Last Update 19 Feb 26

Fair value Increased 36%SLAB: Deal Terms And Mixed Ratings Will Shape Future Upside Potential

Analysts have lifted their Silicon Laboratories fair value estimate from $164.13 to about $222.86, citing updated assumptions for revenue growth, profit margins, discount rate, and future P/E that better reflect recent Street research on the name.

Analyst Commentary

Recent Street research on Silicon Laboratories is mixed, with several firms lifting price targets while others move to more neutral stances. Together, these updates frame a debate around how much of the company’s potential is already reflected in the share price and what needs to go right for the valuation to hold.

Bullish Takeaways

- Bullish analysts raising price targets by between about $45 and $101 point to a view that the company’s long term earnings power could support a higher valuation than previously modeled.

- Upward target revisions suggest these analysts are more comfortable with assumptions around revenue growth and margins. This feeds directly into higher fair value estimates and supports the recent lift from $164.13 to about $222.86.

- Multiple firms increasing their targets in a tight window hints at a cluster of positive reassessments of execution risk, with models apparently giving more credit to the company’s ability to deliver on its roadmap.

- Target hikes from larger global houses signal that, in their view, the stock still offers room for upside if the company hits the earnings and P/E assumptions embedded in their models.

Bearish Takeaways

- Several downgrades to Hold suggest a growing group of bearish analysts see risk that the current share price already discounts much of the anticipated growth, limiting the margin of safety.

- Some bearish analysts explicitly cite a lack of additional bidder interest, which may cap any takeover premium and keep valuation more tightly tied to the company’s own execution and earnings delivery.

- The shift to neutral stances indicates concern that, while fundamentals may be sound, the risk and reward trade off is now more balanced, especially if revenue or margin trends do not match the more optimistic models.

- With both price target increases and fresh downgrades landing around the same dates, the spread of opinions highlights uncertainty about how reliably Silicon Laboratories can translate its opportunities into sustained growth that supports higher P/E assumptions.

What's in the News

- Texas Instruments is reported to be in advanced talks to buy Silicon Labs for about US$7b, according to the Financial Times, with Reuters noting the possibility of an announcement in the days following the February 3, 2026 report (Financial Times, Reuters).

- On February 4, 2026, Texas Instruments signed a definitive agreement to acquire Silicon Labs for approximately US$7.8b, with Silicon Labs shareholders to receive US$231 per share in cash, and both company boards unanimously approving the deal.

- The planned acquisition aims to create a global player in embedded wireless connectivity by combining Silicon Labs mixed signal solutions with Texas Instruments analog and embedded processing portfolio. Texas Instruments plans to fund the deal using cash on hand and new debt.

- The merger agreement includes termination fees of US$259m payable by Silicon Labs in certain scenarios and US$499m payable by Texas Instruments if specific regulatory related conditions prevent closing.

- At CES 2026, Silicon Labs highlighted its IoT product portfolio and launched the Simplicity SDK for Zephyr, targeting secure, scalable and energy efficient connected devices and offering a commercial package around the Zephyr real time operating system.

Valuation Changes

- Fair Value: updated from $164.13 to about $222.86, a sizeable uplift in the modeled equity value per share.

- Discount Rate: adjusted slightly lower from 10.48% to about 10.40%, reflecting a modest change in the required rate of return used in the model.

- Revenue Growth: revised from 16.28% to about 16.40%, a marginal increase in the assumed long-term top line expansion rate.

- Net Profit Margin: updated from 14.71% to about 15.51%, a moderate step up in expected long-run profitability on each $ of revenue.

- Future P/E: raised from 41.46x to about 53.12x, implying a higher valuation multiple applied to expected earnings in the projection period.

Key Takeaways

- Expanding IoT deployments and energy-efficient wireless platforms position Silicon Labs for strong revenue growth and improved market share.

- Focus on high-margin, secure, and diverse IoT solutions enhances earnings sustainability and operational efficiency.

- Limited diversification, rising competition, and industry commoditization threaten long-term margins and profitability, while regulatory changes and OEM vertical integration could further erode growth prospects.

Catalysts

About Silicon Laboratories- A fabless semiconductor company, provides analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally.

- Rapid expansion of smart home, healthcare, and industrial IoT deployments-including multiple large-scale customer production ramps and a deep design win pipeline-supports robust, multi-year revenue growth as the number of connected devices in these sectors accelerates.

- Ongoing rollout of new, highly integrated, energy-efficient wireless platforms (Series 2 and Series 3) positions Silicon Labs to capture increased market share and supports higher ASPs, which is likely to drive top-line growth and gross margin improvement.

- Growing adoption of battery-powered IoT and connected healthcare applications, enabled by the company's ultra-low-power wireless solutions, unlocks new, higher-value end markets and diversifies revenue streams, supporting improved earnings sustainability.

- Continued focus on portfolio optimization, with a shift to IoT-centric, higher-margin products and tight expense management, is expected to enhance net margins and deliver operating leverage as revenues ramp.

- Industry-first security certifications and multi-protocol support address increasing requirements for secure, integrated IoT connectivity, enhancing differentiation and enabling Silicon Labs to win premium projects, likely supporting both revenue growth and margin expansion.

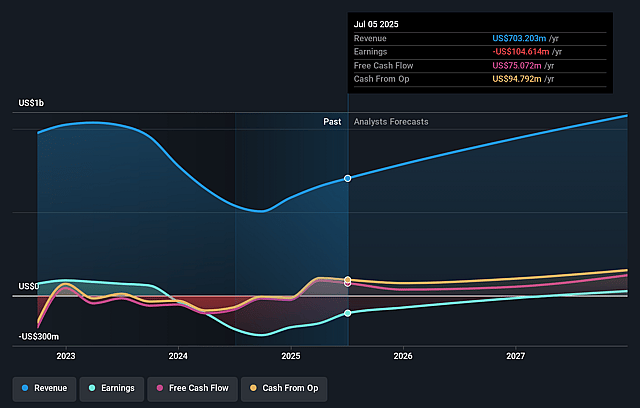

Silicon Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Silicon Laboratories's revenue will grow by 19.2% annually over the next 3 years.

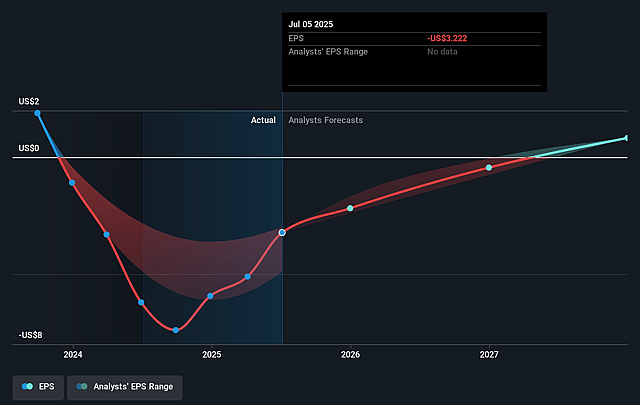

- Analysts assume that profit margins will increase from -14.9% today to 1.2% in 3 years time.

- Analysts expect earnings to reach $13.9 million (and earnings per share of $0.42) by about September 2028, up from $-104.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 476.2x on those 2028 earnings, up from -41.1x today. This future PE is greater than the current PE for the US Semiconductor industry at 30.1x.

- Analysts expect the number of shares outstanding to grow by 1.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.05%, as per the Simply Wall St company report.

Silicon Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in the wireless IoT chip market, including ongoing pressure from larger semiconductor vendors and low-cost Asian rivals, could force Silicon Labs to lower average selling prices over time, which would negatively affect long-term gross margins and net earnings.

- The company's highly focused portfolio on low-power wireless IoT limits its diversification; if growth in IoT adoption slows or market standards shift, Silicon Labs could face revenue underperformance and increased vulnerability to technological disruption.

- Potential industry-wide chip commoditization may erode Silicon Labs' pricing power, making it difficult to sustain premium gross margins as basic connectivity and wireless features become standardized in competing products, impacting long-term profitability.

- Rising regulatory and tax uncertainties, including escalating global cybersecurity requirements, shifting tariffs, and newly passed tax legislation ("big beautiful bill"), could increase R&D, compliance, and tax costs, which would reduce operating and net margins.

- The increasing trend of large device OEMs exploring vertical integration or in-house chip design poses a threat to Silicon Labs' long-term revenue streams by shrinking its external customer base for semiconductor products.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $150.444 for Silicon Laboratories based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $180.0, and the most bearish reporting a price target of just $130.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $13.9 million, and it would be trading on a PE ratio of 476.2x, assuming you use a discount rate of 10.1%.

- Given the current share price of $131.03, the analyst price target of $150.44 is 12.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Silicon Laboratories?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.