Key Takeaways

- Demographic tailwinds support long-term demand, but shifts toward home-based care and dependency on resilient property values may limit future growth and occupancy.

- Persistent staff cost pressures and high debt levels, despite operational improvements, threaten margin sustainability and financial flexibility amid rising rates and weaker core cash flow.

- Reliance on new asset sales amid rising costs, operating losses at new sites, and lost income streams heighten risks to earnings, liquidity, and balance sheet strength.

Catalysts

About Oceania Healthcare- Owns and operates retirement villages and care centres in New Zealand.

- Although Oceania Healthcare is benefitting from long-term demographic tailwinds such as an aging population and rising life expectancy that support sustained demand and occupancy, the company's ability to translate this into earnings growth may be constrained by a potentially structural change in retirement living preferences-with greater numbers of seniors opting for home-based care, impacting future revenue growth rates.

- While the business is modernising its portfolio and realising some gains from premium product offerings (leveraging rising affluence among retirees seeking higher quality), these gains may be offset if residential property values stagnate or fall over the long-term, as retirees depend on home sales to fund entry into retirement villages-potentially dampening occupancy and sales revenue.

- Despite management's focus on operational optimisation, efficiency improvements, and material cost-out targets set for the next two years, the company continues to face persistent staff cost pressures and the risk of workforce shortages, which could erode net margins and challenge the sustainability of planned cost reductions.

- Although gearing has been reduced and refinancing has lowered interest expense in the near-term, elevated debt levels coupled with exposure to rising interest rates and tighter credit conditions could limit Oceania's flexibility to fund future development or withstand economic downturns, negatively impacting net earnings over time.

- Despite strong sales momentum in recent quarters and the potential for improved operating cash flow as unsold stock is sold down, recent results show that underlying operating cash flow from core operations (excluding development gains) has weakened, raising questions about cash conversion and the ongoing ability to turn top-line growth into durable, sustainable free cash flow.

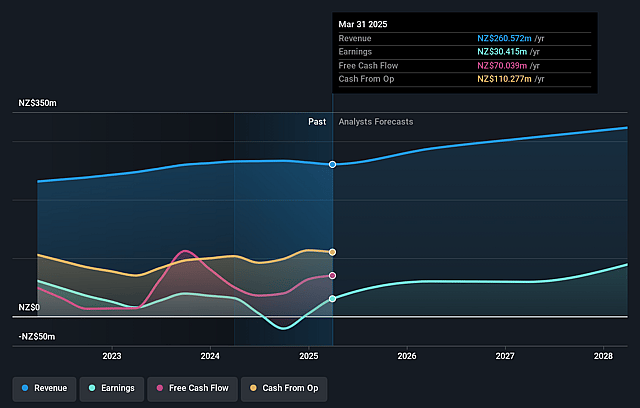

Oceania Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Oceania Healthcare compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Oceania Healthcare's revenue will grow by 3.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 11.7% today to 25.6% in 3 years time.

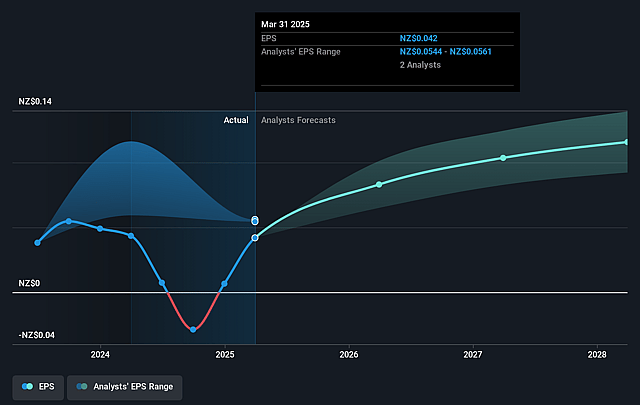

- The bearish analysts expect earnings to reach NZ$74.0 million (and earnings per share of NZ$0.1) by about September 2028, up from NZ$30.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.9x on those 2028 earnings, down from 15.7x today. This future PE is lower than the current PE for the NZ Healthcare industry at 15.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

Oceania Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's cost base has grown significantly faster than revenue over recent years, even as the overall portfolio size remained stable; although management targets up to $20 million in cost savings, the fact that previous cost increases outpaced revenue growth could present an ongoing risk to net margins and long-term earnings if cost-out programs prove insufficient or encounter delays.

- Operating cash flow from existing operations declined sharply in the second half, with the company reliant on new sales to offset cash flow shortfalls; this reliance on asset sales for cash generation suggests that underlying earnings and liquidity could be vulnerable if sales momentum stalls, eventually impacting earnings and financial flexibility.

- The closure of the Wesley Institute of Nursing Education removes a $4.7 million earnings contributor for the coming year, with no immediate replacement for this income stream, placing additional pressure on revenue growth and earnings retention.

- The ongoing ramp-up phase at several new or redeveloped sites, especially The Helier and Redwood, is generating operating losses and dragging down average site profitability; if occupancy and sales take longer than anticipated to reach targets, the drag on net margin and EBITDA could persist, diminishing overall earnings growth.

- While management is targeting increased debt reduction, there remains a significant level of unsold stock and high receivables, combined with a planned reduction in future development; if the property market softens or sales cycle elongates, the company may face heightened balance sheet strain and pressure on net asset value from both slow debt paydown and potential downward revaluations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Oceania Healthcare is NZ$0.73, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Oceania Healthcare's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NZ$1.01, and the most bearish reporting a price target of just NZ$0.73.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be NZ$288.8 million, earnings will come to NZ$74.0 million, and it would be trading on a PE ratio of 8.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of NZ$0.66, the bearish analyst price target of NZ$0.73 is 9.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.