Key Takeaways

- Premium care focus and efficient capital deployment in modern villages are strengthening pricing power, margins, and asset stability.

- Cost-saving efforts, digitization, and lower interest expenses are set to improve margins and support sustained growth despite sector headwinds.

- Heavy reliance on rapid property sales, cost pressures, regulatory risks, and weak cash flow threaten earnings stability, margins, and long-term profitability.

Catalysts

About Oceania Healthcare- Owns and operates retirement villages and care centres in New Zealand.

- Strong demand tailwinds due to New Zealand's rapidly aging population are expected to underpin sustained occupancy growth and long-term revenue expansion, as evidenced by consistently high occupancy rates at mature villages and momentum in sales at key sites.

- Higher net wealth among incoming retirees, coupled with Oceania's increased focus on premium care suites and continuum-of-care models, is boosting pricing power and supporting higher margins, as seen in record-high unit prices and EBITDA per bed performance at newer locations.

- Ongoing cost-out initiatives, including a targeted $15–20 million reduction in operating expenses and increased operational efficiencies from digitization and procurement optimization, are expected to materially improve net margins and cash flow conversion by FY '27.

- Oceania's active divestment of non-core assets and strategic redeployment of capital into high-demand, modern, integrated villages (supported by the modernization of 88% of sites since IPO) positions the company for both greater asset efficiency and stronger earnings stability.

- Successful refinancing at lower interest rates provides immediate reduction in interest expense and greater flexibility to fund future growth, helping offset sector-wide headwinds from tighter credit and further supporting bottom-line earnings resilience.

Oceania Healthcare Future Earnings and Revenue Growth

Assumptions

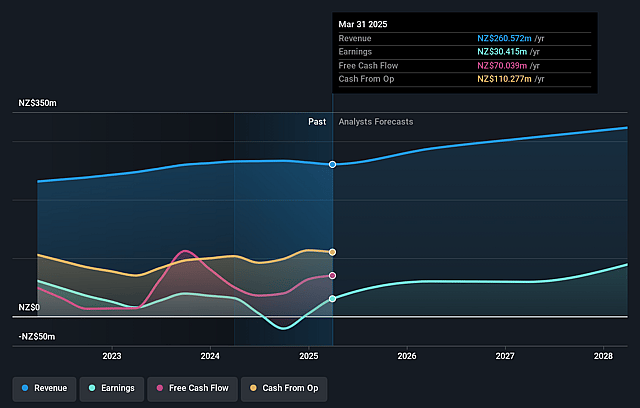

How have these above catalysts been quantified?- Analysts are assuming Oceania Healthcare's revenue will grow by 7.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.7% today to 27.6% in 3 years time.

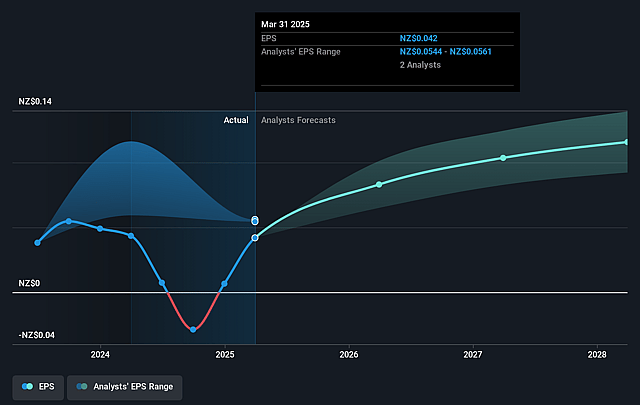

- Analysts expect earnings to reach NZ$89.1 million (and earnings per share of NZ$0.12) by about September 2028, up from NZ$30.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting NZ$100.9 million in earnings, and the most bearish expecting NZ$66.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.9x on those 2028 earnings, down from 16.4x today. This future PE is lower than the current PE for the NZ Healthcare industry at 15.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

Oceania Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Oceania Healthcare's profitability and revenue remain highly dependent on the ongoing development and rapid sell-down of new retirement village units and care suites; slowing development (with only one major site under construction), longer days on market for resales, and persistent unsold stock could lead to revenue volatility and impede effective debt reduction, negatively impacting earnings consistency.

- Underlying operating cash flow from existing operations deteriorated significantly in the second half, even as headline operating cash flow was bolstered by new sales and divestments; this weak cash conversion, if it persists, could strain liquidity, limit capacity for reinvestment and debt servicing, and underscore the risk that cost-out targets may prove insufficient to stabilize net margins.

- Despite cost-reduction efforts, the company has faced multi-year cost growth that has outpaced revenue, largely due to escalation in staffing and professional services-the sustainability of projected $15–$20 million net cost out depends on successful (yet disruptive) restructuring, adoption of efficient operating models, and labor relations; failure in execution may continue to compress net margins and impair long-term profitability.

- Oceania is exposed to property market cycles, as units frequently require buybacks prior to resale, and resales have exhibited prolonged days on market; a downturn in residential property values, demand, or liquidity could drive inventory buildup, slow cash generation, and erode resale margins, directly suppressing net asset growth and earnings.

- Heightened regulatory scrutiny, likely tightening post-COVID cost structures, and evolving government funding policies in aged care represent continual risks; any curtailment in funding, increased compliance costs, or requirements for sustainability-driven capital expenditures could either elevate OpEx or capex, reducing operating leverage and putting downward pressure on net margins and earnings over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NZ$0.882 for Oceania Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NZ$1.01, and the most bearish reporting a price target of just NZ$0.73.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NZ$323.3 million, earnings will come to NZ$89.1 million, and it would be trading on a PE ratio of 8.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of NZ$0.69, the analyst price target of NZ$0.88 is 21.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.