Last Update 11 Nov 25

Fair value Decreased 10%QTWO: Lower Rates Will Support Rebound As Efficiency Gains Drive Profitability

Q2 Holdings' average analyst price target has been reduced from approximately $101 to $90. Analysts cite strong recent performance, but also note lower software sector valuations and expectations for a more moderate growth environment ahead.

Analyst Commentary

Analyst reactions to Q2 Holdings' recent performance and outlook have been mixed, with some emphasizing strengths while others are turning more cautious due to sector trends and macroeconomic considerations.

Bullish Takeaways- Q2 Holdings delivered robust Q3 results, surpassing expectations for both revenue and profit. This reflects solid execution and demand.

- Subscription revenue growth remains strong at 17.5 percent, supporting the narrative of ongoing expansion in the company’s core business.

- Improvements in both gross margin and EBITDA margin indicate operational efficiency and effective cost management.

- Some analysts believe that a lower interest rate environment could serve as a catalyst for increased technology investment by Q2 Holdings’ banking clients, which could potentially benefit future growth.

- Several price target reductions signal caution about valuation levels within the software sector and this is impacting Q2 Holdings despite strong recent results.

- Shares have lagged behind the broader software group since the Fed rate cut. This reflects investor concerns about a potential slowdown in spending among financial services clients.

- Expectations for a more moderate growth environment suggest challenges in sustaining previous growth rates as macro conditions evolve.

- Analysts note that a less robust spending environment among customers may weigh on revenue growth, as banks prioritize efficiency over expansive investment.

What's in the News

- Q2 Holdings announced a $150 million share repurchase program, funded by existing cash balances with no expiration date. (Buyback Transaction Announcements)

- The company raised its full-year 2025 revenue guidance to $789 million to $793 million, signaling year-over-year growth of 13 percent to 14 percent. (Corporate Guidance - Raised)

- Q2 Holdings provided fourth quarter 2025 revenue guidance in the range of $202.4 million to $206.4 million. (Corporate Guidance - New/Confirmed)

- The company was recently added to major stock indices, including the S&P 1000, S&P 600, and S&P Composite 1500. (Index Constituent Adds)

- Q2 Holdings expanded its digital banking platform partnerships, enabling integrated investment and instant payment solutions for financial institutions. (Client Announcements)

Valuation Changes

- The Fair Value Estimate has fallen from $100.86 to $90.36, indicating a notable reduction in the stock's perceived intrinsic worth.

- The Discount Rate decreased slightly from 8.83 percent to 8.78 percent, reflecting a marginally lower required return for investors.

- The Revenue Growth expectation moderated from 10.86 percent to 10.46 percent, suggesting a slightly more conservative outlook for sales expansion.

- The Net Profit Margin improved meaningfully, rising from 13.07 percent to 15.18 percent, signaling enhanced profitability projections.

- The Future P/E ratio declined significantly from 66.81x to 50.99x, pointing to reduced market valuation relative to forward earnings.

Key Takeaways

- Accelerating digital transformation and demand for unified, mobile-first banking solutions are driving customer adoption and revenue growth for Q2's platform.

- Regulatory changes, bank consolidation, and operational efficiencies position Q2 for improved margins, increased cross-sell, and strong long-term retention.

- Customer base vulnerabilities, increased competition, and sluggish services growth could constrain revenue, while cloud migration offers long-term potential but carries near-term risks.

Catalysts

About Q2 Holdings- Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

- The increasing focus by financial institutions on digital transformation, evidenced by strong engagement and expanded investments in mission-critical digital banking, fraud prevention, and AI solutions, is likely to drive robust subscription revenue growth and improve retention for Q2 over the longer term.

- Heightened demand for integrated, omni-channel, and mobile-first banking experiences is accelerating adoption of Q2's unified platform across both new and existing customers, expanding the addressable market and supporting higher average revenue per user (ARPU) and overall revenue growth.

- The rise of regulatory initiatives around open banking, demands for data interoperability, and the growing complexity of managing multiple vendors is positioning Q2 as a preferred, scalable solution-particularly through the Innovation Studio platform-which should enable incremental cross-sell, increased customer stickiness, and margin expansion.

- Ongoing bank consolidation and sustained competition from fintechs is creating urgency among small and mid-sized financial institutions to modernize, with Q2 repeatedly cited as the platform of choice during M&A events; this dynamic supports continued recurring revenue growth and buffers against client attrition.

- Continued cloud migration initiatives and operational efficiencies are forecast to deliver higher gross margins and EBITDA, with additional opportunities for margin expansion once the data center transition completes in 2026, directly benefitting net earnings over time.

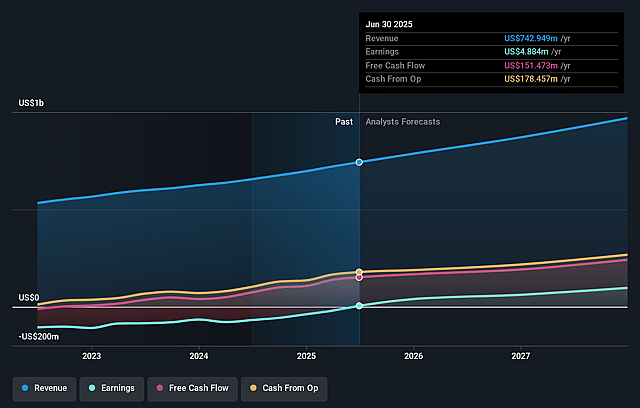

Q2 Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Q2 Holdings's revenue will grow by 11.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.7% today to 13.1% in 3 years time.

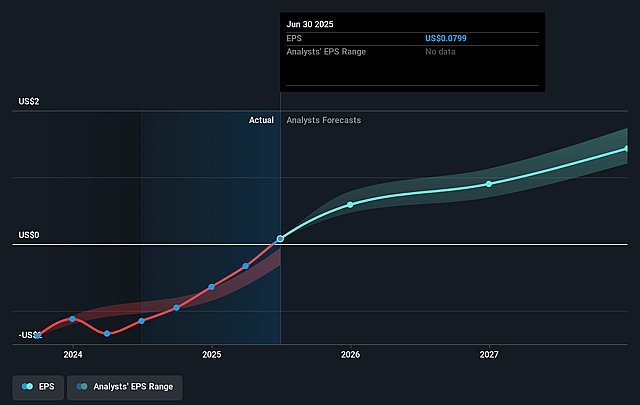

- Analysts expect earnings to reach $132.9 million (and earnings per share of $1.43) by about September 2028, up from $4.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 68.4x on those 2028 earnings, down from 989.6x today. This future PE is greater than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 3.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.74%, as per the Simply Wall St company report.

Q2 Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued consolidation among mid-sized banks and credit unions-a core Q2 customer segment-could further reduce its customer base and drive increased churn, potentially pressuring long-term revenue growth and overall ARR expansion.

- Higher-than-normal churn observed in the second quarter, in part due to M&A-related customer loss, indicates possible ongoing vulnerability to customer attrition, which could negatively impact subscription revenues and future earnings.

- The proliferation of point solution vendors in fraud and risk management introduces increased competitive risk, raising the threat of pricing pressure, potential customer defection, and margin compression over time.

- Flat or declining services and professional services revenue, as projected for 2025 and anticipated into 2026, may indicate limited growth opportunities in these segments, which could constrain total revenue growth if subscription momentum falters.

- Q2's continued migration to the cloud, while offering some margin benefit, involves transitional costs and operational risks, and any delay or unforeseen complications could impact near-term gross margins as well as long-term cost optimization and EBITDA growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $104.071 for Q2 Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $115.0, and the most bearish reporting a price target of just $74.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $132.9 million, and it would be trading on a PE ratio of 68.4x, assuming you use a discount rate of 8.7%.

- Given the current share price of $77.4, the analyst price target of $104.07 is 25.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.