Key Takeaways

- Rapid digital adoption and strong regulatory positioning enable above-peer efficiency, cross-selling, and non-interest income growth, positioning BBVA Argentina for outsized long-term performance.

- Robust loan and deposit momentum, alongside industry consolidation and financial inclusion, create momentum for sustainable earnings and market share expansion against rivals.

- Intense competition, macroeconomic instability, high costs, and asset risks threaten BBVA Argentina's profitability, operational flexibility, and long-term growth prospects.

Catalysts

About Banco BBVA Argentina- Provides various banking products and services to individuals and companies in Argentina.

- While analyst consensus sees BBVA Argentina's digital acquisition as a driver for cost savings and higher net margins, digital sales now comprise 95% of volumes and 90% of monetary value, setting the stage for hyper-efficient, AI-driven cross-selling and next-gen product innovation that can propel net margin and fee income growth well above peer averages.

- Analysts broadly agree BBVA's robust real loan and deposit growth outpaces both inflation and system averages, but with risk-adjusted returns well below potential; sustained market share gains in both loans and deposits, combined with a recovering middle class, create an explosive pathway for BBVA to meaningfully outscale rivals and deliver sustainable, double-digit earnings and ROE growth over multiple years.

- Recent regulatory and macro shifts-including the lifting of FX controls, a wide-band floating exchange regime, and normalization of monetary policy-vastly expand the profit pool for export financing, dollarized lending, and FX-related fee products, implying a step-change in non-interest income and risk-adjusted returns on capital.

- BBVA Argentina's multiyear track record of proactive cost control and balance sheet optimization, alongside rapid growth in time deposits and a 123.9% surplus over regulatory capital requirements, positions the bank to aggressively leverage upcoming industry consolidation and invest in high-growth verticals, fueling compounding revenue and net income expansion.

- Accelerating digital banking adoption and heightened financial inclusion, powered by technology-driven customer experience and partnership with the global BBVA Group, will allow for rapid wallet share capture from unbanked and underbanked Argentines, increasing the addressable market and driving compounding topline growth well into the next decade.

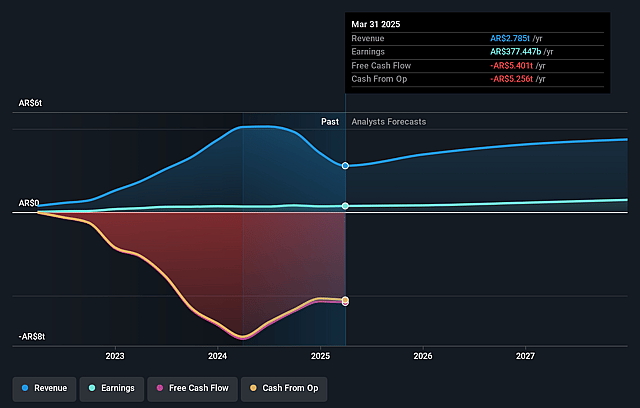

Banco BBVA Argentina Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Banco BBVA Argentina compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Banco BBVA Argentina's revenue will grow by 31.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 12.1% today to 23.1% in 3 years time.

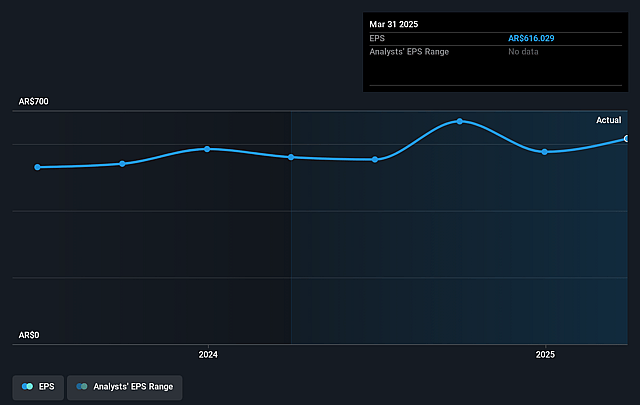

- The bullish analysts expect earnings to reach ARS 1211.7 billion (and earnings per share of ARS 3.71) by about September 2028, up from ARS 279.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, up from 9.6x today. This future PE is greater than the current PE for the US Banks industry at 10.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 25.81%, as per the Simply Wall St company report.

Banco BBVA Argentina Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent macroeconomic instability, high inflation, and currency volatility in Argentina could continue to undermine confidence and pressure BBVA Argentina's profit margins and long-term revenue growth.

- The rise of local and international fintech and digital-native competitors may accelerate customer attrition and lead to margin compression, as BBVA Argentina's pace of digital transformation and fee income growth is noted as lagging relative to best-in-class peers.

- Heavy reliance on traditional banking, a high cost/income ratio, and a rigid cost structure-evidenced by a unionized workforce and legacy infrastructure-constrain operational flexibility and may weigh down net margins and long-term earnings potential.

- Increasing nonperforming loans in the retail segment and a historically low provisioning coverage (115 percent) risk further asset quality deterioration, which could result in higher credit losses and negatively impact net income if macro or credit conditions deteriorate.

- Exposure to Argentine sovereign risk remains significant, with asset allocation responding to changing government policies and bond exchanges, risking future credit losses or asset devaluations in the event of renewed sovereign stress, with direct consequences for capital and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Banco BBVA Argentina is ARS15200.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Banco BBVA Argentina's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ARS15200.0, and the most bearish reporting a price target of just ARS8540.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ARS5237.8 billion, earnings will come to ARS1211.7 billion, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 25.8%.

- Given the current share price of ARS4400.0, the bullish analyst price target of ARS15200.0 is 71.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.