Last Update 24 Jan 26

Fair value Decreased 0.32%QTWO: Strong Bookings And Margin Expansion Should Support Future Share Gains

Analysts trimmed their average price target on Q2 Holdings by a small amount to reflect sector wide multiple compression and modest adjustments to growth and margin assumptions, even as recent research continues to highlight strong Q3 execution and solid bookings trends.

Analyst Commentary

Street research on Q2 Holdings has been mixed, with some analysts trimming price targets to reflect sector wide valuation changes while still recognizing solid execution in the latest quarter.

Bullish Takeaways

- Bullish analysts point to Q3 results with total revenue and adjusted EBITDA above internal forecasts, which they view as support for the current execution story.

- Several reports highlight a solid track record of strong quarterly bookings over the last two years, with Q3 described as continuing that trend and reinforcing confidence in demand.

- Management's preliminary guidance for 2026 is described positively, which some analysts see as helpful for underpinning longer term growth expectations despite sector volatility.

- Comments about impressive gross margin and EBITDA margin expansion in Q3 suggest to bullish analysts that the company is balancing growth and profitability in a way that can support valuation even after recent sector multiple compression.

Bearish Takeaways

- Bearish analysts are trimming price targets, in some cases by a meaningful amount, primarily to align with lower valuations across software peers rather than company specific execution issues.

- Even where Q3 is described as strong, several reports retain Neutral stances, which signals some hesitation about upside from current levels after the sector wide reset in multiples.

- The decision to reduce targets following a quarter that beat revenue and earnings forecasts suggests concern that current trading multiples may already reflect recent operational strength.

- References to model updates after Q3, without corresponding upgrades in ratings, point to caution around how much further growth and margin expansion can translate into higher valuation in the near term.

What's in the News

- Q2 Holdings announced a share repurchase program of up to US$150 million, funded from existing cash balances, with no stated expiration date. The Board of Directors authorized the buyback plan on November 5, 2025 (company announcement).

- The company issued guidance for full year 2025 revenue in the range of US$789 million to US$793 million, described as representing year over year growth of 13% to 14% (company guidance).

- Q2 Holdings provided guidance for the fourth quarter of 2025, expecting revenue between US$202.4 million and US$206.4 million (company guidance).

- Helix by Q2 announced that Bangor Savings Bank selected Helix as one of its Banking as a Service platform partners to support the bank's expansion of fintech focused solutions and embedded finance offerings (client announcement).

Valuation Changes

- Fair Value: trimmed slightly from 89.71 to 89.43, reflecting a small reset in the base case estimate.

- Discount Rate: adjusted marginally from 8.78% to 8.77%, indicating only a very small change in the risk assumption used in the model.

- Revenue Growth: revised slightly from 10.52% to 10.49%, reflecting a modestly more conservative growth outlook in the forecasts provided.

- Net Profit Margin: nudged up from 16.12% to 16.13%, indicating a minor adjustment in expected profitability in the model inputs.

- Future P/E: eased from 46.88x to 46.72x, pointing to a small reduction in the valuation multiple applied to future earnings.

Key Takeaways

- Accelerating digital transformation and demand for unified, mobile-first banking solutions are driving customer adoption and revenue growth for Q2's platform.

- Regulatory changes, bank consolidation, and operational efficiencies position Q2 for improved margins, increased cross-sell, and strong long-term retention.

- Customer base vulnerabilities, increased competition, and sluggish services growth could constrain revenue, while cloud migration offers long-term potential but carries near-term risks.

Catalysts

About Q2 Holdings- Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

- The increasing focus by financial institutions on digital transformation, evidenced by strong engagement and expanded investments in mission-critical digital banking, fraud prevention, and AI solutions, is likely to drive robust subscription revenue growth and improve retention for Q2 over the longer term.

- Heightened demand for integrated, omni-channel, and mobile-first banking experiences is accelerating adoption of Q2's unified platform across both new and existing customers, expanding the addressable market and supporting higher average revenue per user (ARPU) and overall revenue growth.

- The rise of regulatory initiatives around open banking, demands for data interoperability, and the growing complexity of managing multiple vendors is positioning Q2 as a preferred, scalable solution-particularly through the Innovation Studio platform-which should enable incremental cross-sell, increased customer stickiness, and margin expansion.

- Ongoing bank consolidation and sustained competition from fintechs is creating urgency among small and mid-sized financial institutions to modernize, with Q2 repeatedly cited as the platform of choice during M&A events; this dynamic supports continued recurring revenue growth and buffers against client attrition.

- Continued cloud migration initiatives and operational efficiencies are forecast to deliver higher gross margins and EBITDA, with additional opportunities for margin expansion once the data center transition completes in 2026, directly benefitting net earnings over time.

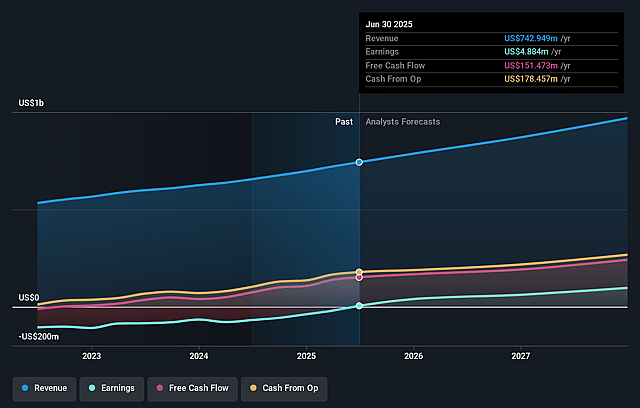

Q2 Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Q2 Holdings's revenue will grow by 11.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.7% today to 13.1% in 3 years time.

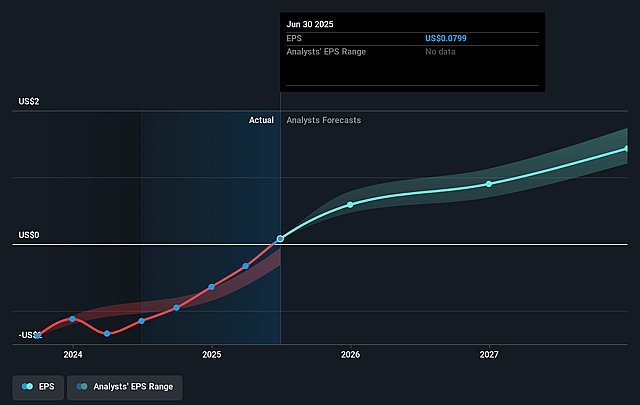

- Analysts expect earnings to reach $132.9 million (and earnings per share of $1.43) by about September 2028, up from $4.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 68.4x on those 2028 earnings, down from 989.6x today. This future PE is greater than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 3.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.74%, as per the Simply Wall St company report.

Q2 Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued consolidation among mid-sized banks and credit unions-a core Q2 customer segment-could further reduce its customer base and drive increased churn, potentially pressuring long-term revenue growth and overall ARR expansion.

- Higher-than-normal churn observed in the second quarter, in part due to M&A-related customer loss, indicates possible ongoing vulnerability to customer attrition, which could negatively impact subscription revenues and future earnings.

- The proliferation of point solution vendors in fraud and risk management introduces increased competitive risk, raising the threat of pricing pressure, potential customer defection, and margin compression over time.

- Flat or declining services and professional services revenue, as projected for 2025 and anticipated into 2026, may indicate limited growth opportunities in these segments, which could constrain total revenue growth if subscription momentum falters.

- Q2's continued migration to the cloud, while offering some margin benefit, involves transitional costs and operational risks, and any delay or unforeseen complications could impact near-term gross margins as well as long-term cost optimization and EBITDA growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $104.071 for Q2 Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $115.0, and the most bearish reporting a price target of just $74.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $132.9 million, and it would be trading on a PE ratio of 68.4x, assuming you use a discount rate of 8.7%.

- Given the current share price of $77.4, the analyst price target of $104.07 is 25.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Q2 Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.