBVA Argentina-having shifted its balance sheet mix more toward private sector lending and away from public sector exposure-is better positioned to benefit from rising loan volumes and expanding net interest income as credit demand returns.

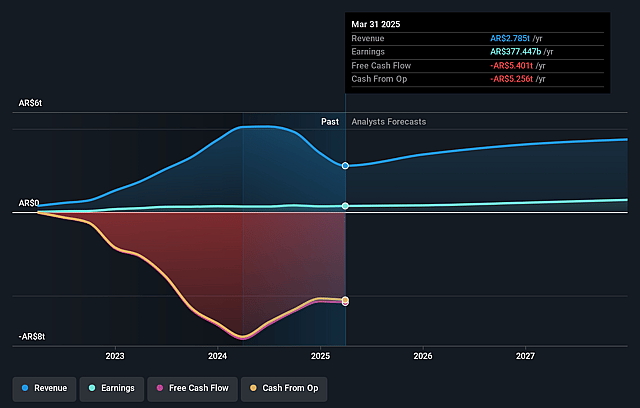

Banco BBVA Argentina Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Banco BBVA Argentina's revenue will grow by 30.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.1% today to 17.1% in 3 years time.

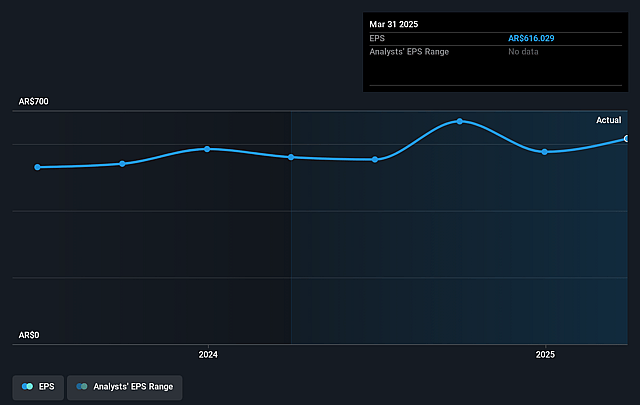

- Analysts expect earnings to reach ARS 879.9 billion (and earnings per share of ARS 4.21) by about September 2028, up from ARS 279.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ARS1034.8 billion in earnings, and the most bearish expecting ARS743.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from 12.1x today. This future PE is greater than the current PE for the US Banks industry at 12.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 24.77%, as per the Simply Wall St company report.

Banco BBVA Argentina Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The bank experienced a 31.1% decrease in inflation-adjusted net income quarter-over-quarter, driven by lower operating income, loan loss provisions, and write-downs from a voluntary sovereign bond exchange-signaling ongoing vulnerability to Argentina's sovereign risk and earnings volatility, which may pressure future net margins and ROE.

- Despite robust loan and deposit growth, management highlighted a systemic rise in nonperforming loans (NPLs), particularly in the retail/consumer segment, with BBVA's provision coverage ratio for bad credit (115%) described as historically low; this trend signals ongoing credit quality deterioration that may require higher future provisioning, negatively impacting earnings stability.

- The shift from securities to loans has led to a significant decline in net interest margin (NIM), from 50% in 2023 to 19.1% in 2025, with management indicating that further compression could occur if deposit costs reprice more quickly than loan yields in a volatile interest rate environment, directly pressuring profitability.

- The sustainability of recent high loan growth is uncertain, with management cautioning that system-wide deceleration is likely due to elevated real interest rates suppressing loan demand-particularly in commercial lending-while any further slowdown would limit revenue growth opportunities.

- Regulatory and macro factors remain a material risk: the recent removal of FX controls brought short-term trading gains, but management anticipates these to be one-off rather than recurring revenue drivers; additionally, continued reliance on government-driven disinflation and policy stability means that renewed currency volatility, shifts in government strategy, or further adverse regulatory changes could quickly erode cost control efforts and financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ARS11746.667 for Banco BBVA Argentina based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ARS15200.0, and the most bearish reporting a price target of just ARS8540.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ARS5154.1 billion, earnings will come to ARS879.9 billion, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 24.8%.

- Given the current share price of ARS5540.0, the analyst price target of ARS11746.67 is 52.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Banco BBVA Argentina?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.