Last Update 11 Sep 25

Fair value Decreased 33%Analysts have lowered Harvard Bioscience’s price target from $3.00 to $2.00 due to increased uncertainty around research funding, drug pricing pressures, tariff risks, and a generally more cautious sector outlook.

Analyst Commentary

- Uncertainty surrounding basic research funding potentially impacting sector performance.

- Ongoing concerns about drug pricing pressures negatively affecting the company's outlook.

- Tariff-related challenges adding to operational and margin risk.

- Sector environment expected to remain uncertain in the near term.

- Heightened risk profile leading to a more conservative price target.

What's in the News

- Company raised Q2 2025 revenue guidance to $20.4 million from prior $18–20 million outlook and reiterated gross margin expectations of 55%–57%.

- Provided Q3 2025 revenue guidance of $19–21 million.

- CEO James W. Green resigned, with Board member John Duke appointed as successor.

- Received Nasdaq notification of non-compliance due to audit committee vacancy; company intends to regain compliance by appointing a new independent Board member and will rely on the Nasdaq cure period.

Valuation Changes

Summary of Valuation Changes for Harvard Bioscience

- The Consensus Analyst Price Target has significantly fallen from $3.00 to $2.00.

- The Future P/E for Harvard Bioscience has significantly fallen from 14.71x to 9.88x.

- The Consensus Revenue Growth forecasts for Harvard Bioscience has significantly risen from 1.4% per annum to 1.7% per annum.

Key Takeaways

- Strong alignment with biomedical research trends and expanding proprietary technology platforms positions the company well for sustained growth and margin improvement.

- Enhanced operational efficiency and capital restructuring increase financial flexibility, supporting continued investment in innovation and long-term profitability.

- Heavy reliance on core products, limited diversification, and external pressures from funding, tariffs, and debt costs threaten growth, profitability, and long-term competitiveness.

Catalysts

About Harvard Bioscience- Develops, manufactures, and sells technologies, products, and services for life science applications in the United States, Germany, and internationally.

- Ongoing demographic shifts, such as the global aging population and rising chronic disease prevalence, are expected to spur increased demand for advanced biomedical research and laboratory instrumentation-areas where Harvard Bioscience's product suite is well-aligned-supporting long-term revenue growth.

- Emerging clarity around NIH funding and budget normalization into 2026 is likely to unlock delayed academic purchasing, particularly in neuroscience research platforms and organoid-based systems, driving incremental top-line growth as research spending rebounds.

- Expanding adoption and commercialization of new, proprietary platforms (e.g., Mesh MEA organoid system, SoHo Telemetry, and BTX bioproduction consumables) position the company in high-growth and innovation-centric segments, which can accelerate recurring revenues and improve gross margins over time.

- Cost discipline through ongoing SG&A reduction, supply chain optimization, and ERP consolidation has already translated to improved EBITDA and cash flow, which, if sustained, is likely to drive net margin expansion and greater earnings stability.

- Restructuring of the capital structure and anticipated debt refinancing enhance financial flexibility, enabling Harvard Bioscience to invest further in R&D and growth initiatives, ultimately supporting improved profitability and topline growth beyond 2025.

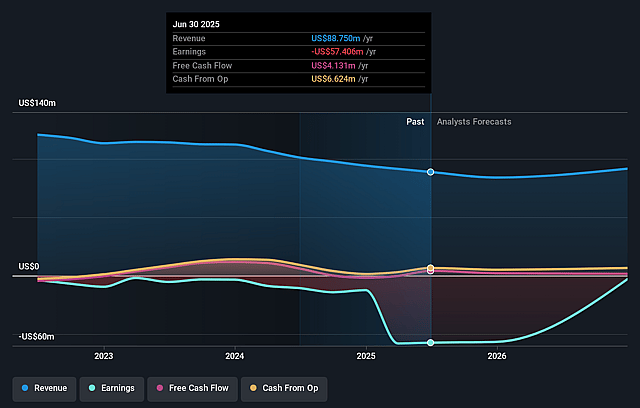

Harvard Bioscience Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Harvard Bioscience's revenue will grow by 1.4% annually over the next 3 years.

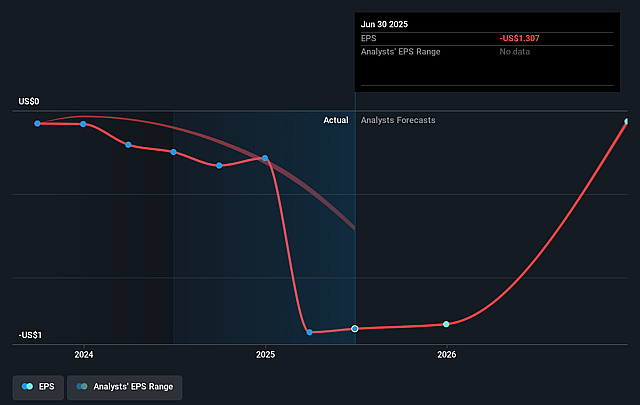

- Analysts are not forecasting that Harvard Bioscience will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Harvard Bioscience's profit margin will increase from -64.7% to the average US Life Sciences industry of 14.2% in 3 years.

- If Harvard Bioscience's profit margin were to converge on the industry average, you could expect earnings to reach $13.2 million (and earnings per share of $0.28) by about September 2028, up from $-57.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.7x on those 2028 earnings, up from -0.4x today. This future PE is lower than the current PE for the US Life Sciences industry at 29.1x.

- Analysts expect the number of shares outstanding to grow by 2.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.11%, as per the Simply Wall St company report.

Harvard Bioscience Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged delays and uncertainty around NIH and academic purchasing cycles, driven by shifting funding priorities or ongoing government budget disruptions, may continue to suppress demand for Harvard Bioscience's instruments in the U.S. academic sector, resulting in pressure on revenues and growth.

- Persistent or escalating tariffs and geopolitical tensions, particularly involving China and Europe, expose a significant portion of revenues (notably the ~10% China exposure) to ongoing volatility and potential future disruption, negatively impacting international sales and profitability.

- Harvard Bioscience's dependence on core product platforms and lack of clear mention of substantive diversification or expansion into non-traditional bioscience tools leaves it vulnerable to technological obsolescence or diminished demand, posing risks to long-term revenue streams and margin stability.

- The stated focus on cost reduction, operating expense controls, and working capital initiatives-rather than meaningful R&D acceleration or bold new product development-may hinder Harvard Bioscience's ability to sustain competitive differentiation, undermining future growth prospects and potentially compressing net margins over time.

- Ongoing refinancing requirements and elevated interest costs related to amended credit facilities (with increased SOFR adders and amendment fees) risk consuming operating cash flow and weighing on net earnings, especially if top-line growth remains stagnant or global market headwinds persist.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.0 for Harvard Bioscience based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $92.6 million, earnings will come to $13.2 million, and it would be trading on a PE ratio of 14.7x, assuming you use a discount rate of 11.1%.

- Given the current share price of $0.47, the analyst price target of $3.0 is 84.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.