Last Update 17 Jan 26

Fair value Decreased 4.87%STKS: Updated Revenue Outlook Will Support Bullish Repricing Potential

Narrative update

Analysts trimmed their price target on ONE Group Hospitality by $0.25, citing updated assumptions around fair value, a slightly higher discount rate, and revised expectations for revenue growth, profit margins, and future P/E levels.

Analyst Commentary

Recent research on ONE Group Hospitality centers on why the price target was trimmed and what that implies for risk and reward. Analysts are rechecking their assumptions on fair value, using a slightly higher discount rate and updated views on revenue growth, margins, and future P/E levels.

Bullish Takeaways

- Bullish analysts still see upside based on their fair value work, even after the price target cut. This suggests they view the adjustment as a recalibration rather than a fundamental downgrade.

- They point to the company’s ability to support current revenue assumptions as a key reason to maintain a constructive stance on long term growth potential.

- Supportive views often highlight that, at the revised target, the implied P/E still reflects room for the company to execute on its plan without requiring very aggressive assumptions.

- Some bullish analysts view the more conservative discount rate as adding a larger cushion to their valuation, which can be appealing if execution remains on track.

Bearish Takeaways

- Bearish analysts focus on the lower price target as a signal that prior expectations around revenue growth and profit margins may have been too optimistic.

- The slightly higher discount rate is seen as a reminder that perceived risk around execution or macro sensitivity is meaningful for a smaller restaurant operator.

- Cautious views emphasize that if the company falls short of revised revenue or margin assumptions, the current valuation could prove demanding relative to those updated expectations.

- Some bearish analysts flag uncertainty around what future P/E levels the market will be willing to assign, especially if growth or profitability does not track current models.

What's in the News

- Preliminary guidance for the fourth quarter of 2025 points to total GAAP revenues of about US$207 million, compared with US$222 million in the same quarter of 2024. The change is mainly tied to RA Sushi and Kona Grill closures and a fiscal year change, with grill closures accounting for roughly 2.4% of total GAAP revenues and 35% of the expected total GAAP revenue decline (Corporate Guidance).

- For full year 2025, preliminary total GAAP revenues are expected to be about US$805 million, compared with US$673 million in the prior year. This is driven largely by the Benihana acquisition completed in May 2024, while comparable sales are expected to show a 3.7% decline (Corporate Guidance).

- The company issued updated guidance for 2025, calling for total GAAP revenues of US$820 million to US$825 million and consolidated comparable sales in a range of a 3% decline to a 2% decline (Corporate Guidance).

- Management plans to open five to seven new venues in 2025, indicating ongoing unit growth alongside the portfolio optimization that included RA Sushi and Kona Grill closures (Business Expansions).

- For the third quarter ended September 28, 2025, ONE Group Hospitality recorded a loss on impairment of long lived assets of US$3.386 million. Between June 30, 2025 and September 28, 2025, the company repurchased 69,749 shares for US$0.2 million, completing a total buyback of 1,126,428 shares for US$4.39 million under the program announced on March 14, 2024 (Impairments and Buyback Tranche Update).

Valuation Changes

- Fair Value: Trimmed slightly from 5.13x to 4.88x, reflecting a modestly lower valuation multiple in the updated work.

- Discount Rate: Raised slightly from 12.32% to 12.50%, indicating a small increase in the required return used in the models.

- Revenue Growth: Assumption increased from 4.40% to 6.49%, signaling higher expectations for top line expansion in the updated analysis.

- Net Profit Margin: Adjusted down marginally from 8.21% to 8.06%, indicating a slightly more cautious view on future profitability.

- Future P/E: Reduced from 2.89x to 2.70x, reflecting a more conservative multiple applied to estimated earnings.

Key Takeaways

- Operational redesigns, loyalty programs, and menu innovation are driving revenue growth, stronger margins, and broader customer engagement across core brands.

- Asset-light franchising and portfolio optimization are increasing high-margin, recurring revenue streams while focusing investment on scalable, high-return concepts.

- Weakening customer demand, brand concentration risk, and cost pressures combine with shifting consumer habits to threaten revenue growth, margin stability, and future investment prospects.

Catalysts

About ONE Group Hospitality- A restaurant company, owns, develops, operates, manages, licenses, and franchises restaurants and lounges worldwide.

- The integration and operational redesign of Benihana restaurants (e.g., the San Mateo prototype with higher table density and improved guest flow) is already generating above-target revenue and margins, suggesting rollout of these innovations systemwide will substantially boost future revenue and restaurant-level EBITDA margins.

- The expanded and unified loyalty program, coupled with an effective digital marketing push (leveraging a 7 million+ contact database), is likely to drive higher guest frequency and broaden the customer base-particularly as millennials and Gen Z prioritize experiential dining and digital engagement-supporting ongoing comparable sales and revenue growth.

- Fast acceleration of asset-light franchising, with Benihana (including Benihana Express) and STK seeing strong franchise interest from both new and existing partners, is set to deliver high-margin recurring revenue streams and higher returns on invested capital, paving the way for long-term growth in earnings and systemwide sales.

- Focus on menu innovation (such as the premium Wagyu program and new daypart/occasion offerings), pricing strategies, and weekday value programming positions the company to capitalize on rising disposable incomes and consumer demand for premium, differentiated, and experiential dining-fueling average check growth and improved net margins.

- Portfolio optimization (closure of underperforming or non-strategic Grill locations in favor of capital deployment toward brands with industry-leading returns) allows for improved free cash flow generation and margin expansion, as capital is increasingly directed toward scalable, high-ROIC concepts aligned with evolving dining and urbanization trends.

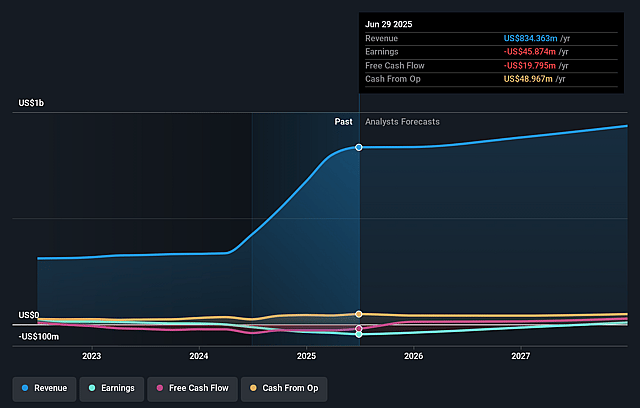

ONE Group Hospitality Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ONE Group Hospitality's revenue will grow by 4.4% annually over the next 3 years.

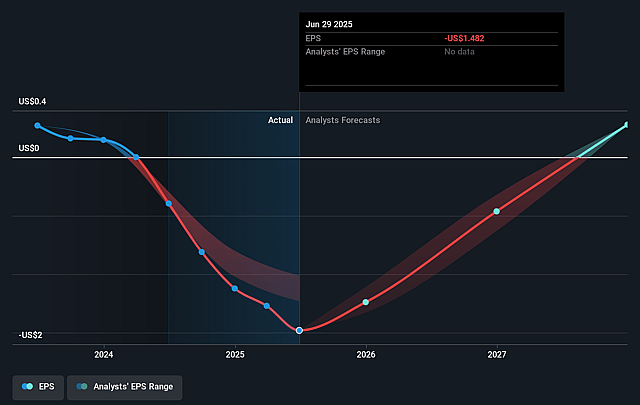

- Analysts are not forecasting that ONE Group Hospitality will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate ONE Group Hospitality's profit margin will increase from -5.5% to the average US Hospitality industry of 8.2% in 3 years.

- If ONE Group Hospitality's profit margin were to converge on the industry average, you could expect earnings to reach $78.0 million (and earnings per share of $2.52) by about September 2028, up from $-45.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 2.9x on those 2028 earnings, up from -1.8x today. This future PE is lower than the current PE for the US Hospitality industry at 24.0x.

- Analysts expect the number of shares outstanding to grow by 0.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

ONE Group Hospitality Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining comparable sales (down 4.1% in the quarter and projected between -3% and 1% for the year) signal that underlying customer demand is weakening, exposing revenue and earnings to ongoing consumer headwinds that could be exacerbated by secular shifts toward at-home dining and health-focused spending.

- The upscale and fine-dining focus of brands like STK and Benihana increases sensitivity to economic cycles and discretionary spending downturns; prolonged weakness or a recession could result in outsized volatility in traffic, compressing net margins and earnings.

- Heavy reliance on flagship brands, especially Benihana now representing over 55% of sales, exposes the company to concentration risk where brand fatigue, changing consumer tastes, or operational missteps could disproportionately affect revenue growth and profitability.

- The Grill Concepts segment is facing structural headwinds from changing entertainment habits (declining movie-going), seafood consumption declines, and low-cost sushi competition, making this part of the portfolio a potential drag on same-store sales and overall net margins.

- Persistently high food and labor costs, coupled with rising debt (higher interest expense), mean that inflation, commodity price shocks, or tighter labor markets could structurally compress margins and limit free cash flow, hampering future investment and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.133 for ONE Group Hospitality based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $4.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $949.5 million, earnings will come to $78.0 million, and it would be trading on a PE ratio of 2.9x, assuming you use a discount rate of 12.3%.

- Given the current share price of $2.69, the analyst price target of $5.13 is 47.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ONE Group Hospitality?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.