Key Takeaways

- Enhanced sales practices, premium offerings, and modernization are driving faster occupancy and value growth compared to the wider sector, strengthening revenue potential.

- Operational improvements and targeted cost reductions, together with favorable government policy and strategic development, are set to significantly boost margin and earnings outlook.

- Rising costs, narrow geographic focus, shifting customer preferences, intense competition, and high debt levels raise risks to profitability, growth, and financial stability.

Catalysts

About Oceania Healthcare- Owns and operates retirement villages and care centres in New Zealand.

- Analyst consensus sees strong occupancy and price growth sustained by demographic trends, but actually, with Oceania demonstrating rapid uptake at recently-optimized sites like The Helier, accelerated sales practices and premium repositioning may result in unit price and occupancy growth well ahead of sector averages, materially boosting revenue and margin growth rates over the next several years.

- Analysts broadly agree that operating margins will improve from cost savings and efficiency gains, yet the scale and granularity of Oceania's transformation office, ICT systems adoption, and procurement project appear set to yield greater-than-expected net cost reductions, with management now directly targeting a net $20 million reduction by FY27-creating significant operating leverage and upside to earnings forecasts.

- New Zealand's government is on track to expand funding and subsidies for aged care and integrated retirement living, which could be a powerful catalyst for Oceania's revenue resilience and growth, as government support materially derisks occupancy and underwrites higher levels of public sector and mid-market demand.

- The company's deliberate shift of development capital toward lower-risk villa-based expansions at high-demand sites (leveraging a shovel-ready land bank) allows Oceania to flexibly respond to market upswings and monetize property gains as urban land values climb, further boosting the medium-term asset base and development profit margins.

- With a rapidly growing, affluent elderly population increasingly seeking modern, professional retirement living environments, Oceania's modernized, integrated village portfolio (now 88% upgraded) positions it for step-change increases in both penetration rates and resident lifetime value, accelerating both top-line revenue growth and long-term earnings power beyond current consensus projections.

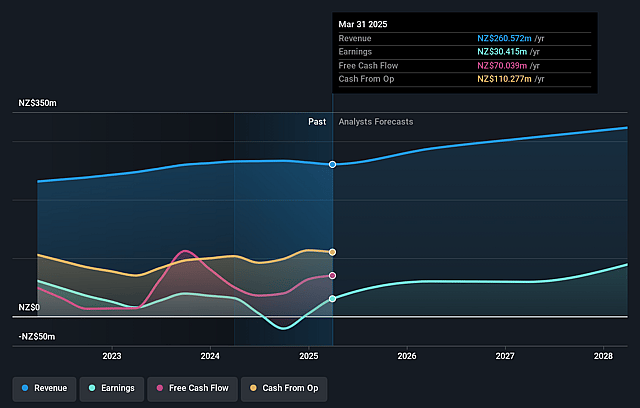

Oceania Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Oceania Healthcare compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Oceania Healthcare's revenue will grow by 13.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.7% today to 29.2% in 3 years time.

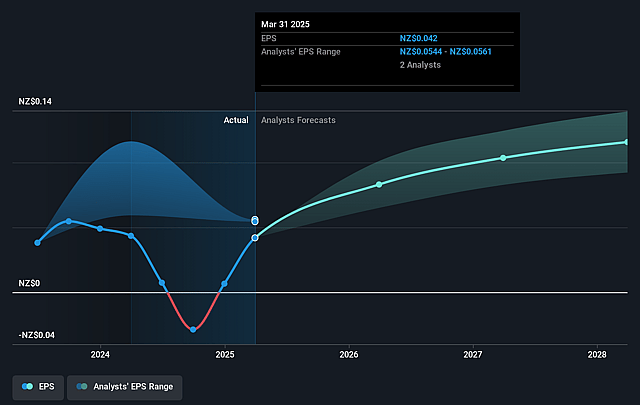

- The bullish analysts expect earnings to reach NZ$111.8 million (and earnings per share of NZ$0.15) by about September 2028, up from NZ$30.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.1x on those 2028 earnings, down from 16.4x today. This future PE is lower than the current PE for the NZ Healthcare industry at 15.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.52%, as per the Simply Wall St company report.

Oceania Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently rising development costs and higher interest expenses, despite refinancing, are expected to compress operating margins and reduce net profit, particularly as Oceania shifts more of its pipeline to greenfield and villa-style projects.

- The company's ability to control costs and deliver targeted $15 million to $20 million in cost savings is not assured, as previous cost growth has outpaced revenue growth and further reductions may be harder to achieve, which could impede improvements in operating margins and earnings.

- Oceania's exclusive focus on the New Zealand market leaves it highly vulnerable to local economic downturns or adverse changes in government policy or funding, creating risks of both revenue volatility and asset devaluations.

- Growing industry competition and customer preferences shifting toward home-based care threaten to erode demand for traditional aged care and retirement village units, potentially resulting in slower unit sales, lower occupancy rates, and reduced development profits.

- Elevated debt levels and dependence on the successful sell-down of unsold stock to repay debt expose the company to liquidity risk, and any slowdown in sales could increase financial leverage and interest costs, putting downward pressure on net margins and return on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Oceania Healthcare is NZ$1.01, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Oceania Healthcare's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NZ$1.01, and the most bearish reporting a price target of just NZ$0.73.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be NZ$383.4 million, earnings will come to NZ$111.8 million, and it would be trading on a PE ratio of 8.1x, assuming you use a discount rate of 7.5%.

- Given the current share price of NZ$0.69, the bullish analyst price target of NZ$1.01 is 31.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.