Key Takeaways

- Expanding IoT deployments and energy-efficient wireless platforms position Silicon Labs for strong revenue growth and improved market share.

- Focus on high-margin, secure, and diverse IoT solutions enhances earnings sustainability and operational efficiency.

- Limited diversification, rising competition, and industry commoditization threaten long-term margins and profitability, while regulatory changes and OEM vertical integration could further erode growth prospects.

Catalysts

About Silicon Laboratories- A fabless semiconductor company, provides analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally.

- Rapid expansion of smart home, healthcare, and industrial IoT deployments-including multiple large-scale customer production ramps and a deep design win pipeline-supports robust, multi-year revenue growth as the number of connected devices in these sectors accelerates.

- Ongoing rollout of new, highly integrated, energy-efficient wireless platforms (Series 2 and Series 3) positions Silicon Labs to capture increased market share and supports higher ASPs, which is likely to drive top-line growth and gross margin improvement.

- Growing adoption of battery-powered IoT and connected healthcare applications, enabled by the company's ultra-low-power wireless solutions, unlocks new, higher-value end markets and diversifies revenue streams, supporting improved earnings sustainability.

- Continued focus on portfolio optimization, with a shift to IoT-centric, higher-margin products and tight expense management, is expected to enhance net margins and deliver operating leverage as revenues ramp.

- Industry-first security certifications and multi-protocol support address increasing requirements for secure, integrated IoT connectivity, enhancing differentiation and enabling Silicon Labs to win premium projects, likely supporting both revenue growth and margin expansion.

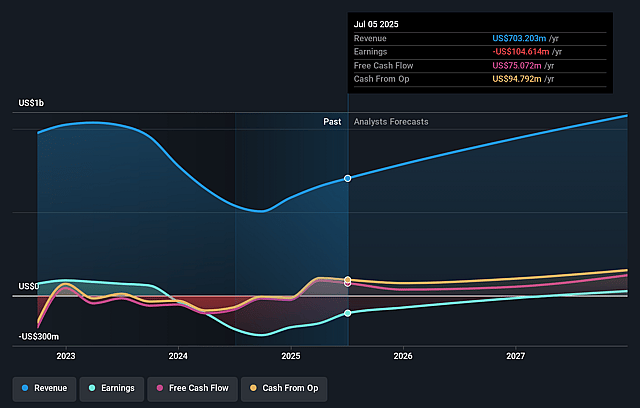

Silicon Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Silicon Laboratories's revenue will grow by 19.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -14.9% today to 1.2% in 3 years time.

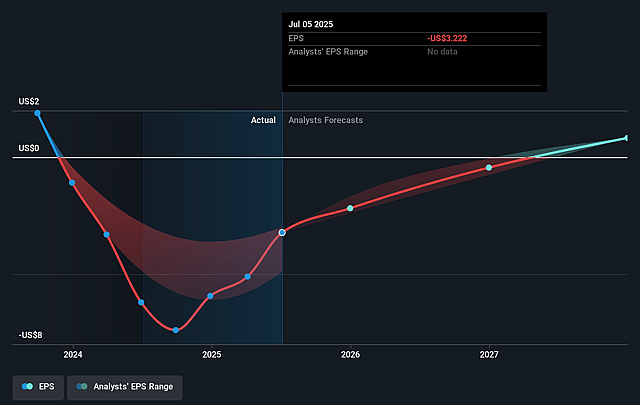

- Analysts expect earnings to reach $13.9 million (and earnings per share of $0.42) by about September 2028, up from $-104.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 476.2x on those 2028 earnings, up from -41.1x today. This future PE is greater than the current PE for the US Semiconductor industry at 30.1x.

- Analysts expect the number of shares outstanding to grow by 1.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.05%, as per the Simply Wall St company report.

Silicon Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in the wireless IoT chip market, including ongoing pressure from larger semiconductor vendors and low-cost Asian rivals, could force Silicon Labs to lower average selling prices over time, which would negatively affect long-term gross margins and net earnings.

- The company's highly focused portfolio on low-power wireless IoT limits its diversification; if growth in IoT adoption slows or market standards shift, Silicon Labs could face revenue underperformance and increased vulnerability to technological disruption.

- Potential industry-wide chip commoditization may erode Silicon Labs' pricing power, making it difficult to sustain premium gross margins as basic connectivity and wireless features become standardized in competing products, impacting long-term profitability.

- Rising regulatory and tax uncertainties, including escalating global cybersecurity requirements, shifting tariffs, and newly passed tax legislation ("big beautiful bill"), could increase R&D, compliance, and tax costs, which would reduce operating and net margins.

- The increasing trend of large device OEMs exploring vertical integration or in-house chip design poses a threat to Silicon Labs' long-term revenue streams by shrinking its external customer base for semiconductor products.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $150.444 for Silicon Laboratories based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $180.0, and the most bearish reporting a price target of just $130.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $13.9 million, and it would be trading on a PE ratio of 476.2x, assuming you use a discount rate of 10.1%.

- Given the current share price of $131.03, the analyst price target of $150.44 is 12.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.