Last Update 22 Jan 26

Fair value Decreased 1.49%SDHC: Future Returns Will Depend On Execution Risk At Current Price Levels

Narrative Update

The analyst price target for Smith Douglas Homes has been trimmed by $0.25 to $16.50 as analysts factor in updated assumptions on revenue growth, profit margins and future P/E, along with recent research pointing to a more neutral valuation stance.

Analyst Commentary

Recent research on Smith Douglas Homes points to a more balanced outlook, with analysts weighing solid fundamentals against valuation and execution risks. Here is how the bullish and bearish arguments are shaping up based on the latest price target moves and coverage updates.

Bullish Takeaways

- Bullish analysts highlight the company’s return on equity profile as a key support for the stock, suggesting the business is using shareholder capital efficiently relative to its current P/E assumptions.

- Analysts referencing “strong growth prospects over the medium term” see room for the business to scale, which they view as supportive of the current valuation even after the modest target reductions.

- The view that the stock’s valuation is “reasonable” signals that, in bullish eyes, the current share price already reflects many of the known risks, leaving potential upside if the company delivers on its growth plans.

- Coverage initiations and assumption of coverage, such as the recent Neutral at JPMorgan with a US$17 target, indicate that the name is firmly on institutional radar. Bullish analysts see this as helpful for liquidity and price discovery over time.

Bearish Takeaways

- Bearish analysts point to the recent price target trims, including the US$1 cut highlighted in research and the move from US$18 to US$17 at JPMorgan, as a signal that prior expectations for the stock may have been too optimistic.

- The shift toward a Neutral stance reflects caution that current valuation already prices in much of the company’s medium term growth potential, limiting the margin of safety if execution falls short.

- Lowered targets tied to updated assumptions on revenue growth, profit margins and future P/E indicate that analysts are reassessing how much investors should pay for the stock until there is clearer evidence on delivery against those metrics.

- Some cautious investors may read the “reasonable” valuation comment as a sign that the stock is fairly priced rather than obviously cheap, which can reduce enthusiasm for adding exposure at current levels.

What's in the News

- The company reported that from July 1, 2025 to September 30, 2025, it repurchased 0 shares for a total of $0 million under its buyback program. (Key Developments)

- Management indicated that, with this update, the company has completed the repurchase of 0 shares for $0 million under the buyback announced on May 28, 2025. (Key Developments)

Valuation Changes

- Fair Value: trimmed slightly from US$16.75 to US$16.50 per share, reflecting more conservative assumptions.

- Discount Rate: nudged higher from 8.55% to about 8.56%, indicating a marginally higher required return in the model.

- Revenue Growth: reduced from roughly 4.44% to about 3.57%, signaling a more cautious stance on top line expansion assumptions.

- Net Profit Margin: lifted from about 4.68% to roughly 4.89%, implying slightly stronger expected profitability on each dollar of revenue.

- Future P/E: eased from about 3.63x to roughly 3.50x, suggesting a modestly lower valuation multiple in forward projections.

Key Takeaways

- Growing reliance on buyer incentives and increased operating spend are compressing margins and delaying profitability amidst persistent market affordability challenges.

- Regional concentration and industry-wide cost inflation heighten revenue volatility and limit margin expansion despite ongoing inventory and geographic growth efforts.

- Strategic expansion, operational efficiency, and focus on affordable housing drive growth and resilience, supported by strong financial flexibility and disciplined balance sheet management.

Catalysts

About Smith Douglas Homes- Designs, constructs, and sale of single-family homes in the southeastern United States.

- The persistent affordability crisis, marked by rising home prices outpacing wage growth and stricter mortgage qualification standards, is leading Smith Douglas Homes to increase reliance on incentives (e.g., significant rate buy-downs and closing cost assistance) to stimulate demand, resulting in compression of gross margins and likely sustained downward pressure on earnings.

- Expectations of a structurally higher interest rate environment due to macroeconomic volatility and government debt concerns are compounding affordability issues for entry-level buyers-Smith Douglas Homes' core segment-potentially reducing future sales volumes and top-line revenue growth despite current inventory build-up and community expansion.

- Heavy concentration in the Southeast and Sun Belt regions exposes the company to elevated risk from localized economic downturns, housing oversupply (notably in new markets like Dallas-Fort Worth), or climate-related disruptions, increasing revenue volatility and risk to consistent earnings growth.

- The ongoing need to dedicate incremental SG&A spend to support geographic expansion (such as new greenfield entries in DFW and Gulf Coast) is likely to erode near-term operating leverage, delaying contributions to net margins and overall profitability, especially as new divisions run below optimal scale for several years.

- Industry-wide cost pressures from material input inflation, scarcity of affordable lots, and rising competition from institutional land buyers are expected to elevate build costs and constrain inventory turnover, creating further headwinds to margin expansion and dampening long-term ROE targets.

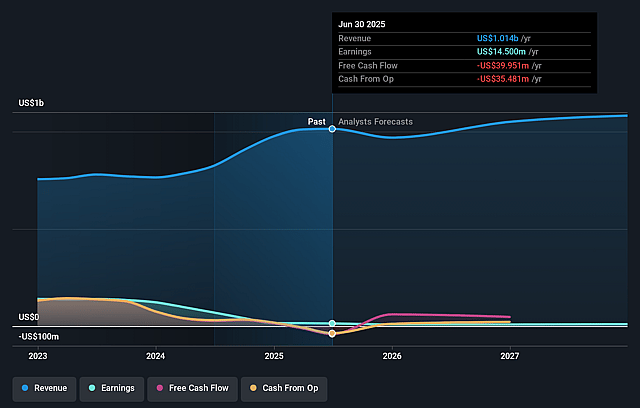

Smith Douglas Homes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Smith Douglas Homes's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 1.4% today to 0.8% in 3 years time.

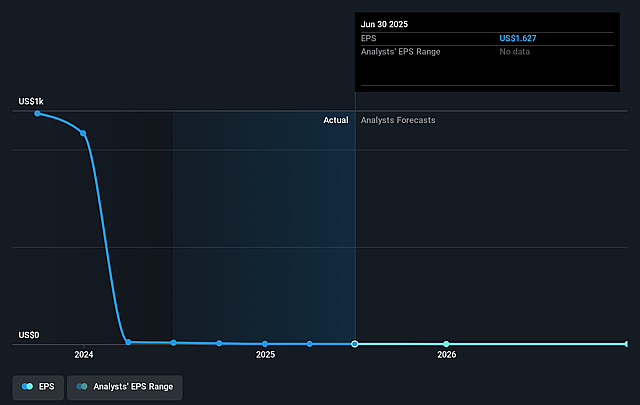

- Analysts expect earnings to reach $8.5 million (and earnings per share of $0.65) by about September 2028, down from $14.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 141.8x on those 2028 earnings, up from 12.2x today. This future PE is greater than the current PE for the US Consumer Durables industry at 11.5x.

- Analysts expect the number of shares outstanding to grow by 1.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.37%, as per the Simply Wall St company report.

Smith Douglas Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing geographic expansion and increases in active community count-including new entries into high-growth markets like Dallas-Fort Worth and the Gulf Coast-position Smith Douglas Homes to capture incremental revenue growth and market share, countering potential long-term sales declines.

- The company's "asset-light" and efficient land acquisition strategy (with 96% of unstarted lots optioned) provides significant operational and financial flexibility, which can mitigate downside risk and support healthy ROE and margins over the long term.

- Smith Douglas Homes' focus on entry-level and affordable homes aligns with the persistent, structural undersupply of attainable housing and expected continued demand from Millennial and Gen Z household formation, supporting robust revenue and volume growth prospects.

- Reduction in build cycle times and continued improvements in construction efficiency allow for faster inventory turnover, lower carrying costs, and stronger profitability-potentially insulating earnings even in a muted macro environment.

- The company maintains a conservative balance sheet, low net debt, expanded credit facilities, and authorized share repurchases, all of which enhance liquidity and financial flexibility, supporting potential EPS growth and decreasing the risk to net margins and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.6 for Smith Douglas Homes based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $8.5 million, and it would be trading on a PE ratio of 141.8x, assuming you use a discount rate of 8.4%.

- Given the current share price of $19.56, the analyst price target of $17.6 is 11.1% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Smith Douglas Homes?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.